Instructions For Filing: Personal & School District Income Tax & Telefile - Department Of Taxation State Of Ohio - 2012 Page 16

ADVERTISEMENT

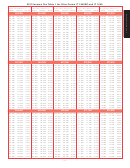

2012 Ohio Forms IT 1040EZ / IT 1040 / Instructions

Sample W-2 – This form reports taxpayers' wages and withholding

See "Ohio Income Tax Withheld" on page 19 (Ohio form IT 1040EZ) and page 21 (Ohio form IT 1040)

Place all W-2 documents on top of page 1 of your Ohio income tax return. Do not use staples, tape or glue.

a Employee’s social security number

22222

OMB No. 1545-0008

b Employer identification number (EIN)

1 Wages, tips, other compensation

2 Federal income tax withheld

Box b – Employer

XX-XXXXXXX

identifi cation number

c Employer’s name, address, and ZIP code

3 Social security wages

4 Social security tax withheld

5 Medicare wages and tips

6 Medicare tax withheld

7 Social security tips

8 Allocated tips

d Control number

9

10 Dependent care benefits

e Employee’s first name and initial

Last name

Suff.

11 Nonqualified plans

12a

C

o

d

e

13

Statutory

Retirement

Third-party

12b

employee

plan

sick pay

C

o

d

e

14 Other

12c

C

o

d

e

12d

C

o

Box 15 – If this shows

d

e

f Employee’s address and ZIP code

a state other than OHIO

State

15

Employer’s state ID number

16

17 State income tax

18

19

20

State wages, tips, etc.

Local wages, tips, etc.

Local income tax

Locality name

or OH, do not include

$ XX,XXX.XX

$ X,XXX.XX

XX-XXXXXX

OH

the amount in box 17 as

part of your Ohio income

tax withholding.

W-2

2012

2011

Wage and Tax

Department of the Treasury—Internal Revenue Service

Statement

Form

Copy 1—For State, City, or Local Tax Department

Box 16 – Your state

wages, tips, etc.

Box 17 – Your state

income tax withholding

Box 19 – Do not include this amount as

part of your Ohio income tax withholding.

Sample W-2G – This form reports taxpayers' gambling winnings/withholding

See "Ohio Income Tax Withheld" on page 19 (Ohio form IT 1040EZ) and page 21 (Ohio form IT 1040)

Place all W-2G documents on top of page 1 of your Ohio income tax return. Do not use staples, tape or glue.

VOID

CORRECTED

OMB No. 1545-0238

PAYER’S name, address, ZIP code, federal identification

1 Gross winnings

2 Federal income tax withheld

Box 1 – Your gross

2012

number, and telephone number

$ XX,XXX.XX

winnings

3 Type of wager

4 Date won

Form W-2G

5 Transaction

6 Race

Certain

Gambling

7 Winnings from identical wagers

8 Cashier

Payer's federal

Winnings

XX-XXXXXXX

identifi cation number

9 Winner’s taxpayer identification no. 10 Window

WINNER’S name, address (including apt. no.), and ZIP code

Box 13 – If this shows

11 First I.D.

12 Second I.D.

Copy 1

a state other than OHIO

13 State/Payer’s state identification no. 14 State income tax withheld

or OH, do not include

For State Tax

OH XX-XXXXXX

$ X,XXX.XX

Department

the amount in box 14 as

part of your Ohio income

Under penalties of perjury, I declare that, to the best of my knowledge and belief, the name, address, and taxpayer identification number that I have furnished

correctly identify me as the recipient of this payment and any payments from identical wagers, and that no other person is entitled to any part of these payments.

tax withholding.

Signature

Date

W-2G

Form

Department of the Treasury - Internal Revenue Service

Box 14 – Your state

income tax withholding

- 16 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64