Instructions For Filing: Personal & School District Income Tax & Telefile - Department Of Taxation State Of Ohio - 2012 Page 33

ADVERTISEMENT

2012 Ohio Forms IT 1040EZ / IT 1040 / Instructions

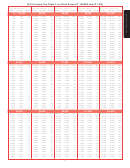

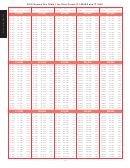

How to Calculate Use Tax for Ohio Forms IT 1040EZ and IT 1040 and the TeleFile Worksheet

If during 2012 you made any out-of-state purchase of goods or services that you used, stored or consumed in Ohio (e.g., Internet,

television/radio ads, catalog purchases or purchases made directly from an out-of-state company) and if you paid

no

sales tax in any

state on that purchase, you are required to complete this worksheet to determine the Ohio use tax that you owe on that purchase.

Complete the following worksheet to determine if you owe any Ohio use tax (which is the Ohio sales tax on your out-of-state purchase).

For additional information, see page 32.

a. During 2012 did you make any of the purchases described above?

No –

STOP

– You do not need to report on your Ohio income tax return any Ohio use tax. Enter

-0- on line e below and on line 14 of Ohio form IT 1040EZ, line 17 of IT 1040 or line 6 of the TeleFile

worksheet.

Yes – Complete line b of this worksheet to determine if you owe Ohio use tax on your purchase(s).

b. Did the retailer charge you sales tax (Ohio or any other state) on your out-of-state purchase(s)?

Yes –

STOP

– You do not owe any Ohio use tax. Enter -0- on line e below and on line 14 of Ohio form

IT 1040EZ, line 17 of IT 1040 or line 6 of the TeleFile worksheet.

No – You owe Ohio use tax on your purchase(s). Complete lines c, d and e of this worksheet.

$

.00

c. Enter the total of your out-of-state purchases on which you paid

no

sales tax and

no

Ohio use tax.

_ _ _ _

.

d. Enter your county use tax rate. Use the decimal rates below to calculate your use tax.

X

e. Multiply line c by line d. This is the amount of Ohio use tax that

you owe

on your out-of-state purchase(s).

Write the amount here (round to the nearest dollar) and on line 14 of Ohio form IT 1040EZ, line 17 of IT 1040

$

.00

or line 6 of the TeleFile worksheet. This amount is part of your income tax liability.

County Sales and Use Tax Rates

State and county sales and use tax rates changed during the year. The following chart refl ects sales and use tax rates in effect on Oct. 1,

2012. You can access our Web site at tax.ohio.gov for specifi c tax rates in effect at the time of your purchase.

Rate

Rate

Rate

County

Decimal

Percent

County

Decimal

Percent

County

Decimal

Percent

Adams

.0700

7.00%

Hamilton

.0650

6.50%

Ottawa

.0675

6.75%

Allen

.0650

6.50%

Hancock

.0650

6.50%

Paulding

.0700

7.00%

Ashland

.0675

6.75%

Hardin

.0700

7.00%

Perry

.0700

7.00%

Ashtabula

.0650

6.50%

Harrison

.0700

7.00%

Pickaway

.0700

7.00%

Athens

.0675

6.75%

Henry

.0700

7.00%

Pike

.0700

7.00%

Auglaize

.0700

7.00%

Highland

.0700

7.00%

Portage

.0675

6.75%

Belmont

.0700

7.00%

Hocking

.0675

6.75%

Preble

.0700

7.00%

Brown

.0700

7.00%

Holmes

.0650

6.50%

Putnam

.0700

7.00%

Butler

.0625

6.25%

Huron

.0700

7.00%

Richland

.0700

7.00%

Carroll

.0650

6.50%

Jackson

.0700

7.00%

Ross

.0700

7.00%

Champaign

.0700

7.00%

Jefferson

.0700

7.00%

Sandusky

.0700

7.00%

Clark

.0700

7.00%

Knox

.0650

6.50%

Scioto

.0700

7.00%

Clermont

.0650

6.50%

Lake

.0675

6.75%

Seneca

.0700

7.00%

Clinton

.0700

7.00%

Lawrence

.0700

7.00%

Shelby

.0700

7.00%

Columbiana

.0700

7.00%

Licking

.0700

7.00%

Stark

.0625

6.25%

Coshocton

.0700

7.00%

Licking (COTA)

.0750

7.50%

Summit

.0650

6.50%

Crawford

.0700

7.00%

Logan

.0700

7.00%

Trumbull

.0650

6.50%

Cuyahoga

.0775

7.75%

Lorain

.0625

6.25%

Tuscarawas

.0650

6.50%

Darke

.0700

7.00%

Lucas

.0675

6.75%

Union

.0675

6.75%

Defi ance

.0650

6.50%

Madison

.0675

6.75%

Union (COTA)

.0725

7.25%

Delaware

.0675

6.75%

Mahoning

.0675

6.75%

Van Wert

.0700

7.00%

Delaware (COTA)

.0725

7.25%

Marion

.0650

6.50%

Vinton

.0700

7.00%

Erie

.0650

6.50%

Medina

.0650

6.50%

Warren

.0650

6.50%

Fairfi eld

.0650

6.50%

Meigs

.0700

7.00%

Washington

.0700

7.00%

Fairfi eld (COTA)

.0700

7.00%

Mercer

.0700

7.00%

Wayne

.0625

6.25%

Fayette

.0700

7.00%

Miami

.0675

6.75%

Williams

.0700

7.00%

Franklin

.0675

6.75%

Monroe

.0700

7.00%

Wood

.0650

6.50%

Fulton

.0700

7.00%

Montgomery

.0700

7.00%

Wyandot

.0700

7.00%

Gallia

.0675

6.75%

Morgan

.0700

7.00%

Geauga

.0650

6.50%

Morrow

.0700

7.00%

Greene

.0650

6.50%

Muskingum

.0700

7.00%

Guernsey

.0700

7.00%

Noble

.0700

7.00%

- 33 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64