Instructions For Filing: Personal & School District Income Tax & Telefile - Department Of Taxation State Of Ohio - 2012 Page 29

ADVERTISEMENT

2012 Ohio Forms IT 1040EZ / IT 1040 / Instructions

Line 43c – Qualifi ed Organ Donor

income from a certain transfer agreement or

retirement income included in Ohio adjusted

an enterprise transferred under that agree-

gross income on line 3. Sue has $2,000 in

Expenses

ment if the income was included in your

qualifying retirement income included in

federal adjusted income. See Ohio Revised

Ohio adjusted gross income on line 3. The

Deduct on this line up to $10,000 of

Code sections 126.60-126.605.

total of the two qualifying retirement incomes

qualifi ed organ donation expenses you

is $7,000. The table above shows a credit

incurred during the taxable year. If your

Schedule B –

of $130 for retirement income of more than

fi ling status is married fi ling jointly, each of

$5,000, but not more than $8,000. They are

Nonbusiness Credits

you can deduct on this line up to $10,000

entitled to claim on line 48 an Ohio retire-

of qualifi ed organ donation expenses you

Line 48 – Retirement Income Credit

ment income credit of $130.

each incurred during the taxable year.

"Qualified organ donation expenses"

Line 49 – Senior Citizen Credit

To qualify for the Ohio retirement income

means unreimbursed travel and lodging

credit, you must meet all of the following:

expenses that you incur in connection with

You can claim a $50 credit if you were 65

You received retirement benefits, an-

your donation, to another human being,

or older before Jan. 1, 2013. If you are fi ling

nuities or distributions that were made

of your human liver, pancreas, kidney,

a joint return, only one credit of $50 is

from a pension, retirement or profi t-sharing

intestine, lung or any portion of your hu-

allowed even if you and your spouse are

plan; AND

man bone marrow.

both 65 or older.

You received this income because you

have retired; AND

You can claim this deduction only once for

If you take or have previously taken the

all taxable years. If you claim the deduction

This income is included in your Ohio

lump sum distribution credit, you cannot

for this year, you cannot claim this deduction

adjusted gross income on line 3. Note:

take the $50 senior citizen credit on this

Social Security and certain railroad

in any subsequent year. If your fi ling status

year's return or any future year's return.

retirement benefits required to be

is married fi ling jointly and if you and your

shown on line 40 and military retire-

spouse both claim the deduction for this year,

Line 50 – Lump Sum Distribution Credit

both you and your spouse cannot claim this

ment income required to be shown on

line 37b do not qualify for this credit.

deduction in any subsequent year. However,

This credit is available only to individuals 65

if your fi ling status is married fi ling jointly but

or older before Jan. 1, 2013. If you received

only one spouse claims this deduction for this

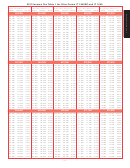

The Amount of the Credit is as Follows:

a lump sum distribution from a pension,

year, the other spouse can claim the deduc-

retirement or profi t-sharing plan, whether

Amount of qualifying

Line 48

tion in a subsequent year, regardless of your

on account of retirement or separation from

retirement

retirement income

spouse's fi ling status in that subsequent year.

employment, and if you are 65 or older, you

during the taxable

income credit

may be able to take advantage of a special

year:

for taxable year:

You can also deduct matching contribu-

tax treatment that uses the $50 senior citi-

tions that you made to another person's

$500 or less................................... $

0

zen tax credit multiplied by your expected

Individual Development Account when the

remaining life years.

More than $500,

account has been established by a county

but not more than $1,500 .............. $ 25

department of human services. For further

If the answers to questions 1 through 6

More than $1,500,

information, contact your local county de-

below are all "Yes," you can claim the

but not more than $3,000 .............. $ 50

partment of human services.

lump sum distribution credit. If you an-

More than $3,000,

swer "No" to any of the questions, you

Line 44 – Wage Expense

but not more than $5,000 .............. $ 80

do not qualify for this credit.

More than $5,000,

Deduct the amount of employer wage and

1. Were you 65 or older before Jan. 1, 2013?

but not more than $8,000 .............. $130

salary expenses that you did not deduct

2. Was the lump sum distributed from a

More than $8,000 .......................... $200

for federal income tax purposes because

qualifi ed employee benefi t plan (pension,

you instead claimed the federal targeted

profit-sharing, stock bonus, Keogh,

jobs tax credit or the work opportunity tax

The Maximum Credit Per Return is $200.

Internal Revenue Code 401(k), STRS,

credits.

If you are fi ling a joint return, combine the

PERS, SERS, etc.)?

total qualifying retirement income for both

3. Was the distribution made from all of the

Line 45 – Interest Income from Ohio

spouses to determine the credit from the

employer's qualifi ed plans of one kind in

Public Obligations

table above.

which the employee had funds?

4. Was the distribution for the full amount

If the taxpayer has previously taken a

Deduct interest income earned from Ohio

credited to the employee?

public obligations and Ohio purchase obli-

lump sum retirement income credit, they

5. Was the distribution paid within a single

gations if the interest income was included

cannot take the retirement income credit

taxable year?

in your federal adjusted gross income. You

on this year's return or any future year's

6. Was the distribution made because the

return to which this taxpayer is a party.

can also deduct any gains resulting from the

employee died, quit, retired, or was laid

sale or disposition of Ohio public obligations

off or fi red?

Note: Retirement buy-out amounts, attrition

to the extent that the gain was included in

buy-out amounts and other similar amounts

your federal adjusted gross income.

If you take this credit, you cannot take the

reported on IRS form W-2 qualify for this

$50 senior citizen's credit on this year's

Deduct income from providing public ser-

credit only if the amounts are paid under a

return or on any future year's return. For

vices under a contract through an Ohio

retirement plan.

more information, see page 2 of Ohio form

state project (including highway services)

LS WKS, which is available on our Web site

Example: Bob and Sue are retired and fi le

if the income was included in your federal

at tax.ohio.gov.

a joint return. Bob has $5,000 in qualifying

adjusted gross income. You can also deduct

- 29 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36 37

37 38

38 39

39 40

40 41

41 42

42 43

43 44

44 45

45 46

46 47

47 48

48 49

49 50

50 51

51 52

52 53

53 54

54 55

55 56

56 57

57 58

58 59

59 60

60 61

61 62

62 63

63 64

64