1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

4

4

Form EST-I, Page 3

SSN

FEIN

5

5

-

-

-

X X X X X X X X X

X X X X X X X X X

6

6

7

7

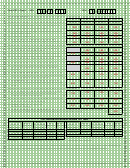

Part IV. Annualized Income Installment Method Worksheet. Complete lines 29 through 53 only if computing installments using

8

8

annualized income installment method.

9

9

Complete each column beginning with Column A through line 53 before completing the next column.

10

10

B

A

C

D

11

11

Estates and trusts, do not use the period ending dates shown to

12

1/1/14 to

1/1/14 to

1/1/14 to

1/1/14 to

12

the right. Instead, use the following: 2/28/14, 4/30/14, 7/31/14

8/31/14

3/31/14

5/31/14

12/31/14

13

13

and 11/30/14.

14

14

29. Montana adjusted gross income for the period. (Estates and

15

15

trusts, enter your taxable income without your exemption for

16

16

each period.)........................................................................... 29.

17

17

30. Annualization amounts. Estates and trusts, do not use the

18

18

amounts shown in columns (a)–(d). Instead, use 6, 3, 1.71429

2.4

1.5

4

1

19

19

and 1.09091, respectively, as the annualization amounts ...... 30.

20

20

31. Annualized income. Multiply line 29 by line 30 ....................... 31.

21

21

32. *Enter your itemized deductions for the period shown. (Estates

22

22

and trusts, enter -0-; skip to line 37, and enter the amount from

23

23

line 31 on line 37.) .................................................................. 32.

24

24

33. Annualization amounts ........................................................... 33.

2.4

1.5

4

1

25

25

34. Multiply line 32 by line 33 ....................................................... 34.

26

26

27

35. **Enter the full amount of your standard deduction ................ 35.

27

28

28

36. Enter the larger of line 34 or line 35 ....................................... 36.

29

29

37. subtract line 36 from line 31 ................................................... 37.

30

30

38. Multiply $2,330 by number of exemptions. (Estates and trusts

31

31

enter the exemption amount shown on your tax return.) ........ 38.

32

32

39. Subtract line 38 from line 37 ................................................... 39.

33

33

34

34

40. Figure the tax on the amount on line 39 using the tax

35

35

table on page 2 ....................................................................... 40.

36

36

41. If you have net capital gains included in your Montana

37

37

adjusted gross income on line 29, multiply the net capital

38

38

gains amount by 2% (0.02) and enter the result of your capital

39

gains credit here ..................................................................... 41.

39

40

40

42. Subtract line 41 from line 40 and enter the result here........... 42.

41

41

43. Enter nonrefundable tax credits for each period..................... 43.

42

42

44. subtract line 43 from line 42 ................................................... 44.

43

43

45. Applicable percentage ............................................................ 45.

22.5%

67.5%

45%

90%

44

44

45

45

46. Multiply line 44 by line 45 ....................................................... 46.

46

46

47. Add the amounts in all preceding columns of line 53 ............. 47.

47

47

48. Subtract line 47 from line 46. If less than zero, enter zero ..... 48.

48

48

49. Divide line 6, Part I of this form, by four (4) and enter the

49

49

result in each column.............................................................. 49.

50

50

50. Enter the amount from line 52 of the preceding column of

51

51

this worksheet......................................................................... 50.

52

52

51. Add lines 49 and 50 and enter the result ................................ 51.

53

53

54

54

52. If line 51 is more than line 48, subtract line 48 from line 51;

55

otherwise, enter zero .............................................................. 52.

55

56

56

53. Enter the smaller of line 48 or line 51 here and on line 14 of

57

57

Part III ..................................................................................... 53.

58

58

* If you do not itemize deductions, enter zero.

59

59

** The standard deduction is 20% (0.20) of line 31, subject to the following limitations:

60

60

•

Single or separate - no less than $1,940, no more than $4,370

61

•

Married or head of household - no less than $3,880, no more than $8,740

61

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3 4

4 5

5 6

6 7

7