Form EST-I, Page 6

Example 1.

You filed your 2013 tax return on June 1, 2014, showing a $2,000 refund. You elected to have $1,000 of your 2013

overpayment applied to your 2014 estimated tax payments. In 2014, you had $4,000 of Montana income tax withheld

from wages. You also made $500 estimated tax payments on September 15, 2014 and January 15, 2015. On line

15, in each column, enter $1,000 (one-fourth of total 2014 withholding). On line 17, column A, enter $1,000 (2013

overpayment applied to 2014). In column B, enter $0 (no estimated tax payment was made for this period), and in

columns C and D, enter $500 (estimated tax payment).

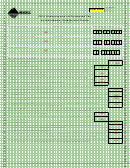

Part III. Regular Method. Use this method if you made payments of unequal amounts. The due dates shown are for calendar year

taxpayers. Adjust these dates accordingly for fiscal year returns.

A

B

C

D

Complete lines 14 through 17 in each column before going to line 18.

4/15/14

6/16/14

9/15/14

1/15/15

14. Required quarterly payment. Divide line 6 from page 1 by

four (4) and enter the result in each column ........................... 14.

15. Add lines 3a and 3b from page 1 and enter one-fourth of the

1,000

1,000

1,000

1,000

amount in each column .......................................................... 15.

16. subtract line 15 from line 14 ................................................... 16.

17. Enter the amount of estimated tax paid by each date.

1,000

0

500

500

(Include the amount from line 3c on page 1 in column A.) ..... 17.

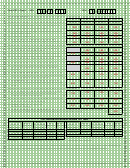

Line 23. Current quarter underpayment

Example 3.

If line 23 is zero for all payment periods, you do not owe

Your required installment for each payment due date is

interest on your underpayment.

$4,000. You made the following estimated tax payments.

Figure the Interest (Lines 25-28)

Payments

Date

Complete lines 25 through 28 of Part III to figure your

$2,000

4/30/14

interest for each period by applying the appropriate rate

against each underpayment shown on line 23 of Part

$3,000

6/16/14

III. Interest is figured for the number of days that each

$4,000

9/15/14

underpayment remains unpaid. Use line 26 to show the

$4,000

1/15/15

number of days an underpayment remained unpaid. Use

line 27 to figure the actual interest amount by applying the

Line 23, column A, shows $4,000. You enter “4/30

appropriate rate to an underpayment for the number of

$2,000” and “6/16 $2,000” on line 25, column A. The

days it remained unpaid.

remaining $1,000 ($3,000 – $2,000) of the June 16

Your payments are applied first to any underpayment

payment is entered on line 25, column B, “6/17 $1,000.”

balance on an earlier required installment. It does not

Also enter “9/15 $3,000” on line 25, column B, because

matter if you designate a payment for a later period. See

$3,000 of the $4,000 September payment must be used

Example 2.

to fully pay the June underpayment. Continue in this

manner until all your payments are used.

Example 2.

You had a $500 underpayment remaining after your

Line 26. If more than one payment was applied to an

April 15 payment. The June 17 installment required a

underpayment on line 23, enter the number of days each

payment of $1,200. On June 10, you made a payment of

payment was late. See Example 4.

$1,200 to cover the June 17 installment. However, $500

of this payment is applied first to the April 15 installment.

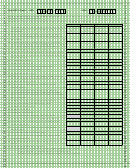

Example 4.

The interest for the April 15 installment is figured from

April 15 to June 10 (56 days). The amount remaining to

Using the same facts as Example 3 above, enter “15”

be applied to the June 17 installment is $700.

(number of days from 4/15 to 4/30) and “63” (number

of days from 4/15 to 6/17) on line 26, column A (see

Line 25. If more than one payment was applied to fully

illustration under Example 5).

pay the underpayment amount in a column (line 23),

enter on line 25 the date and amount applied up to the

Line 27. If more than one payment was required to fully

underpayment amount. If a payment was more than the

satisfy an underpayment amount, make a separate

underpayment amount, enter the excess in the next column

computation for each payment. See Example 5. If you filed

with the same date. See Example 3.

your tax return by January 31 and paid in full the amount

due as computed on the return, there is no underpayment

interest penalty calculated on the fourth installment

payment; enter $0 for column D.

1

1 2

2 3

3 4

4 5

5 6

6 7

7