Form EST-I, Page 5

column heading. For most taxpayers, this is one-fourth of

Part I. Required Annual Payment

the required annual payment shown in Part I, line 6.

Complete lines 1 through 6 to figure your required annual

Line 15. Add lines 3a (withholding) and 3b (refundable

payment.

tax credits) from Part I on page 1. Divide the result by 4

For this part, if you are married filing separately on the

and enter that amount in each column. The sum of all four

same form, you will need to add the amounts from both

columns should equal the sum of lines 3a and 3b from

columns of Form 2 together.

page 1.

If you filed an amended return, use the amounts shown on

Line 17. List your estimated tax payments for 2014. Before

your original return to figure your underpayment.

completing line 17, enter in Table 1 the payments you made

Line 1. Enter the amount from your 2014 Form 2, line 54;

for 2014 Include the following payments:

Form 2M, line 47; or Form 2EZ, line 15. For an estate or

● Any overpayment from your 2013 return applied to your

trust, enter the amount from Form FID-3, line 36.

2014 estimated tax payments. Treat the payment as

Line 3a. Enter the taxes withheld from Form 2, lines 55

made on April 15, 2014.

through 57; Form 2M, line 48; or Form 2EZ, line 16. For an

● Estimated tax payments you made for the 2015 tax

estate or trust, enter the amount from Form FID-3, lines 37

year.

through 39.

Line 3b. Enter your 2014 refundable credits. This amount

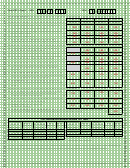

Table 1. Estimated Tax Payments

can be found on Form 2, line 60; Form 2M, line 51; or FID-

Payments

Payments

Date

Date

3, line 42.

Line 3c. Enter the amount of any overpayment you had in

2013 that you chose to carry forward to 2014.

Line 4. Subtract line 3 from line 1. If the result is less than

$500, you do not need to continue filling out this form. You

do not owe interest on your underpayment.

Line 5. Enter the amount from your 2013 Form 2, line 54;

Form 2M, line 47; or Form 2EZ, line 15. For an estate or

trust, enter the amount from Form FID-3, line 36.

Entries on Form EST-I. Enter on line 17 the following tax

payments.

Line 6. Enter the smaller of line 2 or 5. If total withholding,

● Column A—total payments you made by April 15, 2014,

refundable credits and any overpayment from 2013 on line

3 is equal to or more than this line, you do not owe any

including any 2013 overpayment that was applied to

interest on the underpayment of estimated taxes.

2014.

● Column B—total payments you made after April 15,

Part II. Short Method

2014, through June 16, 2014.

You may use the short method if either of the following

● Column C—total payments you made after June 16,

situations apply to you:

2014, through September 15, 2014.

● You did not make estimated tax payments; or

● Column D—total payments you made after september

● You made all of your estimated tax payments on or

15, 2014, through January 15, 2015.

before the due dates and in four equal amounts.

When figuring your payment dates and the amounts to

If you can use the short method, complete lines 7 through

enter on line 17 of each column, apply the following rules.

10 to figure your total underpayment for the year, and lines

● Include all estimated tax payments you made for each

11 through 13 to figure the interest.

period. Include any overpayment from your 2013 tax

If you are filing Form 2EZ, stop here. Do not use the

return you elected to apply to your 2014 estimated tax.

regular method in Part III to calculate your interest on the

If your 2013 return was fully paid by the due date, treat

underpayment of estimated taxes.

the overpayment as a payment made on April 15, 2014.

● If an overpayment is generated on your 2013 return

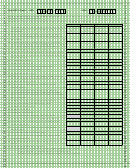

Part III. Regular Method

from a payment made after the due date, treat the

Use the regular method if you are not eligible to use the

payment as made on the date of payment. For

short method. You must use the regular method if you

example, you paid $500 in tax due on your 2013 return

made payments of unequal amounts and/or you made the

on July 2, 2014, and later amended the return and were

payments after the due dates.

due a $400 refund which you elected to have applied

If you are using the annualized method, you will need to

as an estimated payment to your 2014 taxes. The $400

complete Part IV before beginning Part III.

overpayment would be treated as paid on July 2.

Figure Your Quarterly Underpayment/Overpayment

(Lines 14-24)

Line 14. Enter on line 14, columns A through D, the amount

of your required installment for the due date shown in each

1

1 2

2 3

3 4

4 5

5 6

6 7

7