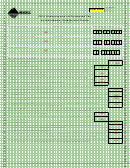

Form EST-I, Page 4

Form EST-I Instructions

the annualized income installment method. For details, see

Purpose of Form

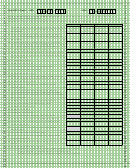

Form EST-I, Part IV, Annualized Income Installment Method

Use est-I (2014 Underpayment of estimated tax by

Worksheet.

Individuals, Estates and Trusts) to determine if you owe

Return. In these instructions, “return” refers to your original

interest on the underpayment of estimated tax and, if you

return.

do, to figure the amount of the interest.

Exceptions to Interest on the Underpayment of

Who Must File Form EST-I?

Estimated Tax

You are not required to file Form EST-I but can use it to

figure your interest on your underpayment if you wish to do

You were not required to make estimated tax payments

so.

and, therefore, will not have to pay interest if any of the

following conditions apply to you:

Who Must Pay the Interest on the Underpayment

● Your 2013 tax period covered 12 months and your

of Estimated Tax?

Montana tax liability was zero;

In general, you may owe interest on the underpayment

● Your 2014 income tax due after credits and withholding

of estimated tax for 2014 if you did not make the required

is less than $500. To determine whether your tax due is

quarterly payments totaling at least 90% of your 2014

less than $500, complete Part I, lines 1 through 4;

income tax liability (after applying any withholding and/

● You are a nonresident or part-year resident and were

or credits) or 100% of your 2013 income tax liability (after

not required to file a 2013 Montana income tax return;

applying any withholding and/or credits).

● You retired and were at least 62 years of age (This

Interest is figured separately for each required

exception applies only in the year you retire and for one

payment. The interest is figured separately for each

additional year following the year of retirement.);

installment due date. Therefore, you may owe interest for

● You became disabled in 2013 or 2014 or

an earlier due date even if you paid enough tax later to

make up the underpayment. This is true even if you are

● At least 2/3 of your gross income is derived from

due a refund when you file your tax return. However, you

farming or ranching operations.

may be able to reduce or eliminate the interest by using

Table of Contents

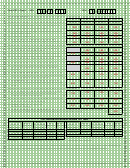

Part I. Required Annual Payment .................................................................................................................................. 5

Complete this part to calculate your required annual payment. This part must be completed.

Part II. Short Method ...................................................................................................................................................... 5

Complete this part to calculate your interest on the underpayment of estimated taxes. This part only applies in

specific situations which are outlined in this section of the instructions.

Part III. Regular Method ................................................................................................................................................. 5

Complete this part to calculate your interest on the underpayment of estimated taxes. This part must be used if you

are not eligible to use the short method.

Part IV. Annualized Income Installment Method .......................................................................................................... 7

This part may be used if your income varied during the year and it must be completed before Part III if you are

annualizing.

1

1 2

2 3

3 4

4 5

5 6

6 7

7