1

1

2

1 2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

84

85

3

3

4

4

Form EST-I, Page 2

SSN

FEIN

5

5

-

-

-

X X X X X X X X X

X X X X X X X X X

6

6

7

7

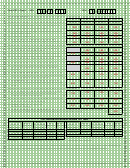

Part III. Regular Method. Use this method if you made payments of unequal amounts. The due dates shown are for calendar year

8

8

taxpayers. Adjust these dates accordingly for fiscal year returns.

A

B

C

D

9

9

Complete lines 14 through 17 in each column before going to line 18.

4/15/14

6/16/14

9/15/14

1/15/15

10

10

14. Required quarterly payment. Divide line 6 from page 1 by

11

11

320

330

340

350

four (4) and enter the result in each column ........................... 14.

12

12

13

13

15. Add lines 3a and 3b from page 1 and enter one-fourth of the

360

370

380

390

amount in each column .......................................................... 15.

14

14

15

15

400

410

16. subtract line 15 from line 14 ................................................... 16.

420

430

16

16

17. Enter the amount of estimated tax paid by each date.

17

17

(Include the amount from line 3c on page 1 in column A.) ..... 17.

440

450

460

470

18

18

Complete lines 18 through 24 of one column before going to the next column.

19

19

18. Overpayment from previous quarter. Enter the amount, if

20

20

480

490

500

any, from line 24 of the previous column ................................ 18.

21

21

520

530

540

510

19. Estimated payments for the quarter. Add lines 17 and 18 ...... 19.

22

22

23

23

20. Total underpayment to date. Add the amounts from lines 22

and 23 of the previous column and enter the result ............... 20.

24

24

550

560

570

25

25

21. Subtract line 20 from line 19. If zero or less, enter zero ......... 21.

590

600

580

610

26

26

22. Underpayment from previous quarters. If the amount on

27

27

line 21 is zero, subtract line 19 from line 20. Otherwise,

620

630

640

28

28

enter zero ............................................................................... 22.

29

29

23. Current quarter underpayment. If line 21 is equal to or less

30

30

660

670

680

650

than line 16, subtract line 21 from line 16 and enter the result.

31

31

If line 21 is greater than line 16, go to line 24 ......................... 23.

32

32

24. Overpayment. If line 16 is less than line 21, subtract line

33

33

16 from line 21 and enter the result. Then go to line 18, next

700

710

720

690

34

34

column .................................................................................... 24.

35

35

Complete lines 25 through 27 of the columns where there is an amount on line 23.

36

36

25. Enter the date(s) you paid the amount on line 23 or the 15th

37

37

740

750

760

730

day of the fourth month after the close of the tax year,

38

38

whichever is earlier (see instructions) .................................... 25.

39

39

26. Enter the number of days from the installment due date to the

780

790

770

800

40

40

date shown on line 25 (see instructions) ................................ 26.

41

41

27. Interest. Multiply line 23 x days from

42

42

820

830

840

810

line 26 x 8% / 365 days .......................................................... 27.

43

43

28. Interest on Underpayment of Estimated Tax. Add the amounts on line 27 of each column. Enter total here

44

44

850

and on Form 2, line 66; Form 2M, line 57; Form 2eZ, line 17; or Form FID-3, line 46 ...........................................28. $

45

45

46

46

47

47

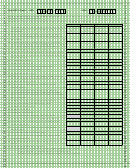

2014 Montana Individual Income Tax Table

48

48

49

If Your Taxable

Multiply

If Your Taxable

Multiply

49

But Not

And

This Is

But Not

And

This Is

Income Is

Your Taxable

Income Is

Your Taxable

50

50

More Than

Subtract

Your Tax

More Than

Subtract

Your Tax

More Than

Income By

More Than

Income By

51

51

$0

$2,800

1% (0.010)

$0

$10,300

$13,300

5% (0.050)

$257

52

52

$2,800

$5,000

2% (0.020)

$28

$13,300

$17,100

6% (0.060)

$390

53

53

$5,000

$7,600

3% (0.030)

$78

More Than $17,100

6.9% (0.069)

$544

54

54

$7,600

$10,300

4% (0.040)

$154

55

55

For example:

Taxable income $6,800 X 3% (0.030) = $204.

$204 minus $78 = $126 tax

56

56

57

57

58

58

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically, you

represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

59

59

60

60

61

61

62

62

63

63

64

64

65

1

2

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

49

50

51

52

53

54

55

56

57

58

59

60

61

62

63

64

65

66

67

68

69

70

71

72

73

74

75

76

77

78

79

80

81

82

83

84 85

66

66

1

1 2

2 3

3 4

4 5

5 6

6 7

7