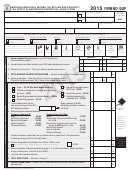

Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2015 Page 16

ADVERTISEMENT

FORM 500 INSTRUCTIONS (continued)

7.

21. Federally taxable interest received on Georgia municipal bonds

Depreciation because of differences in Georgia and Federal law

during tax years 1981 through 1986.

designated as “Build America Bonds” under Section 54AA of the Inter-

nal Revenue Code of 1986. “Recovery Zone Economic Development

8.

Dependent’s unearned income included in parents’ Federal

Bonds” under Section 1400U-2 of the Internal Revenue Code or any other

adjusted gross income.

bond treated as a ‘Qualified Bond” under Section 6431(f) of the Internal

9.

Income tax refunds from states other than Georgia included in

Revenue Code are considered “Build America Bonds” for this purpose.

Federal adjusted gross income. Do not subtract Georgia income

22. Federally taxable interest received on Georgia municipal bonds

tax refunds.

issued by the State of Georgia and certain authorities or agencies of the

10. Income from any fund, program or system which is specifically

State of Georgia for which there is a special exemption under Georgia

exempted by Federal law or treaty.

law from Georgia tax on such interest.

11. Adjustment to Federal adjusted gross income for Georgia resident

23. Interest eliminated from federal itemized deductions due to the

shareholders for Subchapter S income where the Sub S election is

Federal Form 8396 credit.

not recognized by Georgia or another state in order to avoid double

24. An amount equal to $1,000 for each clerkship (see below for those

taxation. This adjustment is only allowed for the portion of income on

who provide more than 10) for any physician who served as the com-

which the tax was actually paid by the corporation to another state(s).

munity based faculty physician for a medical core clerkship, physician

In cases where the Sub S election is recognized by another state(s)

assistant core clerkship, or nurse practitioner core clerkship. For pur-

the income should not be subtracted. Credit for taxes paid to other

poses of this subtraction a “community based faculty physician” means

states may apply.

a non-compensated physician who provides a minimum of three and a

12. Adjustment for teachers retired from the Teacher’s Retirement

maximum of ten clerkships within a calendar year. As such, a physician

System of Georgia for contributions paid between July 1, 1987 and

who provides more than 10 clerkships may only subtract $10,000. A core

December 31, 1989 that were reported to and taxed by Georgia.

clerkship means a clerkship for a student who is enrolled in a Georgia

medical school, a Georgia physician assistant school, or a Georgia nurse

13. Amount claimed by employers in food and beverage establishments

practitioner school and who completes a minimum of 160 hours of com-

who took a credit instead of a deduction on the Federal return for FICA

munity based instruction in family medicine, internal medicine, pediatrics,

tax paid on employee cash tips.

obstetrics and gynecology, emergency medicine, psychiatry, or general

14. An adjustment of 10% of qualified payments to minority

surgery under the guidance of a community based faculty physician. The

subcontractors or $100,000, whichever is less, per taxable year

Statewide Area Health Education Centers Program Office at Georgia

by individuals, corporations or partnerships that are party to state

Regents University administers the program and certifies rotations. The

contracts. For more information call the Department of Administrative

physician should attach to their return a copy of the certification received

Services at 404-657-6000 or visit their website:

from the Statewide Area Health Education Centers Program Office. If they

state-purchasing/suppliers

file electronically and their software does not allow attachments, the certi-

15. Deductible portion of contributions to the Path2College 529 Plan.

fication should be retained and provided if requested by the Department.

The deduction is limited on a return to the amount contributed but

cannot exceed $2,000 per beneficiary.

LINE 10 Georgia adjusted gross income (net total of Line 8 and Line 9).

16. Adjustments due to Federal tax changes. (See pages 7-8 for

information.)

LINES 11a-c Enter the standard deduction that corresponds to your

17. Combat zone pay exclusion. See page 6 for more information.

marital status as indicated below on Line 11a and any additional

18. Up to $10,000 of unreimbursed travel expenses, lodging expenses

deductions on Line 11b. Enter the total standard deduction on Line 11c.

and lost wages incurred as a direct result of a taxpayer’s donation of

If you use the standard deduction on your Federal return, you must

all or part of a kidney, liver, pancreas, intestine, lung or bone marrow

use the Georgia standard deduction on your Georgia return. The

during the taxable year.

additional deduction applies if you and/or your spouse are age 65

or over and/or blind.

19. Adjustments to Federal adjusted gross income for Georgia res-

ident partners in a partnership or member(s) in a LLC where such

entities income has been taxed at the entity level by another state.

Leave Lines 12a-c blank if you use the standard deduction.

Adjustment is only allowed for the portion of income on which the tax

Single/Head of Household:

$2,300

was actually paid.

Married Filing Separate:

$1,500

Married Filing Joint:

$3,000

20. An amount equal to 100 percent of the premium paid by the taxpay-

er during the taxable year for high deductible health plans as defined

Additional Deduction:

$1,300

by Section 223 of the Internal Revenue Code. The amount may only

be deducted to the extent the deduction has not been included in fed-

L I N E S 1 2 a - c E n t e r i t e m i z e d d e d u c t i o n s f r o m F e d e r a l

eral adjusted income and the expenses have not been provided from

Schedule A on Line 12a; enter adjustments for income taxes

a health reimbursement arrangement and have not been included in

other than Georgia and investment interest expense for the production

itemized deductions. In the event the taxpayer claims the expenses

of income exempt from Georgia tax on Line 12b. Subtract Line 12b from

as itemized deductions, the taxpayer should multiply the expense by

Line 12a; enter the total on Line 12c.

the ratio of total allowed itemized deductions after the federal limitation

to the total allowed itemized deductions before the federal limitation to

Leave Lines 11a-c blank if you itemize deductions.

determine the amount that is not allowed to be deducted pursuant to

When Federal itemized deductions are reduced because of high income,

this paragraph. For example the taxpayer has $1,000 in high deductible

the reduced amount should be used as the starting point to compute

health insurance premiums. They also have $7,000 of other medical

.

Georgia itemized deductions

expenses which means they have total medical expenses of $8,000.

the taxpayer is only allowed to deduct $2,000 of

If you itemize deductions on your Federal return, or if you are

,

After the limitation

married filing separate and your spouse itemizes deductions,

medical expenses. The $1,000 deduction must be reduced by $250

you

($2,000/$8,000 x $1,000). Which means the taxpayer is allowed to

must itemize deductions on your Georgia return. Include a copy

of Federal Schedule A with your Georgia return.

deduct $750 pursuant to this paragraph.

Page 12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34