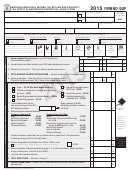

Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2015 Page 3

ADVERTISEMENT

FROM THE COMMISSIONER

Did you know that by registering an account with the Department of Revenue’s Georgia Tax Center (GTC), you can sign up

to receive notifications when any activity takes place on your account? These notifications help you closely monitor your tax

status and help combat fraudulent activity. Visit https://gtc.dor.ga.gov to register. For assistance, you may visit our self-service

instructional videos at

Did you also know that if you file electronically and choose direct deposit, you can receive your refund in less than 30 days?

Taxpayers who filed their returns electronically and had their refunds directly deposited into their bank accounts received their

refunds within an average of 30 days. Refunds from paper returns can take up to 12 weeks to be issued. If you’ve been con-

sidering electronic filing, some of the benefits include:

□

Faster and more accurate processing

□

Receiving your refund by mail or direct deposit

□

The ability to file from your home PC or have your taxes prepared by a professional electronic return originator

□

Elimination of mailing paper returns

If you file electronically and need to make a payment, you may pay by electronic check using the Georgia Tax Center. Visit

https://gtc.dor.ga.gov or visit our self-service instructional videos at For additional

information contact the Taxpayer Services Call Center at 1-877-423-6711.

The Department of Revenue, as outlined in the Taxpayer Bill of Rights, will provide “fair, courteous and timely service” to the

taxpayers of Georgia. We have implemented several initiatives to ensure we uphold that standard. Our mission is to provide

the best customer service and operational performance of any state taxing authority.

Lynnette T. Riley

Commissioner

Lynne.Riley@dor.ga.gov

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34