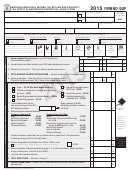

Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2015 Page 19

ADVERTISEMENT

WORKSHEET FOR OTHER STATE(S) TAX CREDIT

Georgia allows a credit for tax paid to another state on income taxable to Georgia and the other state. Use these worksheets

to compute the other state(s) tax credit for full-year and part-year residents. Do not file these worksheets with your return.

Keep them for your records.

Enter the Total Tax Credit on the IND-CR. Enclose a copy of tax return(s) filed with other state(s). The credit is for state

and U.S. local income tax only. No other income taxes such as foreign local, foreign city, foreign province, foreign country,

U.S. Possession, etc., qualify for this credit.

FULL-YEAR RESIDENTS

$ __________________

1. Other state(s) adjusted gross income

$ __________________

2. Georgia adjusted gross income (Line 10, Form 500)

__________________ %

3. Ratio: Line 1 divided by Line 2

$ __________________

4. Georgia standard or itemized deductions

5. Georgia personal exemption and credit for dependents from

$ __________________

Form 500, Line 14c

$ __________________

6. Total of Line 4 and Line 5

$___________________

7. Line 6 multiplied by ratio on Line 3

$___________________

8. Income for computation of credit (Line 1 less Line 7)

$___________________

9. Tax at Georgia rates (use tax table on pages 20 - 22)

10. Tax shown on return(s) filed with other state(s)*

$___________________

$___________________

11. Total Tax Credit (Lesser of Line 9 or Line 10) to be claimed on the IND-CR

PART-YEAR RESIDENTS

$___________________

1. Income earned in another state(s) while a Georgia resident

2. Georgia adjusted gross income (Line 8, Column C of

$ __________________

Form 500, Schedule 3)

__________________ %

3. Ratio: Line 1 divided by Line 2

4. Georgia standard or itemized deductions and Georgia personal

exemption and credit for dependents after applying the ratio

$ __________________

on Schedule 3 (Line 13, Schedule 3, Form 500)

$___________________

5.

Line 4 multiplied by ratio on Line 3

$___________________

6.

Income for computation of credit (Line 1 less Line 5)

$___________________

7.

Tax at Georgia rates (use tax table on pages 20 - 22)

8.

Tax shown on return(s) filed with other state(s) for income taxed by Georgia*

$___________________

$___________________

9.

Total Tax Credit (Lesser of Line 7 or Line 8) to be claimed on the IND-CR

* The amount entered must be reduced by credits that have been allowed by the other states.

Page 15

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34