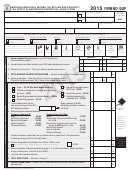

Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2015 Page 8

ADVERTISEMENT

FILING REQUIREMENTS

Full-year Residents

Military Personnel

Residents. Military personnel whose home of record is

Full-year residents are taxed on all income, except tax exempt

Georgia or who are otherwise residents of Georgia are subject

income, regardless of the source or where derived. You are

required to file a Georgia income tax return if:

to Georgia income tax on all income regardless of the source

or where earned, unless specifically exempt by Georgia law.

You are required to file a Federal income tax return;

Military personnel who serve outside of the continental U.S.

You have income subject to Georgia income tax

may file their Georgia income tax return within six months

after they come back to the continental U.S. No penalties or

that is not subject to Federal income tax;

interest will accrue during this period.

Your income exceeds the standard deduction and

Members of the National Guard or Air National Guard who are

personal exemptions as indicated below:

on active duty for a period of more than 90 consecutive days

A. Single, Head of Household or Qualifying Widow(er)

are allowed a tax credit against their individual income tax.

1. Under 65, not blind

$ 5,000

The credit cannot exceed the amount expended for qualified

2. Under 65, and blind

6,300

life insurance premiums or the taxpayer’s income tax liability

and should be claimed on Form IND-CR.

3. 65 or over, not blind

6,300

Nonresidents. Military personnel whose home of record is

4. 65 or over, and blind

7,600

not Georgia and who are not otherwise residents of Georgia

B. Married filing Joint

are only required to file a Georgia income tax return if they

1. Both under 65, not blind

$ 10,400

have earned income from Georgia sources other than military

2. One 65 or over, not blind

11,700

pay. If required, nonresident military personnel should file

3. Both under 65, both blind

13,000

Georgia Form 500 and use Schedule 3 to calculate Georgia

taxable income. (See pages 17-18 for instructions on

4. Both under 65, one blind

11,700

completing Schedule 3.)

5. Both 65 or over, not blind

13,000

Combat Zone Pay. Effective tax year 2003, military income

6. One 65 or over, and blind

13,000

earned by a member of the National Guard or any reserve

7. One 65 or over, and both blind

14,300

component of the armed services while stationed in a combat

8. Both 65 or over, and blind

15,600

zone or stationed in defense of the borders of the United

C. Married filing Separate

States pursuant to military orders is not subject to Georgia

1. Under 65, not blind

$ 5,200

income tax. The exclusion from income is only with respect

to military income earned during the period covered by such

2. Under 65, and blind

6,500

military orders. A copy of the Federal return must be enclosed

3. 65 or over, not blind

6,500

with the Georgia return to claim this exclusion. The exclusion

4. 65 or over, and blind

7,800

is limited to the amount included in Federal Adjusted Gross

These requirements apply as long as your legal residence

Income.

is Georgia, even if you are absent from or live outside the

Taxpayers Required to File Form 1040NR

State temporarily. A credit for taxes paid to another state is

Individuals who are required to file Federal Form 1040NR must

allowed. See the worksheet on page 15 and the IND-CR for

file Georgia Form 500. Similar to Federal income tax rules,

more information.

most of these Georgia taxpayers are only allowed to deduct

Filing for Deceased Taxpayers

the applicable Georgia personal exemption and expenses

reflected on Form 1040NR. Most taxpayers are not allowed to

The surviving spouse, administrator, or executor may file a

take the standard deduction and they are allowed only limited

return on behalf of a taxpayer who dies during the taxable

itemized deductions as shown on Form 1040NR, Schedule A.

year. When filing, use the same filing status that was used

Other State’s Tax Return

on the Federal income tax return. The due date for filing is

If you claim a credit for taxes paid to another state(s), you

the same as for Federal purposes.

must include a copy of your return filed with that state along

To have a refund check in the name of a deceased

with your Georgia return. No credit for taxes paid to another

taxpayer reissued, mail Georgia Form 5347, a copy of the

state will be allowed unless the other state’s return is enclosed

death certificate, and the information specified on Form

with the Georgia return.

5347 along with the check to the address on the form.

Amended Returns

Part-year Residents and Nonresidents

File Form 500X to correct information reported on Form

500. Do not use Form 500 to correct a previously filed

Instructions for part-year residents and nonresidents are

return or Form 500X as an original return.

available on pages 17 through 18.

Page 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34