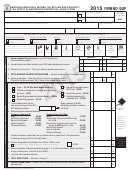

Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2015 Page 18

ADVERTISEMENT

Low Income Credit Worksheet

You may claim the low income credit if your Federal adjusted gross income is less than $20,000 and you are not claimed or eligible to be claimed

as a dependent on another taxpayer’s Federal or Georgia income tax return. Part-year residents may only claim the credit if they were residents

at the end of the tax year. Taxpayers filing a separate return for a taxable year in which a joint return could have been filed can only claim the

credit that would have been allowed had a joint return been filed. You cannot claim this credit if you are an inmate in a correctional facility.

Please note for tax years beginning on or after January 1, 2010, the credit cannot exceed the taxpayer’s income tax liability.

1. Enter the amount from Form 500, Line 8 or Form 500EZ, Line 1.

2. Enter the number of exemptions. Exemptions are self, spouse and natural or legally adopted children.

3. Enter 1 if you or your spouse is 65 or older; enter 2 if you and your spouse are 65 or older.

4. Add Lines 2 and 3; enter on the IND-CR if you are filing the Form 500, or if filing the Form 500EZ, Line 5a.

5. Find the credit that corresponds to your income in the table below and enter on the IND-CR if you are filing

the Form 500, or if filing the Form 500EZ, Line 5b.

6. Multiply Line 4 by Line 5; enter the total on the IND-CR if you are filing the Form 500; or if filing the Form

500EZ, Line 5c.

Credit Table:

Federal Adjusted Gross Income

Credit

All claims for the low income credit, including

Under $6,000

$26

claims on amended returns, must be filed on

$6,000 but not more than $7,999

$20

or before the end of the 12th month following

$8,000 but not more than $9,999

$14

the close of the tax year for which the credit

$10,000 but not more than $14,999

$ 8

$15,000 but not more than $19,999

$ 5

may be claimed.

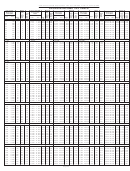

RETIREMENT INCOME EXCLUSION WORKSHEET (Keep for your records)

TAXPAYER

SPOUSE

1.

Salary and wages

2.

Other Earned Income(Losses)

3.

Total Earned Income

4.

Maximum Earned Income

$4,000

$4,000

5.

Smaller of Line 3 or 4; if zero or less, enter zero

6.

Interest Income

7.

Dividend Income

8.

Alimony

9.

Capital Gains(Losses)

10. Other Income(Losses)*

11. Taxable IRA Distributions

12. Taxable Pensions

13. Rental, Royalty, Partnership, S Corp, etc. Income(Losses)**

14. Total of Lines 6 through 13; if zero or less, enter zero

15. Add Lines 5 and 14

16. Maximum Allowable Exclusion, if age 62-64 or

less than age 62 and permanently disabled enter $35,000, or if age

65 or older enter $65,000.

17. Smaller of Lines 15 and 16; enter here and on Form 500,

Schedule 1, Lines 7 A & B

Social security and railroad retirement paid by the Railroad Retirement Board, exempt interest, or other income that is not taxable to Georgia should not

be included in the retirement income exclusion calculation. Income or losses should be allocated to the person who owns the item. If any item is held

jointly, the income or loss should be allocated to each taxpayer at 50%.

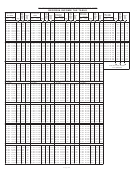

Part-year residents and nonresidents must prorate the retirement income exclusion. The earned income portion and the unearned income portion must be

separately prorated. The earned income portion shall be prorated using the ratio of Georgia source earned income to total earned income computed as if

the taxpayer were a resident of Georgia for the entire year. The unearned portion shall be prorated using the ratio of Georgia source unearned retirement

income to total unearned retirement income computed as if the taxpayer were a resident of Georgia for the entire year.

*Retirement income does not include income received directly or indirectly from lotteries, gambling, illegal sources or similar income.

** Rental, Royalty or Partnership income that is subject to FICA tax or Self employment tax should be included on line 2 not line 13. Trade or business

income from an S Corp in which the taxpayer or their spouse materially participated should be included on line 2 not line 13.

Page 14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34