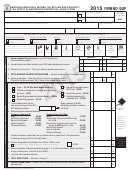

Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2015 Page 6

ADVERTISEMENT

2015 New Developments

continued

◦ Provides that the Department shall provide a

that the project creates 200 or more full-time,

permanent jobs or $5 million in annual pay-

report to the chairperson of the House Committee

roll within two years of the placed in service

on Ways and Means and the chairperson of the

date, the project is eligible for credits up to

Senate Finance Committee by June 30 of each

$10 million for an individual certified structure.

year. Such report shall contain the total sales tax

collected in the prior calendar year and the aver-

◦ Provides that in no event shall more than one

age number of full-time employees at the certified

application for any individual certified structure

structure and the total value of credits claimed

be

approved in any 120

month

period.

for each taxpayer claiming the credit for a cer-

tified structure, other than a historic home.

◦ For projects earning more than $300,000 in

credits, provides that in no event shall the aggre -

HB 310 (O.C.G.A. § 48-7-161) This bill changes

gate amount of tax credits exceed $25 million per

agencies that are eligible to offset an individual

calendar year.

taxpayer’s state income tax refund from both the

Department of Corrections and State Board of Par-

◦ Provides that a taxpayer must apply for preap-

dons and Paroles to the Department of Community

proval with the Department (preapproval is re-

Supervision.

quested before the certified rehabilitation is

completed). For applications on projects over

HB 320 (O.C.G.A. § 20-3-236) The income tax

the annual $25 million limitation, those applica-

portion of this bill provides that individuals who owe

tions shall be given priority the following year.

any amount to the Georgia Student Finance Com-

mission relating to any scholarship or grant made

◦

Eliminates the carry forward provision.

by the Commission including repayments and re-

funds, are subject to offset of their state tax refund in

◦ Specifies that tax credits earned by a taxpayer

accordance with rules and regulations promulgated

and previously claimed but not used by such tax-

by the Commission.

payer may be transferred or sold in whole or in

part by such taxpayer to another Georgia taxpayer.

HB 339 (O.C.G.A. § 48-7-40.26) This bill ex-

tends the film tax credit for qualified interactive

◦ Provides that the sale of a credit does

entertainment production companies through tax

not extend the period for which a credit

years beginning before January 1, 2019. Also for

may be carried forward and does not increase the

tax years beginning on or after January 1, 2016,

total amount of the credit that may be claimed.

it requires preapproval for such companies and

makes certain other changes for such companies.

◦ Specifies that a credit earned or purchased

by, or assigned to, a partnership, limited liability

HB 464 (O.C.G.A. §§ 48-7-40.10, 48-7-40.11, and

company, Subchapter ‘S’ corporation or oth-

48-7-29.12) This bill repeals Code Section 48-

7-40.10, qualified water conservation investment

er pass-through entity may be allocated to the

partners, members, or shareholders of that entity

tax credit, on December 31, 2016. It also repeals

and claimed in accordance with provisions of any

Code Section 48-7-40.11, tax credit for shift from

agreement among the partners, members, or

ground-water usage, on December 31, 2016.

shareholders of that entity and without regard to the

Finally, it provides that beginning on January 1,

ownership interest of the partners, members or

2016, the aggregate amount of conservation tax

shareholders in the rehabilitated certified struc-

credits shall not exceed $30 million per calendar

ture, provided that the entity or person that

year and it provides that the Department of Natural

claims the credit must be subject to Georgia tax.

Resources shall not accept new applications for

the conservation tax credit after December 31, 2016.

◦ Provides reporting requirements for the earner

of the credit.

Page 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34