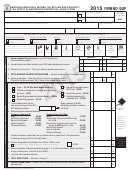

Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2015 Page 32

ADVERTISEMENT

COMMON MISTAKES THAT WILL DELAY YOUR REFUND

1. Sending your return by certified mail. The postal service imposes special handling procedures for certified mail that

could delay processing of your return.

2. Not filling in the name(s), social security number(s), address, residency code, and/or filing status.

3. Failing to list your spouse’s social security number when filing a separate return.

4. Incorrectly listing or failing to list exemptions, dependents, income, and deductions.

5. Failing to submit required schedules, statements, and supporting documentation, including W-2s, other states’ tax returns,

or necessary federal returns and schedules.

6. Entering information on a special funds line when a donation is not being made; including a check for a donation with a

refund return.

7. Not entering the amount owed or the refund amount. Do not enter amounts on both lines.

8. Not verifying calculations, including the tax rate, or placing zeros on lines that are not being used.

9. Incorrectly completing Schedule 3 or failing to include it with your return when required.

10. Mailing your Georgia return to the wrong address.

REMINDERS

•

Mail your return, payment and all necessary documentation to the appropriate address listed on the return. For

additional mailing addresses, please check the section called “Where Do You File?” in the tax instruction booklet.

•

Enclose copies of required returns, schedules and other documentation with your return. Failure to enclose proper

documentation could delay your refund.

•

If you have an overpayment, indicate the amount to be refunded, credited to estimated tax and/or contributed to

one of the special funds.

•

Mail Payment Voucher 525 TV with your return and payment to the address on Form 500 or 500EZ to ensure proper

posting to your account. If you file electronically, mail the voucher and your payment to the address on the voucher.

•

Make your check or money order payable to the Georgia Department of Revenue. If you owe less than $1, you do

not need to send a payment. If you are due a refund of less than $1, submit Form IT 550 to request a refund.

•

Do not staple your check, W-2s or any other documents to your return.

PENALTY AND INTEREST

Tax not paid by the statutory due date of the return is subject to 1 percent interest and ½ of 1 percent late payment penalty

per month, or fraction thereof. Also a late filing penalty is imposed at 5 percent of the tax not paid by the original due date.

Interest accrues until the tax due has been paid in full; the combined total of late filing and late payment penalty cannot

exceed 25 percent of the tax not paid by the original due date. An extension of time for filing the return does not extend the

date for making the payment. Additional penalties may apply as follows:

Frivolous Return Penalty - $1,000. (A frivolous return is one that contains incorrect or insufficient information to

accurately compute the appropriate tax liability with the intent to delay or impede Georgia tax law or is based on a

frivolous position.)

Negligent Underpayment Penalty - 5 percent of the underpaid amount.

Fraudulent Underpayment Penalty - 50 percent of the underpaid amount.

Failure to File Estimated Tax Penalty - 9 percent per year for the period of underpayment. Use Form 500 UET to

calculate the penalty.

Page 25

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34