Instructions For Form 540 2ez - California Resident Income Tax Return - 2003

ADVERTISEMENT

Instructions for Form 540 2EZ

Things you need to know before you complete

Form 540 2EZ

Use blue or black ink to complete Form 540 2EZ.

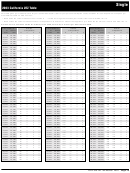

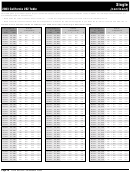

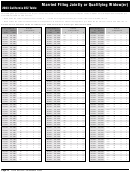

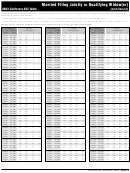

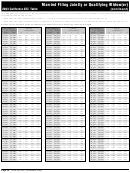

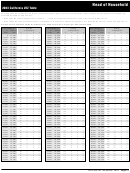

The California 2EZ tables are made for the Form 540 2EZ only. They

may not be used with any other California tax form. There are three

separate tables, one for each filing status. Note: married filing jointly and

qualifying widow(er) share the same tables. The tax amounts have been

reduced for the standard deduction for your filing status, your personal

exemption credit, and dependent exemption credits you may claim.

Use the label on the cover of this booklet to speed processing and

prevent common errors that can delay refunds. After completing your

return, sign it and attach the mailing label. Make corrections to the

label by crossing out any errors and printing the correct or missing

information in black or blue ink.

Enter your social security number(s) in the space(s) provided. This

information is not pre-printed on your label.

Specific Line Instructions

Line 10 – Interest Income

These instructions are based on the Internal Revenue Code (IRC) as of

Enter interest income shown on Form 1099-INT, box 1.

January 1, 2001, and the California Revenue and Taxation Code (R&TC).

Do not include amounts shown on Form 1099-INT,

Tip

box 3, Interest on U.S. Savings Bonds and Treasury

Line 1 through Line 5 – Filing Status

Obligations. This interest is not taxed by California.

See page 5 for the requirements for each of the filing statuses. Then fill

Line 11 – Unemployment Compensation

in the circle on Form 540 2EZ for the filing status that applies to you.

Enter unemployment compensation from federal Form 1099-G. This

Line 6 – Can you be claimed as a dependent?

type of income is not taxed by California and should not be included in

If your parent (or someone else) can claim you (or your spouse, if

the total for line 13.

married) as a dependent on his or her tax return, even if he or she

Line 12 – U.S. Social Security or Railroad

chooses not to, fill in the circle on line 6.

Retirement Benefits

Line 7 – Seniors

Enter U.S. social security or tier 1 and tier 2 railroad retirement benefits.

If you (or if married, your spouse) are 65 or older, enter 1; if both, enter

California does not tax this income.

2 on line 7.

Line 14 – Tax

Line 8 – Dependents

The standard deduction and personal exemption credit

Enter the names of the dependents you are allowed to claim. Up to 3

are built into the tax tables and not reported on the tax

Tip

dependents are allowed on Form 540 2EZ. If you are claiming 4 or

return.

more dependents, you must e-file or use Form 540A or Form 540.

Refundable Child and Dependent Care Expenses Credit

Did you fill in the circle for line 6?

If you qualify for the similar federal credit and your

Yes Complete the Dependent Tax Worksheet on the next page.

Tip

California adjusted gross income is $100,000 or less,

No

Follow the instructions below.

claim the credit using Form 540A or Form 540. The

easiest way to claim the credit is to e-file. This credit may

Use the California 2EZ table for your filing status to complete line 14.

not be claimed on Form 540 2EZ.

The 2EZ tables in this booklet give you credit for the standard deduction

for your filing status, your personal exemption credit, and dependent

Line 9 – Wages

exemption credits. There are three different tables. Make sure you use the

right one. If your filing status is:

Enter the amount from Form W-2, box 16. If you have more than one

W-2, add all amounts shown in box 16. The picture on this page shows

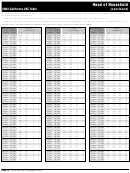

• Single, go to page 19.

where this information is located on your Form W-2.

• Married filing jointly or qualifying widow(er), go to page 22.

• Head of household, go to page 27.

Generally, federal Form W-2 box 1 and box 16 should reflect the same

amounts. If they are different because you had income from a source

outside California, you cannot file Form 540 2EZ. Please e-file or get

Form 540A, Form 540, or Long or Short Form 540NR, from our Website

(Instructions continued on following page.)

at or see the back cover.

Exception: You may use Form 540 2EZ, if your Form W-2, box 1 and

box 16 are different because you received ride-sharing benefits or sick

pay under the Federal Insurance Contributions Act and Railroad

Retirement Act.

If this exception applies to you, enter the amount from federal

Form W-2, box 16.

Page 6 Form 540 2EZ Tax Booklet 2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18