Instructions For Form 540 2ez - California Resident Income Tax Return - 2003 Page 2

ADVERTISEMENT

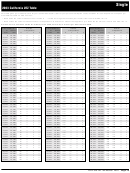

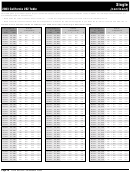

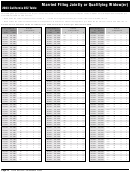

Instructions for Form 540 2EZ

Instructions for Form 540 2EZ

If you owe use tax but choose not to report it on your income tax return,

Dependent Tax Worksheet

you must report and pay the tax to the State Board of Equalization. To do

1. Is the amount on line 13 less than or equal to:

so, download a copy of Publication 79-B, California Use Tax, from

• $10,220 if single

You can also request a copy by calling the State Board

• $20,290 if married filing jointly or qualifying widow(er)

of Equalization's Information Center at (800) 400-7115, or TTY/TDD

• $14,390 if head of household, or

(800) 735-2929.

2. Do you have a dependent?

Note: Businesses that have a California seller's permit must continue to

If the answer to question 1 or question 2 is:

report business purchases subject to use tax on their sales and use tax

Yes

Stop here. You cannot use Form 540 2EZ because you will not be

returns.

able to figure the correct amount of tax using the California 2EZ Tables.

Please e-file (see page 2), or get Form 540A or Form 540 at

See page 31 for a general explanation of California use tax.

Use Tax Worksheet

No

If you can be claimed as a dependent by another taxpayer, your

Round all amounts to the nearest whole dollar.

personal exemption credit amount is zero. You will need to adjust the tax

1.Enter your purchases from out-of-state or internet

from the 2EZ Table for this amount as follows:

sellers made without payment of California

1. Using the amount from Form 540 2EZ, line 13, and

1

sales/use tax.

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ________.00

your filing status, look up the tax in the 2EZ Table.

2.Enter the applicable sales and use tax rate.

If your filing status is:

}

See page 8.

2

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ________

• Single, go to page 19.

3.Multiply line 1 by the tax rate on line 2.

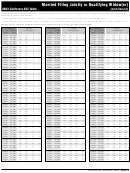

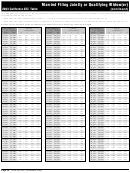

• Married filing jointly or qualifying widow(er),

Enter result here. . . . . . . . . . . . . . . . . . . . . . . . . . . . $ ________.00

go to page 22

. . . . . . . . . . . . . . . . . . . . . 1 ________

4.Enter any sales or use tax you paid to another

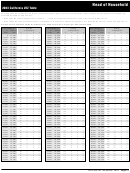

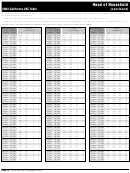

• Head of household, go to page 27

state for purchases included on line 1.

3

. . . . . . . . . . $ ________.00

2. • If single or head of household, enter $82

}

5.Subtract line 4 from line 3. This is the total use

• If married and both spouses can be

tax due.Enter the amount due on line 22. If the

claimed as a dependent by another

taxpayer, enter $164

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 ________

amount is less than zero, enter -0-. . . . . . . . . . . . . . $ ________.00

• If married and only one spouse can be

1

Include handling charges. Do not include any other states’ sales or use

claimed, enter $82

tax paid on the purchase(s).

• If qualifying widow(er), enter $164

2

Enter the decimal equivalent of the sales and use tax rate. For example,

3. Add line 1 and line 2. Enter here and on

the decimal equivalent of 7.25% is 0.0725, and the decimal equivalent

Form 540 2EZ, line 14 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 ________

of 7.375% is 0.07375. Use the tax rate applicable to the place in

California where the property is used, stored, or otherwise consumed.

Line 15 - Senior Exemption

3

This is a credit for tax paid to other states. You cannot claim a credit

If you entered 1 in the box on line 7, enter $82. If you entered 2 in the

greater than the amount of tax that would have been due if the

purchase had been made in California. For example, if you paid $8.00

box on line 7, enter $164.

sales tax to another state for a purchase, and you would have paid

Line 16 – Nonrefundable Renter’s Credit

$6.00 in California, you can claim a credit of only $6.00 for that

purchase.

If you paid rent on your principal California residence in 2003, you may

be eligible for a credit to reduce your tax. See page 9 for more

Worksheet, Line 1, Purchases Subject to Use Tax

information.

• Report only purchases from out-of-state or internet sellers made

Line 19 – Tax Withheld

during the year that corresponds with the income tax return you are

filing. For example, use your 2003 return to report taxable purchases

Enter the amount from Form W-2, box 17. If you have more than one

made in 2003.

Form W-2, add all amounts shown in box 17. The picture on page 6

• Report items that would have been taxable in a California store. For

shows where this information is located on your Form W-2. The

example, you would include purchases of clothing, but not

Franchise Tax Board verifies all withholding claimed from Forms W-2

purchases of prescription medicine. If you have questions on

with the Employment Development Department.

whether a purchase is taxable, visit the State Board of Equalization's

Line 21 – Tax Due

Website at , or call its Information Center at

If you increase your withholding, more of your 2004 state tax liability

(800) 400-7115, or TTY/TDD (800) 735-2929.

will be withheld throughout the year. Doing so could eliminate the need

• If you traveled to a foreign country and brought items back to

to make a large payment with your tax return. To increase your withhold-

California, generally the use tax is due on the purchase price of the

ing, complete Employment Development Department (EDD) Form DE-4,

goods you listed on your U.S. Customs Declaration less the $400

Employee’s Withholding Allowance Certificate, and give it to your

per-person exemption. This $400 exemption does not apply to goods

employer's appropriate payroll staff. You can obtain this form by calling

sent or shipped to California by mail or other common carrier.

EDD at (888) 745-3886 or through the Internet at

• Do not report the following on your income tax return:

taxrep/de4.pdf, or you can get this form from your employer.

•· Vehicles, vessels, and trailers that must be registered with the

Department of Motor Vehicles.

Line 22 – Use Tax

• Mobile homes or commercial coaches that must be registered

As explained on page 31, you may owe California use tax for purchases

annually as required by the Health and Safety Code.

from out-of-state sellers (for example, purchases made by telephone,

• Vessels documented with the U.S. Coast Guard.

over the Internet, by mail, or in person).

• Aircraft.

• Leases of machinery, equipment, vehicles, and other tangible

You may now report use tax on your income tax return instead of

personal property.

having to file a use tax return with the California State Board of

Equalization. To report use tax on your income tax return, complete the

Use Tax Worksheet in the next column.

Form 540 2EZ Tax Booklet 2003 Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18