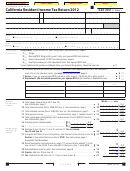

Instructions For Form 540 2ez - California Resident Income Tax Return - 2003 Page 3

ADVERTISEMENT

Instructions for Form 540 2EZ

C. Add line A and line B . . . . . . . . ____________

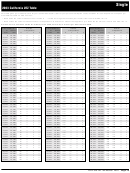

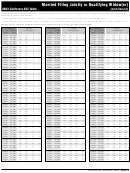

Sales and Use Tax Rates by County

(Includes state, local, and district taxes)

D. Amount on line 20 . . . . . . . . . . ____________

As of December 31, 2003

E. Subtract line C from Line D . . . ____________

The amount on line E will be refunded to you. Transfer this amount to

County

Rate

County

Rate

Form 540 2EZ, line 24. If the refund is less than $1.00, attach a written

Alameda

8.25%

Orange

7.75%

request to your Form 540 2EZ to receive the refund.

Alpine

7.25%

Placer

7.25%

Amador

7.25%

Plumas

7.25%

Note: If the amount on line C is greater than the amount on line D,

Butte

7.25%

Riverside

7.75%

the amount on line E is the amount you owe. Transfer this amount to

Calaveras

7.25%

Sacramento

7.75%

Form 540 2EZ, line 25.

Colusa

7.25%

San Benito

7.25%

Direct Deposit

Contra Costa

8.25%

San Bernardino

7.75%

Del Norte

7.25%

San Diego

7.75%

It’s fast, safe, and convenient to have your refund directly deposited into

El Dorado

1

7.25%

San Francisco

8.50%

your bank account. See the picture on page 11 for locating the bank

1

Fresno

7.875%

San Joaquin

7.75%

information.

Glenn

7.25%

San Luis Obispo

7.25%

Assemble your tax return as shown on this page and mail it in the

Humboldt

7.25%

San Mateo

8.25%

Franchise Tax Board envelope provided. Be sure to attach the green label

Imperial

1

7.75%

Santa Barbara

7.75%

to the front of the envelope.

Inyo

7.75%

Santa Clara

8.25%

The address is:

Kern

7.25%

Santa Cruz

8.00%

Kings

7.25%

Shasta

7.25%

FRANCHISE TAX BOARD

Lake

1

7.25%

Sierra

7.25%

PO BOX 942840

Lassen

7.25%

Siskiyou

7.25%

SACRAMENTO CA 94240-0002

Los Angeles

1

8.25%

Solano

7.375%

Line 25 – Amount You Owe

Madera

7.75%

Sonoma

1

7.50%

Marin

7.25%

Stanislaus

7.375%

Add line 21, line 22, and line 23 and enter the total on line 25. This is

Mariposa

7.75%

Sutter

7.25%

the amount you owe.

Mendocino

1

7.25%

Tehama

7.25%

Assemble your return as shown below and mail it in the Franchise Tax

Merced

7.25%

Trinity

7.25%

Board envelope provided. Be sure to attach the white label to the front of

Modoc

7.25%

Tulare

7.25%

the envelope. The address is:

Mono

7.25%

Tuolumne

7.25%

FRANCHISE TAX BOARD

Monterey

7.25%

Ventura

7.25%

PO BOX 942867

Napa

7.75%

Yolo

1

7.25%

SACRAMENTO CA 94267-0001.

Nevada

1

7.375%

Yuba

7.25%

Sign Your Tax Return

1

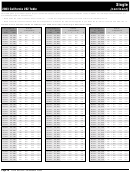

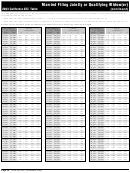

Many cities and towns in California impose a district tax, which results

in a higher sales and use tax rate than in other parts of the county.

You must sign your tax return on Side 2. If you file a joint tax return,

If you are reporting an item that was purchased for use in any of

your spouse must sign it also.

the following cities or towns, please use the appropriate tax rates

Note: If you file a joint return, both you and your spouse are generally

for those areas. The following tax rates apply within the city limits

responsible for tax and any interest or penalties due on the return. If

or the town limits of the listed community.

one spouse does not pay the tax, the other spouse may have to. See

County

City or Town with a Special Tax District

Tax Rate

Innocent Spouse Relief on page 30.

If you pay a person to prepare your tax return, that person must sign on

El Dorado

Placerville

7.50%

Side 2 and include either their social security number (or PTIN) or FEIN.

Fresno

Clovis

8.175%

A paid preparer must give you two copies of your tax return: one to file

Imperial

Calexico

8.25%

with the Franchise Tax Board and one to keep for your records.

Lake

Clearlake

7.75%

Los Angeles

Avalon

8.75%

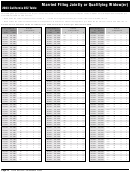

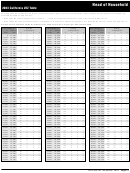

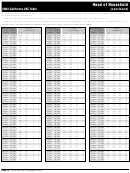

Assembling Your Tax Return

2

Mendocino

Willits (effective October 1, 2003)

7.75%

Nevada

Truckee

7.875%

Attach your Form(s) W-2 to your return as shown.

Sonoma

Sebastopol (effective April 1, 2003)

3

7.625%

To help with our processing costs, please

Yolo

West Sacramento (effective April 1, 2003)

4

7.75%

Form

enclose but do not staple your payment to

Yolo

Woodland

7.75%

540 2EZ

your return.

2

The tax rate in the City of Willits prior to October 1, 2003, is 7.25%.

3

The tax rate in the City of Sebastopol prior to April 1, 2003, is 7.50%.

Please do not enclose a copy of your

4

The tax rate in the City of West Sacramento prior to April 1, 2003, is

federal tax return or any other

Form

7.25%.

W-2

document with your Form 540 2EZ.

This will help us to reduce

Line 23 – Voluntary Contributions

government processing and

Side 1

You may contribute part or all of your refund to the funds listed on

storage costs.

Form 540 2EZ, Side 2. See page 10 for descriptions of the funds.

Questions?

Line 24 – Refund or No Amount Due

See Frequently Asked Questions on page 14 for

Tip

information about filing requirements, amending your

Complete the following worksheet:

return, how long to keep your return, etc.

A. Amount on line 22 . . . . . . . . . . ____________

B. Amount on line 23 . . . . . . . . . . ____________

Page 8 Form 540 2EZ Tax Booklet 2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18