Instructions For Form 540 2ez - California Resident Income Tax Return - 2003 Page 15

ADVERTISEMENT

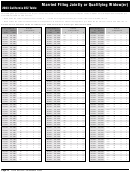

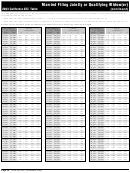

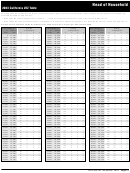

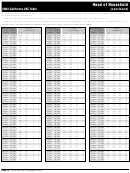

Married Filing Jointly or Qualifying Widow(er)

(continued)

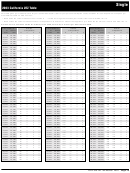

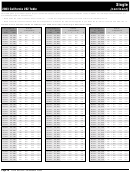

2003 California 2EZ Table

This table gives you credit of $6,140 for your standard deduction, $164 for your personal exemption credit, and $257 for each dependent exemption you

are entitled to claim. To Find Your Tax:

• Read down the column labeled “If Your Income is . . .” to find the range that includes your income from Form 540 2EZ, line 13.

• Read across the columns labeled “Number of dependents” to find the tax amount that applies to you. Enter the tax amount on Form 540 2EZ, line 14.

Caution: Do not use these tables for TeleFile, Form 540A, Form 540, or the Long or Short Form 540NR.

If Your Income is...

Number

If Your Income is...

Number

If Your Income is...

Number

At

But not

of Dependents

At

But not

of Dependents

At

But not

of Dependents

Least

over

0

1

2

3

Least

over

0

1

2

3

Least

over

0

1

2

3

86,191

86,290 3,452 3,195 2,938 2,681

91,691

91,790 3,964 3,707 3,450 3,193

97,191

97,290 4,475 4,218 3,961 3,704

86,291

86,390 3,462 3,205 2,948 2,691

91,791

91,890 3,973 3,716 3,459 3,202

97,291

97,390 4,485 4,228 3,971 3,714

86,391

86,490 3,471 3,214 2,957 2,700

91,891

91,990 3,983 3,726 3,469 3,212

97,391

97,490 4,494 4,237 3,980 3,723

86,491

86,590 3,480 3,223 2,966 2,709

91,991

92,090 3,992 3,735 3,478 3,221

97,491

97,590 4,503 4,246 3,989 3,732

86,591

86,690 3,490 3,233 2,976 2,719

92,091

92,190 4,001 3,744 3,487 3,230

97,591

97,690 4,513 4,256 3,999 3,742

86,691

86,790 3,499 3,242 2,985 2,728

92,191

92,290 4,010 3,753 3,496 3,239

97,691

97,790 4,522 4,265 4,008 3,751

86,791

86,890 3,508 3,251 2,994 2,737

92,291

92,390 4,020 3,763 3,506 3,249

97,791

97,890 4,531 4,274 4,017 3,760

86,891

86,990 3,518 3,261 3,004 2,747

92,391

92,490 4,029 3,772 3,515 3,258

97,891

97,990 4,541 4,284 4,027 3,770

86,991

87,090 3,527 3,270 3,013 2,756

92,491

92,590 4,038 3,781 3,524 3,267

97,991

98,090 4,550 4,293 4,036 3,779

87,091

87,190 3,536 3,279 3,022 2,765

92,591

92,690 4,048 3,791 3,534 3,277

98,091

98,190 4,559 4,302 4,045 3,788

87,191

87,290 3,545 3,288 3,031 2,774

92,691

92,790 4,057 3,800 3,543 3,286

98,191

98,290 4,568 4,311 4,054 3,797

87,291

87,390 3,555 3,298 3,041 2,784

92,791

92,890 4,066 3,809 3,552 3,295

98,291

98,390 4,578 4,321 4,064 3,807

87,391

87,490 3,564 3,307 3,050 2,793

92,891

92,990 4,076 3,819 3,562 3,305

98,391

98,490 4,587 4,330 4,073 3,816

87,491

87,590 3,573 3,316 3,059 2,802

92,991

93,090 4,085 3,828 3,571 3,314

98,491

98,590 4,596 4,339 4,082 3,825

87,591

87,690 3,583 3,326 3,069 2,812

93,091

93,190 4,094 3,837 3,580 3,323

98,591

98,690 4,606 4,349 4,092 3,835

87,691

87,790 3,592 3,335 3,078 2,821

93,191

93,290 4,103 3,846 3,589 3,332

98,691

98,790 4,615 4,358 4,101 3,844

87,791

87,890 3,601 3,344 3,087 2,830

93,291

93,390 4,113 3,856 3,599 3,342

98,791

98,890 4,624 4,367 4,110 3,853

87,891

87,990 3,611 3,354 3,097 2,840

93,391

93,490 4,122 3,865 3,608 3,351

98,891

98,990 4,634 4,377 4,120 3,863

87,991

88,090 3,620 3,363 3,106 2,849

93,491

93,590 4,131 3,874 3,617 3,360

98,991

99,090 4,643 4,386 4,129 3,872

88,091

88,190 3,629 3,372 3,115 2,858

93,591

93,690 4,141 3,884 3,627 3,370

99,091

99,190 4,652 4,395 4,138 3,881

88,191

88,290 3,638 3,381 3,124 2,867

93,691

93,790 4,150 3,893 3,636 3,379

99,191

99,290 4,661 4,404 4,147 3,890

88,291

88,390 3,648 3,391 3,134 2,877

93,791

93,890 4,159 3,902 3,645 3,388

99,291

99,390 4,671 4,414 4,157 3,900

88,391

88,490 3,657 3,400 3,143 2,886

93,891

93,990 4,169 3,912 3,655 3,398

99,391

99,490 4,680 4,423 4,166 3,909

88,491

88,590 3,666 3,409 3,152 2,895

93,991

94,090 4,178 3,921 3,664 3,407

99,491

99,590 4,689 4,432 4,175 3,918

88,591

88,690 3,676 3,419 3,162 2,905

94,091

94,190 4,187 3,930 3,673 3,416

99,591

99,690 4,699 4,442 4,185 3,928

88,691

88,790 3,685 3,428 3,171 2,914

94,191

94,290 4,196 3,939 3,682 3,425

99,691

99,790 4,708 4,451 4,194 3,937

88,791

88,890 3,694 3,437 3,180 2,923

94,291

94,390 4,206 3,949 3,692 3,435

99,791

99,890 4,717 4,460 4,203 3,946

88,891

88,990 3,704 3,447 3,190 2,933

94,391

94,490 4,215 3,958 3,701 3,444

99,891

99,990 4,727 4,470 4,213 3,956

88,991

89,090 3,713 3,456 3,199 2,942

94,491

94,590 4,224 3,967 3,710 3,453

99,991 100,000 4,736 4,479 4,222 3,965

89,091

89,190 3,722 3,465 3,208 2,951

94,591

94,690 4,234 3,977 3,720 3,463

89,191

89,290 3,731 3,474 3,217 2,960

94,691

94,790 4,243 3,986 3,729 3,472

89,291

89,390 3,741 3,484 3,227 2,970

94,791

94,890 4,252 3,995 3,738 3,481

89,391

89,490 3,750 3,493 3,236 2,979

94,891

94,990 4,262 4,005 3,748 3,491

OVER $100,000 YOU MUST USE FORM 540A

89,491

89,590 3,759 3,502 3,245 2,988

94,991

95,090 4,271 4,014 3,757 3,500

OR FORM 540. Go to

89,591

89,690 3,769 3,512 3,255 2,998

95,091

95,190 4,280 4,023 3,766 3,509

89,691

89,790 3,778 3,521 3,264 3,007

95,191

95,290 4,289 4,032 3,775 3,518

89,791

89,890 3,787 3,530 3,273 3,016

95,291

95,390 4,299 4,042 3,785 3,528

89,891

89,990 3,797 3,540 3,283 3,026

95,391

95,490 4,308 4,051 3,794 3,537

89,991

90,090 3,806 3,549 3,292 3,035

95,491

95,590 4,317 4,060 3,803 3,546

90,091

90,190 3,815 3,558 3,301 3,044

95,591

95,690 4,327 4,070 3,813 3,556

90,191

90,290 3,824 3,567 3,310 3,053

95,691

95,790 4,336 4,079 3,822 3,565

90,291

90,390 3,834 3,577 3,320 3,063

95,791

95,890 4,345 4,088 3,831 3,574

90,391

90,490 3,843 3,586 3,329 3,072

95,891

95,990 4,355 4,098 3,841 3,584

90,491

90,590 3,852 3,595 3,338 3,081

95,991

96,090 4,364 4,107 3,850 3,593

90,591

90,690 3,862 3,605 3,348 3,091

96,091

96,190 4,373 4,116 3,859 3,602

90,691

90,790 3,871 3,614 3,357 3,100

96,191

96,290 4,382 4,125 3,868 3,611

90,791

90,890 3,880 3,623 3,366 3,109

96,291

96,390 4,392 4,135 3,878 3,621

90,891

90,990 3,890 3,633 3,376 3,119

96,391

96,490 4,401 4,144 3,887 3,630

90,991

91,090 3,899 3,642 3,385 3,128

96,491

96,590 4,410 4,153 3,896 3,639

91,091

91,190 3,908 3,651 3,394 3,137

96,591

96,690 4,420 4,163 3,906 3,649

91,191

91,290 3,917 3,660 3,403 3,146

96,691

96,790 4,429 4,172 3,915 3,658

91,291

91,390 3,927 3,670 3,413 3,156

96,791

96,890 4,438 4,181 3,924 3,667

91,391

91,490 3,936 3,679 3,422 3,165

96,891

96,990 4,448 4,191 3,934 3,677

91,491

91,590 3,945 3,688 3,431 3,174

96,991

97,090 4,457 4,200 3,943 3,686

91,591

91,690 3,955 3,698 3,441 3,184

97,091

97,190 4,466 4,209 3,952 3,695

Page 26 Form 540 2EZ Tax Booklet 2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18