Instructions For Form 540 2ez - California Resident Income Tax Return - 2003 Page 4

ADVERTISEMENT

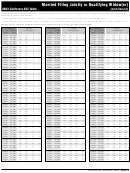

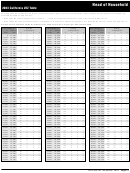

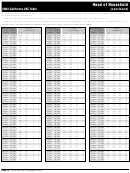

Nonrefundable Renter’s Credit Qualification Record

If you were a resident of California and paid rent on property in California which was your principal residence, you may qualify for a

credit that you can use to reduce your tax. Check the box which answers the questions below to see if you qualify.

Tip

If you e-file, the software will ask you the questions needed to determine if you qualify for this credit.

1. Were you a resident

1

of California for the entire year in

7. Did you claim the homeowner's property tax exemption

3

2003?

anytime during 2003.

YES. Go to the next question.

NO.

Go to question 8.

NO.

Stop. File the Long or Short Form 540NR,

YES. Stop here. You do not qualify for this credit.

California Nonresident or Part-Year Resident

8. Were you single in 2003?

Income Tax Return, e-file, or see the back cover

YES. Go to question 11.

for downloading or ordering forms.

NO.

Go to question 9.

2. Is the amount on Form 540 2EZ, line 13:

9. Did your spouse claim the homeowner's property tax

•

$29,054 or less if single; or

exemption anytime during 2003?

•

$58,108 or less if married filing jointly, head of

NO.

Go to question 11.

household, or qualifying widow(er)?

YES. Go to question 10.

YES. Go to the next question.

NO.

Stop here. You do not qualify for this credit.

10. Did you and your spouse maintain separate residences

for the entire year in 2003?

3. Did you pay rent, for at least half of 2003, on property

(including a mobile home that you owned on rented

YES. Go to question 11.

land) in California which was your principal residence?

NO.

Stop here. You do not qualify for the credit.

YES. Go to the next question.

11. If you are:

NO.

Stop here. You do not qualify for this credit.

•

Single, enter $60 below.

•

4. Can you be claimed as a dependent by a parent, foster

Married filing jointly, head of household, or qualifying

parent, legal guardian, or any other person in 2003?

widow(er), enter $120 below.

NO.

Go to question 6.

$ ___ ___ ___

YES. Go to question 5.

Enter this amount on Form 540 2EZ, line 16.

5. For more than half the year, did you live in the home of

12. Fill in the street address(es) and landlord information below

the person who could claim you as a dependent in 2003?

for the residence(s) you rented in California during 2003

NO. Go to question 6.

which qualified you for this credit.

YES. Stop here. You do not qualify for this credit.

6. Was the property you rented exempt

2

from property tax

in 2003?

Do Not Mail This Record

xxxxxxxxxxxxxxxxx

NO. Go to the next question.

xxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxx

YES. Stop here.You do not qualify for this credit.

Street Address

City, State, and ZIP Code

Dates Rented in 2003 (From______to______)

a_________________________________________________________________________________________________________

b_________________________________________________________________________________________________________

Enter the name, address, and telephone number of your landlord(s) or the person(s) to whom you paid rent for the residence(s) listed

above.

Name

Street Address

City, State, ZIP Code, and Telephone Number

a_________________________________________________________________________________________________________

b_________________________________________________________________________________________________________

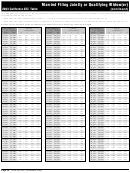

1

Military personnel. If you are not a legal resident of California, you do not qualify for this credit. However, your spouse may claim this credit if he or she was a resident, did not live in

military housing during 2003, and is otherwise qualified.

2

Property exempt from property taxes. You do not qualify for this credit if, for more than half of the year, you rented property that was exempt from property taxes. Exempt property

includes most government-owned buildings, church-owned parsonages, college dormitories, and military barracks. However, if you or your landlord paid possessory interest taxes for the

property you rented, then you may claim this credit if you are otherwise qualified.

3

Homeowner’s property tax exemption. You do not qualify for this credit if you or your spouse received a homeowner’s property tax exemption at any time during the year. However, if you

lived apart from your spouse for the entire year and your spouse received a homeowner’s property tax exemption for a separate residence, then you may claim this credit if you are

otherwise qualified. You can find the homeowner's property tax exemption information on your property tax bill from your County Assessor's office.

Form 540 2EZ Tax Booklet 2003 Page 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18