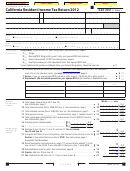

Instructions For Form 540 2ez - California Resident Income Tax Return - 2003 Page 7

ADVERTISEMENT

Paying Your Taxes (continued)

How much is the convenience fee?

2.5% of the amount charged or a minimum fee of $1.00 Example: A tax payment of $753.56 will have a convenience fee of $18.84

($18.839 rounded to the nearest cent). Official Payments Corp. will tell you your fee before you complete your transaction. You can

decide whether to complete the transaction at that time.

How do I use my credit card to pay my taxes?

1. Once you have determined how much you owe, gather your credit card information and complete the worksheet below.

2. Go to the Official Payments Corp. online payment center at or call the toll-free number

(800) 2PAY-TAX or (800) 272-9829 and follow the recorded instructions. Official Payments Corp. provides customer assistance

Monday through Friday, 9 a.m. to 5 p.m. PST.

After authorization of your payment, you will be given a confirmation number. Keep this number with your tax records.

Assistance for persons with disabilities. The Franchise Tax Board complies with the Americans with Disabilities Act. Persons with

hearing or speech impairments please call TTY/TDD (800) 822-6268.

Credit Card Information – Keep for Your Records

1 5 5 5

1. Jurisdiction Code

2. Amount you are paying: $______________________

—

—

—

—

3. Your SSN:

Spouse’s SSN:

First 4 letters of last name:

First 4 letters of spouse’s last name:

(

)

—

—

4. Tax year:

5. Home phone:

M M Y Y Y Y

6. Credit card no.: __________________________________________

7. Expiration date:

8. ZIP Code for address where your monthly credit card bill is sent:

At the end of your call, you will be given a payment confirmation number. You may make multiple credit card payments throughout the year. Record

the payment confirmation number below and save this page for your records.

Date: _____________________________

Confirmation No. __________________________________

Request

Pay as much as you can when you file your return. If you cannot pay your taxes in full, you can request

approval to make monthly payments. However, you will be charged interest and penalties. You will need

Monthly

to complete form FTB 3567, Installment Agreement Request.

Installments

To submit your request electronically, go to to complete and file form FTB 3567. To

submit your request by mail, go to our Website at to download and print the form or

call (800) 338-0505 to order the form by phone. Mail the completed form to FTB at the address shown

on the form.

Page 12 Form 540 2EZ Tax Booklet 2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18