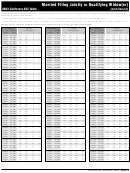

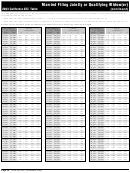

Instructions For Form 540 2ez - California Resident Income Tax Return - 2003 Page 16

ADVERTISEMENT

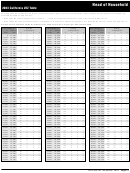

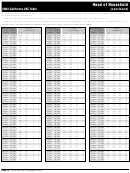

Head of Household

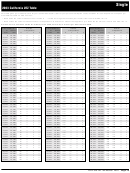

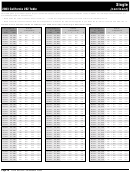

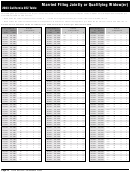

2003 California 2EZ Table

This table gives you credit of $6,140 for your standard deduction, $82 for your personal exemption credit, and $257 for each dependent exemption you

are entitled to claim. To Find Your Tax:

• Read down the column labeled “If Your Income is . . .” to find the range that includes your income from Form 540 2EZ, line 13.

• Read across the columns labeled “Number of dependents” to find the tax amount that applies to you. Enter the tax amount on Form 540 2EZ, line 14.

Caution: Do not use these tables for TeleFile, Form 540A, Form 540, or the Long or Short Form 540NR.

If Your Income is...

Number

If Your Income is...

Number

If Your Income is...

Number

At

But not

of Dependents

At

But not

of Dependents

At

But not

of Dependents

Least

over

0

1

2

3

Least

over

0

1

2

3

Least

over

0

1

2

3

0

14,390

0

0

0

0

19,791

19,890

73

0

0

0

25,291

25,390

183

0

0

0

14,391

14,490

1

0

0

0

19,891

19,990

75

0

0

0

25,391

25,490

185

0

0

0

14,491

14,590

2

0

0

0

19,991

20,090

77

0

0

0

25,491

25,590

187

0

0

0

14,591

14,690

3

0

0

0

20,091

20,190

79

0

0

0

25,591

25,690

189

0

0

0

14,691

14,790

4

0

0

0

20,191

20,290

81

0

0

0

25,691

25,790

191

0

0

0

14,791

14,890

5

0

0

0

20,291

20,390

83

0

0

0

25,791

25,890

193

0

0

0

14,891

14,990

6

0

0

0

20,391

20,490

85

0

0

0

25,891

25,990

195

0

0

0

14,991

15,090

7

0

0

0

20,491

20,590

87

0

0

0

25,991

26,090

197

0

0

0

15,091

15,190

8

0

0

0

20,591

20,690

89

0

0

0

26,091

26,190

199

0

0

0

15,191

15,290

9

0

0

0

20,691

20,790

91

0

0

0

26,191

26,290

201

0

0

0

15,291

15,390

10

0

0

0

20,791

20,890

93

0

0

0

26,291

26,390

203

0

0

0

15,391

15,490

11

0

0

0

20,891

20,990

95

0

0

0

26,391

26,490

205

0

0

0

15,491

15,590

12

0

0

0

20,991

21,090

97

0

0

0

26,491

26,590

207

0

0

0

15,591

15,690

13

0

0

0

21,091

21,190

99

0

0

0

26,591

26,690

209

0

0

0

15,691

15,790

14

0

0

0

21,191

21,290

101

0

0

0

26,691

26,790

211

0

0

0

15,791

15,890

15

0

0

0

21,291

21,390

103

0

0

0

26,791

26,890

213

0

0

0

15,891

15,990

16

0

0

0

21,391

21,490

105

0

0

0

26,891

26,990

215

0

0

0

15,991

16,090

17

0

0

0

21,491

21,590

107

0

0

0

26,991

27,090

217

0

0

0

16,091

16,190

18

0

0

0

21,591

21,690

109

0

0

0

27,091

27,190

219

0

0

0

16,191

16,290

19

0

0

0

21,691

21,790

111

0

0

0

27,191

27,290

221

0

0

0

16,291

16,390

20

0

0

0

21,791

21,890

113

0

0

0

27,291

27,390

223

0

0

0

16,391

16,490

21

0

0

0

21,891

21,990

115

0

0

0

27,391

27,490

225

0

0

0

16,491

16,590

22

0

0

0

21,991

22,090

117

0

0

0

27,491

27,590

227

0

0

0

16,591

16,690

23

0

0

0

22,091

22,190

119

0

0

0

27,591

27,690

229

0

0

0

16,691

16,790

24

0

0

0

22,191

22,290

121

0

0

0

27,691

27,790

231

0

0

0

16,791

16,890

25

0

0

0

22,291

22,390

123

0

0

0

27,791

27,890

233

0

0

0

16,891

16,990

26

0

0

0

22,391

22,490

125

0

0

0

27,891

27,990

235

0

0

0

16,991

17,090

27

0

0

0

22,491

22,590

127

0

0

0

27,991

28,090

237

0

0

0

17,091

17,190

28

0

0

0

22,591

22,690

129

0

0

0

28,091

28,190

239

0

0

0

17,191

17,290

29

0

0

0

22,691

22,790

131

0

0

0

28,191

28,290

241

0

0

0

17,291

17,390

30

0

0

0

22,791

22,890

133

0

0

0

28,291

28,390

243

0

0

0

17,391

17,490

31

0

0

0

22,891

22,990

135

0

0

0

28,391

28,490

245

0

0

0

17,491

17,590

32

0

0

0

22,991

23,090

137

0

0

0

28,491

28,590

247

0

0

0

17,591

17,690

33

0

0

0

23,091

23,190

139

0

0

0

28,591

28,690

249

0

0

0

17,691

17,790

34

0

0

0

23,191

23,290

141

0

0

0

28,691

28,790

251

0

0

0

17,791

17,890

35

0

0

0

23,291

23,390

143

0

0

0

28,791

28,890

253

0

0

0

17,891

17,990

36

0

0

0

23,391

23,490

145

0

0

0

28,891

28,990

255

0

0

0

17,991

18,090

37

0

0

0

23,491

23,590

147

0

0

0

28,991

29,090

257

0

0

0

18,091

18,190

39

0

0

0

23,591

23,690

149

0

0

0

29,091

29,190

259

2

0

0

18,191

18,290

41

0

0

0

23,691

23,790

151

0

0

0

29,191

29,290

261

4

0

0

18,291

18,390

43

0

0

0

23,791

23,890

153

0

0

0

29,291

29,390

263

6

0

0

18,391

18,490

45

0

0

0

23,891

23,990

155

0

0

0

29,391

29,490

265

8

0

0

18,491

18,590

47

0

0

0

23,991

24,090

157

0

0

0

29,491

29,590

267

10

0

0

18,591

18,690

49

0

0

0

24,091

24,190

159

0

0

0

29,591

29,690

269

12

0

0

18,691

18,790

51

0

0

0

24,191

24,290

161

0

0

0

29,691

29,790

271

14

0

0

18,791

18,890

53

0

0

0

24,291

24,390

163

0

0

0

29,791

29,890

273

16

0

0

18,891

18,990

55

0

0

0

24,391

24,490

165

0

0

0

29,891

29,990

275

18

0

0

18,991

19,090

57

0

0

0

24,491

24,590

167

0

0

0

29,991

30,090

277

20

0

0

19,091

19,190

59

0

0

0

24,591

24,690

169

0

0

0

30,091

30,190

279

22

0

0

19,191

19,290

61

0

0

0

24,691

24,790

171

0

0

0

30,191

30,290

281

24

0

0

19,291

19,390

63

0

0

0

24,791

24,890

173

0

0

0

30,291

30,390

283

26

0

0

19,391

19,490

65

0

0

0

24,891

24,990

175

0

0

0

30,391

30,490

285

28

0

0

19,491

19,590

67

0

0

0

24,991

25,090

177

0

0

0

30,491

30,590

287

30

0

0

19,591

19,690

69

0

0

0

25,091

25,190

179

0

0

0

30,591

30,690

289

32

0

0

19,691

19,790

71

0

0

0

25,191

25,290

181

0

0

0

30,691

30,790

291

34

0

0

Form 540 2EZ Tax Booklet 2003 Page 27

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18