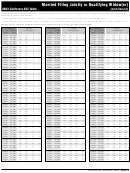

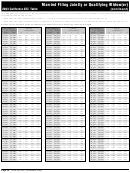

Instructions For Form 540 2ez - California Resident Income Tax Return - 2003 Page 18

ADVERTISEMENT

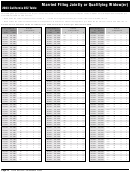

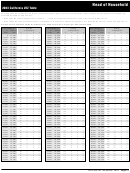

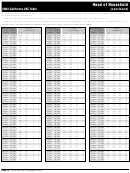

Head of Household

(continued)

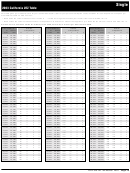

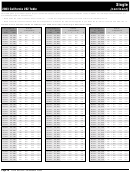

2003 California 2EZ Table

This table gives you credit of $6,140 for your standard deduction, $82 for your personal exemption credit, and $257 for each dependent exemption you

are entitled to claim. To Find Your Tax:

• Read down the column labeled “If Your Income is . . .” to find the range that includes your income from Form 540 2EZ, line 13.

• Read across the columns labeled “Number of dependents” to find the tax amount that applies to you. Enter the tax amount on Form 540 2EZ, line 14.

Caution: Do not use these tables for TeleFile, Form 540A, Form 540, or the Long or Short Form 540NR.

If Your Income is...

Number

If Your Income is...

Number

If Your Income is...

Number

At

But not

of Dependents

At

But not

of Dependents

At

But not

of Dependents

Least

over

0

1

2

3

Least

over

0

1

2

3

Least

over

0

1

2

3

47,291

47,390

977

720

463

206

48,291

48,390 1,037

780

523

266

49,291

49,390 1,097

840

583

326

47,391

47,490

983

726

469

212

48,391

48,490 1,043

786

529

272

49,391

49,490 1,103

846

589

332

47,491

47,590

989

732

475

218

48,491

48,590 1,049

792

535

278

49,491

49,590 1,109

852

595

338

47,591

47,690

995

738

481

224

48,591

48,690 1,055

798

541

284

49,591

49,690 1,115

858

601

344

47,691

47,790 1,001

744

487

230

48,691

48,790 1,061

804

547

290

49,691

49,790 1,121

864

607

350

47,791

47,890 1,007

750

493

236

48,791

48,890 1,067

810

553

296

49,791

49,890 1,127

870

613

356

47,891

47,990 1,013

756

499

242

48,891

48,990 1,073

816

559

302

49,891

49,990 1,133

876

619

362

47,991

48,090 1,019

762

505

248

48,991

49,090 1,079

822

565

308

49,991

50,000 1,139

882

625

368

48,091

48,190 1,025

768

511

254

49,091

49,190 1,085

828

571

314

48,191

48,290 1,031

774

517

260

49,191

49,290 1,091

834

577

320

OVER $50,000 YOU MUST USE FORM 540A

OR FORM 540. Go to

Form 540 2EZ Tax Booklet 2003 Page 29

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18