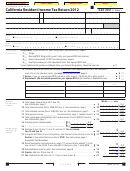

Instructions For Form 540 2ez - California Resident Income Tax Return - 2003 Page 8

ADVERTISEMENT

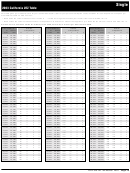

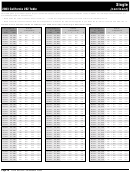

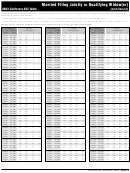

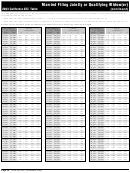

Single

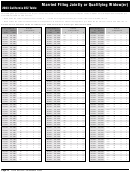

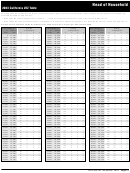

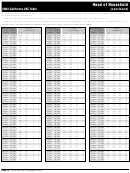

2003 California 2EZ Table

This table gives you credit of $3,070 for your standard deduction, $82 for your personal exemption credit, and $257 for each dependent exemption you

are entitled to claim. To Find Your Tax:

• Read down the column labeled “If Your Income is . . .” to find the range that includes your income from Form 540 2EZ, line 13.

• Read across the columns labeled “Number of dependents” to find the tax amount that applies to you. Enter the tax amount on Form 540 2EZ, line 14.

Caution: Do not use these tables for TeleFile, Form 540A, Form 540, or the Long or Short Form 540NR.

If Your Income is...

Number

If Your Income is...

Number

If Your Income is...

Number

At

But not

of Dependents

At

But not

of Dependents

At

But not

of Dependents

Least

over

0

1

2

3

Least

over

0

1

2

3

Least

over

0

1

2

3

0

10,220

0

0

0

0

15,621

15,720

110

0

0

0

21,121

21,220

300

43

0

0

10,221

10,320

2

0

0

0

15,721

15,820

112

0

0

0

21,221

21,320

304

47

0

0

10,321

10,420

4

0

0

0

15,821

15,920

114

0

0

0

21,321

21,420

308

51

0

0

10,421

10,520

6

0

0

0

15,921

16,020

116

0

0

0

21,421

21,520

312

55

0

0

10,521

10,620

8

0

0

0

16,021

16,120

118

0

0

0

21,521

21,620

316

59

0

0

10,621

10,720

10

0

0

0

16,121

16,220

120

0

0

0

21,621

21,720

320

63

0

0

10,721

10,820

12

0

0

0

16,221

16,320

122

0

0

0

21,721

21,820

324

67

0

0

10,821

10,920

14

0

0

0

16,321

16,420

124

0

0

0

21,821

21,920

328

71

0

0

10,921

11,020

16

0

0

0

16,421

16,520

126

0

0

0

21,921

22,020

332

75

0

0

11,021

11,120

18

0

0

0

16,521

16,620

128

0

0

0

22,021

22,120

336

79

0

0

11,121

11,220

20

0

0

0

16,621

16,720

130

0

0

0

22,121

22,220

340

83

0

0

11,221

11,320

22

0

0

0

16,721

16,820

132

0

0

0

22,221

22,320

344

87

0

0

11,321

11,420

24

0

0

0

16,821

16,920

134

0

0

0

22,321

22,420

348

91

0

0

11,421

11,520

26

0

0

0

16,921

17,020

136

0

0

0

22,421

22,520

352

95

0

0

11,521

11,620

28

0

0

0

17,021

17,120

138

0

0

0

22,521

22,620

356

99

0

0

11,621

11,720

30

0

0

0

17,121

17,220

140

0

0

0

22,621

22,720

360

103

0

0

11,721

11,820

32

0

0

0

17,221

17,320

144

0

0

0

22,721

22,820

364

107

0

0

11,821

11,920

34

0

0

0

17,321

17,420

148

0

0

0

22,821

22,920

368

111

0

0

11,921

12,020

36

0

0

0

17,421

17,520

152

0

0

0

22,921

23,020

372

115

0

0

12,021

12,120

38

0

0

0

17,521

17,620

156

0

0

0

23,021

23,120

376

119

0

0

12,121

12,220

40

0

0

0

17,621

17,720

160

0

0

0

23,121

23,220

380

123

0

0

12,221

12,320

42

0

0

0

17,721

17,820

164

0

0

0

23,221

23,320

384

127

0

0

12,321

12,420

44

0

0

0

17,821

17,920

168

0

0

0

23,321

23,420

388

131

0

0

12,421

12,520

46

0

0

0

17,921

18,020

172

0

0

0

23,421

23,520

392

135

0

0

12,521

12,620

48

0

0

0

18,021

18,120

176

0

0

0

23,521

23,620

396

139

0

0

12,621

12,720

50

0

0

0

18,121

18,220

180

0

0

0

23,621

23,720

400

143

0

0

12,721

12,820

52

0

0

0

18,221

18,320

184

0

0

0

23,721

23,820

404

147

0

0

12,821

12,920

54

0

0

0

18,321

18,420

188

0

0

0

23,821

23,920

408

151

0

0

12,921

13,020

56

0

0

0

18,421

18,520

192

0

0

0

23,921

24,020

412

155

0

0

13,021

13,120

58

0

0

0

18,521

18,620

196

0

0

0

24,021

24,120

416

159

0

0

13,121

13,220

60

0

0

0

18,621

18,720

200

0

0

0

24,121

24,220

420

163

0

0

13,221

13,320

62

0

0

0

18,721

18,820

204

0

0

0

24,221

24,320

424

167

0

0

13,321

13,420

64

0

0

0

18,821

18,920

208

0

0

0

24,321

24,420

428

171

0

0

13,421

13,520

66

0

0

0

18,921

19,020

212

0

0

0

24,421

24,520

432

175

0

0

13,521

13,620

68

0

0

0

19,021

19,120

216

0

0

0

24,521

24,620

436

179

0

0

13,621

13,720

70

0

0

0

19,121

19,220

220

0

0

0

24,621

24,720

440

183

0

0

13,721

13,820

72

0

0

0

19,221

19,320

224

0

0

0

24,721

24,820

444

187

0

0

13,821

13,920

74

0

0

0

19,321

19,420

228

0

0

0

24,821

24,920

448

191

0

0

13,921

14,020

76

0

0

0

19,421

19,520

232

0

0

0

24,921

25,020

452

195

0

0

14,021

14,120

78

0

0

0

19,521

19,620

236

0

0

0

25,021

25,120

456

199

0

0

14,121

14,220

80

0

0

0

19,621

19,720

240

0

0

0

25,121

25,220

460

203

0

0

14,221

14,320

82

0

0

0

19,721

19,820

244

0

0

0

25,221

25,320

464

207

0

0

14,321

14,420

84

0

0

0

19,821

19,920

248

0

0

0

25,321

25,420

468

211

0

0

14,421

14,520

86

0

0

0

19,921

20,020

252

0

0

0

25,421

25,520

474

217

0

0

14,521

14,620

88

0

0

0

20,021

20,120

256

0

0

0

25,521

25,620

480

223

0

0

14,621

14,720

90

0

0

0

20,121

20,220

260

3

0

0

25,621

25,720

486

229

0

0

14,721

14,820

92

0

0

0

20,221

20,320

264

7

0

0

25,721

25,820

492

235

0

0

14,821

14,920

94

0

0

0

20,321

20,420

268

11

0

0

25,821

25,920

498

241

0

0

14,921

15,020

96

0

0

0

20,421

20,520

272

15

0

0

25,921

26,020

504

247

0

0

15,021

15,120

98

0

0

0

20,521

20,620

276

19

0

0

26,021

26,120

510

253

0

0

15,121

15,220

100

0

0

0

20,621

20,720

280

23

0

0

26,121

26,220

516

259

2

0

15,221

15,320

102

0

0

0

20,721

20,820

284

27

0

0

26,221

26,320

522

265

8

0

15,321

15,420

104

0

0

0

20,821

20,920

288

31

0

0

26,321

26,420

528

271

14

0

15,421

15,520

106

0

0

0

20,921

21,020

292

35

0

0

26,421

26,520

534

277

20

0

15,521

15,620

108

0

0

0

21,021

21,120

296

39

0

0

26,521

26,620

540

283

26

0

Form 540 2EZ Tax Booklet 2003 Page 19

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18