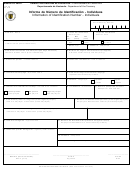

Form As 2640.1 - Subchapter N Corporation Election - Puerto Rico Department Of Treasury Page 3

ADVERTISEMENT

COMMONWEALTH OF PUERTO RICO

DEPARTMENT OF THE TREASURY

INTERNAL REVENUE AND COLLECTIONS AREA

INSTRUCTIONS FOR ELECTION OF SUBCHAPTER N STATUS

Form AS 2640.1

f. A financial institution as such term is

Tax Retum until the corporation or partnership is

GENERAL INSTRUCTIONS

notified that its election has been accepted.

defined in Section 1024(fl)(4).

Meanwhile, continue filing the usual returns.

Purpose - To elect to be a Subchapter N corporation,

g. An entity licensed by the Commissioner of

a corporation or partnership must file Form AS 2640.1

Care should be exercised to ensure that the

Financial Institutions pursuant to Act No. 3 of October

"Subchapter N Corporation Election". The election

Treasury Department ("Treasury") receives the

6,1987, known as the ‘Investment Capital Fund Act,

permits the income of the N corporation to be taxed

election. If the corporation or partnership is not

as amended.

to the shareholder or partner of the corporation or

notified of the aceptance or nonaceptance of its

partnership, rather than to the entity itself, except as

election within three months from the date of filing

provided in Subchapter N of the Pueno Rico Internal

h. A partnership that has in effect an election

(date mailed), or within six months if a business year

Revenue Code of 1994 (the "Code").

under Section 1342 of the Code.

was elected, please take follow up action by verifying

if the election was received by Treasury. If Treasury

Who May Elect - A corporation or partnership may

7. It has a permitted tax year as defined by Section

questions whether Form AS 2640.1 was filed, an

elect to be a Subchapter N corporation only if it meets

aceptable proof of filing is: (a) certified or registered

1399 of the Code. A permitted tax year is a taxable

all the following tests.

mail receipt (timely filed) identifying the sender; (b)

year that ends on or after September 30, including

copy of Form AS 2640.I with Treasury Department

December 31, or any other accounting period for

receipt stamp showing the date of receipt or (c) a

1. It is a domestic corporation or partnership.

which the corporation establishes to the satisfaction

The term "domestic corporation" includes (i) a

letter from Treasury stating that the election has been

of the Secretary of the Treasury a business purpose.

accepted.

corporation or partnership organized under the laws

See Part 11 for details on requesting a fiscal year

of Puerto Rico, and (ii) a corporation or partnership

End of Election - Once the election is made, it stays

organized in any of the states of the United Stater or

based on a business purpose.

in effect for all years until it is terminated. During five

in the District of Columbia, provided that it is engaged

years after the election is terminated, the corporation

exclusively in a trade or business in Puerto Rico.

8. Each shareholder or partner consents to the

or partnership (or its sucessor) will not be eligible to

election. Every shareholder or partner consents to

make a new election unless the Secretary consents

2. It has no more than 35 shareholders or

the Subchapter N election. The consent must be

to such election.

partners. A husband and wife (and their respective

shown in Part 1, Item K of the Form.

estates) are treated as one shareholder or partner

for this requirement. All other persons are treated as

Filing Fee - A certified check of money order in the

Where to Flle - File Form AS 2640.1 "Subchapter N

amount of $500.00 payable to the Secretary of the

separate shareholders or partners.

Corporation Election", with the office of the Assistant

Treasury must be enclosed with Form AS 2640.1.

Secretary, Internal Revenue & Collections Area,

3. It has only individuals, estates or certain trust

Puerto Rico Treasury Department, Office 621,

as shareholder or partners. See the instrucctions

Intendente Ramírez Building, Paseo Covadonga, San

SPECIFIC INSTRUCTIONS

for Part III regarding qualified Subchapter N trust.

Juan, Puerto Rico.

PART I

When to Make an Election - The corporation or

4. It has no nonresident alien shareholder or

partnership can make the election for any taxable

partners.

year: (1) at any time during the preceding tax year,

Part I must be completed by all corporations or

or (2) at any time before the 15th day of the fourth

5. It has only one class of stock or participation

partnerships.

month of the tax year, if filed during the tax year the

(disregarding differences” in voting rights).

election is to take effect. An election made during the

Generally, a corporation or partnership is treated as

Name and Address of Corporation or Partnership-

first 3 I/2 months of a tax year will be effective for

having only one class of stock or partnership

Enter the true Corporate or partnership name as set

the following tax year if (1) the corporation or

participation if all outstanding shares” of the

forth in the corporate charter partnership agreement

partnership failed to comply with the eligibility

corporation's stock or all the participations in the

or other legal document of incorporation or

requirements during one or more days of the taxable

partnership confer identical rights to distribution and

constitution of partnership. If the entity’s mailing

year before the day on which the election was made,

liquidation proceeds.

address is the same as someone else’s, such as a

or (2) any person who held the stock in the

shareholder’s or partner’s, please ente "C/O" and

corporation or participation in the partnership during

6. It is not one of the following ineligible

this person’s name following the name of the

the part of the tax year before tbe election was

corporation or partnership. Include the suite, room,

corporations or partnerships:

made, and who did not hold stock or participations at

or other unit number after the street address. If the

the time the election was made, did not consent to

Post Office does not deliver to the street address

the election. On the other hand, an election made

a. An insurance company subject to tax

and the corporation or partnership has a PO box,

after the first 3 1/2 months of the taxable year will be

under Subchapter G, Chupter 3, Subtitle A of the

show the box number instead of the street address.

effective for the following taxable year if: (1) the

Code.

If the corporation or partnership changed its name or

corporation or partnership makes the election for

address after applying for its employer identification

any taxable year, and (2) the election is made after

b. A registered invesment company subject

number, be sure to check the box in Item G of Part 1.

the 15th day of the fourth month of the following

to tax under Subchapter L Chapter 3, Subtitle A of

year. See Section 1391 of the Code.

Item A. employers Indentification Number - If

the Code.

the corporation or partnership has applied for an

Aceptance or Nonacceptance of Election - The

employer identification number (EIN) but has not

c. A special corporation of employees subject

Secretary of the Treasury will notify the corporation

received it, enter "applied for". If the corporation or

or partnership if its election is accepted and when it

to tax under Subchapter M, Chapter 3, Subtitle A of

partnership does not have an EIN, it should apply for

will take effect. The corporation or partnership will

the Code.

one on Form SS-4, Application for Employer

also be notified if its election is not accepted. The

Identification Number, available from most IRS and

corporation or partnership should generally receive

d. A corporation or partnership enjoying tax

Social Security Administration offices.

a determination on its election within 60 days after

exemption under the provisions of Act No. 57 of

its filing. If a business year has been elected, the

June 13, 1963, Act No. 26 of June 2, 1978, Act No. 8

Iltem D. Effetive Date of Election - Enter the date

corporation or partnership will receive a ruling letter

of January 8, 1987, or any other act of similar nature,

(month, day, year) on which the first tax year for

from Treasury that either approves or denies the

except for a corporation enjoying exemption under

which the election is to be effective commences.

selected tax year. In such cases, it will generally

Act No. 78 of September 10, 1993.

Generally, this will be the beginning date of the tax

take an additional 90 days for the election to be

year for which the ending date is required to be

accepted or denied.

e. A corporation or partnership exempt under

shown in Item 1, Part 1. For a new corporation or

Section 1101 of the Code.

partnership, this date will generally be the date

Income Tax Return - Even if Form AS 2640.1 was

required to be shown in Item H, Part 1. The tax year

filed, do not file the Subchapter N Corporation Income

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4