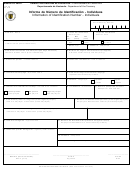

Form As 2640.1 - Subchapter N Corporation Election - Puerto Rico Department Of Treasury Page 4

ADVERTISEMENT

-2-

Note Part III may be completed only in conjunction

of a new corporation or partnership starts on the

Column N. - Enter the month and day that each

date that it has shareholders or partners, acquires

with making the Part I election. The deemed owner of

shareholder’s or partner’s tax year ends. If a

assets, or begins doing business, whichever

the QSNT must also consent to the N corporation

shareholder or partner is changing his or her tax

happens first. If the effective date for Item D for a

year, enter the tax year the shareholder or partner is

election in Item K.

newly formed corporation or partnership is later than

changing to, and attach an explanation indicating the

the date in Item H, the corporation or partnership

present tax year and the basis for the change (e.g.,

PART IV

should file a short-period retum for the tax period

a letter ruling request).

between these dates.

Complete this Part IV if an election is not made by a

If the election is made during the corporation’s or

Item K. Shareholders or Partners’ Consent

now corporation or partnership.

partnership’s tax year for which it first takes effect,

Statement. Each shareholder or partner who owns

you do not have to enter the tax year of any

(or is deemed to own) stock or participations at the

shareholder or partner who sold or transferred all of

Item R - Include the amount of Accumulated earnings

time the election is made must consent to the election.

his or her stock or participations before the election

and profits as of the last day of the last tax year of

If the election is made during the entity’s tax year for

the corporation or partnership before the tax year in

was made.

which it first takes effect, any person who held stock

which the election will be effective. If the election

or participations at any time during the part of that

will be effective in the following tax year, declare the

Signature - Form AS 2640.1 must be signed by the

year that occurs before the election is made, must

accumulated earnings and profits as of the end of

president, treasurer, assistant treasurer, chief

consent to the election, even though the person may

the last taxable year before the election is made.

accounting officer, or other officer authorized to sign.

have sold or transferred his or her stock or

participation before the election is made. Each

Item S. - Check this box if after examining all the

shareholder or partner consents by signing and

PART 11

assets of the corporation or partnership, the

dating in Column K or signing and dating a separate

estimated fair market value of any asset as of the

consent statement as explained below.

first day of the tax year in which the election is

Complete Part 11 if you selected a tax year ending on

effective exceeds its adjusted basis. For this purpose,

any date other than a 52-53 week tax year ending

An election made during the first 3 1/2 months of

recorded or unrecorded goodwill will not be

on or after September 30, including December 31. If

the tax year is effective for the followving tax year if

considered an asset of the corporation or partnership.

you checked Box 0.2, do not complete Items P and Q.

any or shareholder or partner, who held stock or

participations in the corporation or partnership during

Box P1 - Attach a statement showing separately for

the part of the tax year before the election was

each month the amount of gross receipts for the

made, and who did not hold stock or participations at

most recent 47 months as required by Article

the time the election was made, did not consent to

1399(b)(2) of the Regulations. A corporation or

the election.

partnerhip that does not have a 47-month period of

gross receipts cannot establish a natural business

If a husband and wife have a community interest

year.

in the stock or participations, both must consent.

Each tenant in common, joint tenant, and tenant by

Item Q. - Attach a statement explaining the business

the entirety also must consent.

purpose, as well as the facts and circumstances

justifying its acceptance, as required by Article

A minor’s consent is made by the legal

1399(b)(2)-l(c) of the Regulations. The Secretary of

representative of the minor, or by a natural or adoptive

the Treasury will consider, among others, the

parent of the minor if no legal representative has

following factors: (a) the deferral of a substantial

been appointed.

part of tbe entity’s income or deductions that

substantially reduces the entity’s tax liability

The consent of an estate is made by an executor

attributable to that entity’s income; (b) a similar

or administrator.

deferral, but in connection with a stockholder or

partner and (c) the creation of a short period resulting

in a substantialy net operating loss. The following

If stock is owned by a trust that is a qualified

factors, which are not tax related, will generally not

shareholder, the deemed owner of the trust must

be sufftcient to establish a business purpose: (a)

consent.

the use of a specific taxable year for accounting or

regulatory purposes; (b) contracting policies of the

Continuation Sheet or Separate Consent

business; (c) use of a particular tax year for

Statement - If you need a continuation sheet or use

administrative purposes, such as, the admission or

a separate consent statement, attach it to Form AS

retirement of partner or stockholder, the promotion

2640.1. The separate consent statement must contain

of personnel, and compensation and retirement

the name, address, and employer identification

agreements with personnel, stockholders or partner;

number of the corporation or partnership, and the

or (d) the fact that a particular business involves the

shareholder or partner information requested in

use of price list, a model year, or other items that

Columns I through N of Part 1.

vary annually. If a business year requested causes

the deferred or distortion of income, the above factor

must establish compelling reasons for the acceptance

If you want, you may combine all the

of such year.

shareholder’s or partners’consents in one statement.

A request under Item Q must be accompanied by

Column L - Enter the number of shares of stock each

a certified check or money order payable to the

shareholder owns or the percentage of participation

Secretary of the Treasury in the amount of $150.00.

of each partner and the date of acquisition. If the

election is made during the tax year for which it first

PART III

takes effect, do not list the shares of stock or units,

of participation for those shareholder or partners

who sold or transferred all of their stock or

Certain Qualified Subchapter N Trurts ("QSNT") may

participations before the election was made.

make the election according to Section 1391(e)(2) of

However, these shareholder or partner must still

the Code. In general, an election by a QSNT must be

consent to the election for it to be efective for the tax

year. Include every tenant in common, joint tenant,

filed within three month and 16 days from the date in

and tenant by the entirety.

which the stock or participation was transferred to

the trust or within the period of three months and 16

days commencing on the first day of the tax year in

Column M. - Enter the social security number of

which the election is in effect, whichever occurs

each shareholder or partner who is an individual.

later. See, Article 1390(d)-3. You may use a separate

Enter the employer identification number of each

statement in lieu of Part III to make the election.

shareholder or partner that is an estate or a qualified

trust.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4