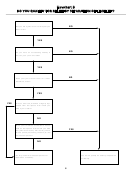

How To Request Relief

Relief from an Understatement of Tax Due to an

Erroneous Item ( See Flowchart A, Page 7)

File an election packet to request relief for an outstand-

An understatement of tax is generally the difference

ing PA Personal Income Tax liability. The election packet

between the total amount of tax that you should have

includes the following forms:

reported on your return and the amount of tax that you

PA 8857, Request for Relief from Joint Liability

actually reported. For example, you reported total tax of

PA 12507, Innocent Spouse Statement

$2,500 on your 2005 return. The Department reviewed

your 2005 return and determined that the total tax is

PA 12510, Questionnaire for Spousal Relief from

$3,000. You have a $500 understatement of tax.

Joint Liability for Requesting Spouse

You may be relieved of joint liability for an understate-

REV-488, Statement of Financial Condition for

ment of tax and the related interest and penalties if all

Individuals.

the following conditions are met:

You may request relief for more than one tax year in a

1. You filed a joint return which has an understate-

single election packet.

ment of tax due to an erroneous item of your

spouse;

You must fully complete all of the above forms for a valid

election packet. See the instructions on Form PA 8857

2. You establish that at the time you signed the joint

for more information.

return you did not know and had no reason to know

that there was an understatement of tax. (If you

Spousal notification. The Department is required to

establish that you were the victim of domestic

inform the non-electing spouse (your spouse or former

abuse prior to the time you signed your joint

spouse) of your request for relief from liability. There are

return, and because of the prior abuse, you did not

no exceptions even for victims of spousal abuse or

challenge the treatment of any items on the return

domestic abuse.

for fear of your spouse’s retaliation, you can quali-

fy for relief even if you had actual knowledge of

The Department will contact the non-electing spouse and

your spouse’s understatement of tax.); and

allow him or her to provide information that may assist

3. Taking into account all the facts and circumstances,

in determining your eligibility for relief from joint

it would be unfair to hold you liable for the under-

liability. The Department will also inform the non-elect-

statement of tax.

ing spouse of its preliminary and final determinations

regarding your request for relief. However, to protect

Erroneous item. Erroneous items include:

your privacy, the Department will not provide

• Unreported income. This is any gross income item

information to the non-electing spouse that could

received by your spouse that is not reported;

infringe on your privacy. The Department will not provide

• Incorrect deduction or credit. This is any improper

your new name, address, information about your

deduction or credit claimed by your spouse.

employer, phone number, or any other information that

• Basis error. Income was incorrectly calculated

does not relate to a determination about your request for

because the basis used by your spouse to deter-

relief from liability.

mine the gain or loss was incorrect.

When To Request Relief

The following are examples of an erroneous item:

You should file a complete election packet as soon as you

1. The expense for which a deduction is taken was

become aware of a tax liability for which you believe only

never paid or incurred. For example, your spouse,

your spouse or former spouse should be held liable. You

a cash-basis taxpayer, deducted $10,000 of

must file the packet no later than 2 years after the date

advertising expenses on PA Schedule C, but never

the Department first attempted to collect the tax from

paid for any advertising.

you. Some example of attempts that may start the 2-

2. The expense does not qualify as a deductible

year period are:

expense. For example, your spouse claimed a

• The mailing of a notice that the Department plans

business fee deduction of $10,000 that was for the

to intercept your Federal Income Tax refund.

payment of state fines. Fines are not deductible.

• The issuance of a writ of execution.

3. No factual argument can be made to support the

deductibility of the expense. For example, your

The issuance of a billing notice, a preassessment notice,

spouse claimed $4,000 for security costs related to

or an assessment notice is not a collection activity.

a home office. The cost were actually veterinary

and food costs for your family’s two dogs.

TIP: You should not file an election packet until the tax

for which relief is requested may no longer be appealed.

4. Your spouse claims a resident credit for taxes paid

Your appeal rights must have expired before you request

to another state, but no tax was due or paid to the

relief from joint liability.

other state.

2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11