Indicators of unfairness to hold spouse jointly liable. The

How the Department will calculate separation of liability

Department will consider all of the facts and circum-

relief. If you qualify for separation of liability relief, the

stances of the case in order to determine whether it is

Department generally allocates erroneous items

unfair to hold you jointly responsible for the understate-

between you and your spouse or former spouse by

ment. Two factors the Department will consider are

determining how the erroneous items would have been

whether you:

reported if you were to have filed a separate return.

Relief from joint liability may be granted for the tax

1. Received any significant benefit from the under-

attributable to the items allocated to your spouse or for-

statement of tax; or

mer spouse.

2. Were later divorced from or deserted by your-

spouse.

Unless your spouse also elects separation of liability

relief, he/she will remain liable for the entire understate-

Significant benefit. You can receive a significant benefit

ment of tax. Even if both you and your spouse elect

either directly or indirectly. For example, if your spouse

separation of liability, there may be a portion of the

did not report $10,000 of income on your joint return,

understatement that is not allocable; and as a result,

you can benefit directly if your spouse shared that

both you and your spouse remain jointly and severally

$10,000 with you. You can benefit indirectly from the

liable.

unreported income, if your spouse uses it to pay extraor-

dinary household expenses.

The Department will calculate your separate liability and

figure any related interest and penalties after you file a

You do not have to receive a benefit immediately for it to

complete election packet. You are not required to calcu-

be significant. For example, money your spouse gives

late these amounts.

you several years after he or she received it or amounts

inherited from your spouse (or former spouse) can be a

Burden of proof. You have the burden of proof in estab-

significant benefit.

lishing the basis for separating your liability.

Normal support or support payments that you receive as

Example:

Bill and Karen Green filed a joint return

a result of a divorce proceeding are not a significant

showing Karen’s wages of $50,000 and Bill’s business

benefit.

income of $10,000.

The Department audited their

The Department will calculate the understatement of tax

return and found that Bill did not report $20,000 of busi-

due to erroneous items of your spouse after you file the

ness income. The additional income resulted in a $614

election packet. You are not required to calculate these

understatement of tax, plus interest and penalties. After

amounts.

obtaining a legal separation from Bill, Karen filed the

election packet to request relief by separation of liability.

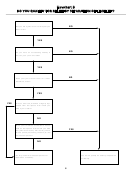

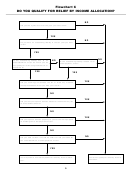

Separation of Liability Relief (See Flowchart B,

The Department proved that Karen actually knew about

Page 8)

the $20,000 of additional income at the time she signed

You may elect separation of liability relief if you meet one

the joint return. Bill is liable for all of the understate-

of the following conditions at the time you file the

ment of tax, interest, and penalties because all of it was

election packet:

due to his unreported income. Karen is also liable for the

• You are divorced, widowed, or legally separated

understatement of tax, interest, and penalties due to the

from the individual with whom you filed the joint

$20,000 of unreported income because she actually

return.

knew of the item. The Department can collect the entire

deficiency from either Karen or Bill.

• You and the individual with whom you filed the

joint return have not been members of the same

Invalid election A request for relief from joint liability

household at any time during the 12-month period

will not be granted in the following situations:

preceding the date the election packet is filed.

1. The Department proves that you and your spouse

Members of the same household. You and your spouse

transferred assets as part of a fraudulent scheme.

are not members of the same household if you are liv-

2. Your spouse (or former spouse) transferred proper-

ing apart and are estranged. However, you and your

spouse are considered members of the same household

ty to you to avoid tax or the payment of tax. See

under any of the following conditions:

transfers of property to avoid tax below.

3. You had actual knowledge of the erroneous item

1. You and your spouse reside in the same dwelling.

responsible for the understatement of tax.

2. You and your spouse reside in separate dwellings

but are not estranged.

Partial relief when the extent of understatement is

unknown. You may qualify for partial relief if, at the time

3. One spouse is temporarily absent from the other's

you filed your return, you knew or had reason to know,

household.

A spouse is considered temporarily

that there was an understatement of tax due to your

absent from the household if it is reasonable to

spouse’s erroneous items, but you did not know how

assume that the absent spouse will return to the

large the understatement was. You will be relieved of the

household. Examples of temporary absences

include absence due to imprisonment, illness,

understatement to the extent you did not know about it

business, vacation, military service, or education.

and had no reason to know about it.

3

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11