Appeal Rights

If I am denied a particular type of relief, must I

reapply if I believe I might qualify for one of the

Relief for an understatement of tax or for relief by sepa-

other two provisions?

ration of liability. You may appeal the Taxpayers’ Rights

Advocate’s determination of relief for an understatement

No. The Taxpayers’ Rights Advocate automatically con-

of tax due to an erroneous statement and relief by sep-

siders whether any of the other provisions apply.

aration of liability by filing a petition with the Board of

Finance and Revenue within 90 days of the mailing date

When should I file an election packet?

of the notice of final determination.

You must file the election packet no later than 2 years

Relief by income allocation. There is no right to appeal

after the date on which the Department first begins

the Taxpayers’ Rights Advocate’s denial of a request for

collection activity. Collection activity includes a notice

relief by income allocation.

that the Department plans to intercept your Federal

Taxpayers’ Rights Advocate fails to act. You may also file

Income Tax refund.

a petition with the Board of Finance and Revenue

requesting it to review your request for relief if the

I am currently undergoing an examination of my

Department has not provided you a final determination

return. Can I file an election packet to request

within six months from the date you filed a complete

relief?

election packet.

You should not file an election packet if the appeal peri-

Questions & Answers

od for the tax for which you are requesting relief is still

This section answers questions commonly asked by tax-

open. Relief from joint liability is available only after the

payers about innocent spouse relief.

tax is no longer subject to appeal.

What are the consequences of filing a joint income

The Department has given me notice that it has

tax return?

filed a lien for the tax liability. Can I still file the

Since spouses filing a joint return are jointly and sever-

election packet to request relief?

ally liable, the Department can collect the entire tax lia-

bility including interest, penalties, and charges, from

Yes. Please note that the Department suspends collec-

either spouse without regard to which spouse earned the

tion activity related to the joint liability for which you are

income during the tax year.

seeking relief after it receives your election packet.

Collection activity will resume on any liability that

What is an erroneous item?

remains after the Taxpayers’ Rights Advocate determi-

An erroneous item includes any deduction, credit, or

nation is final.

other item incorrectly reported on the return, or income

that was incorrectly omitted from the return.

I’ve been separated from my spouse for 12

Will I qualify for relief for an understatement of

months; however, we are still members of the

tax in every situation where my former spouse is

same household. Can I file for relief from joint

responsible for the erroneous item?

liability for tax that was not paid when we filed the

No. There are situations attributable to an erroneous

return?

item reported by your spouse in which you may owe tax.

No. Since relief by income allocation is the only type of

For example, you and your spouse file a joint return on

relief that is applicable to unpaid tax and this relief is not

which you report $10,000 of income but you also know

available if the joint filers are still members of the same

that your spouse did not report $5,000 of dividends. You

household, you should not file for relief until you are no

are not eligible for relief because you had knowledge of

the understatement.

longer members of the same household.

5

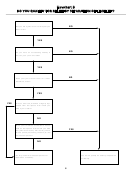

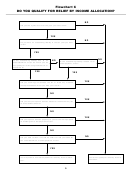

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11