Example: At the time you signed your joint return, you

You may qualify for relief by income allocation if you

meet all of the following conditions:

knew that your spouse did not report $5,000 of gambling

winnings. The Department examined your tax return

1. You are not eligible for relief from an understate-

several months after you filed it and determined that

ment of tax or relief by separation of liability, or

you are jointly liable for an underpayment of tax

your spouse’s unreported gambling winnings were actu-

that is not attributable to income that would have

ally $25,000. This resulted in a much larger understate-

been reported by you if you had filed a separate

ment of tax than you knew about at the time you signed

return;

your return. You established that you did not know

2. You and your spouse did not transfer assets to one

about, and had no reason to know about, the additional

another as a part of a fraudulent scheme;

$20,000 because of the way your spouse handled gam-

3. Your spouse did not transfer assets to you for the

bling winnings. The understatement of tax due to the

main purpose of avoiding tax or the payment of

$20,000 will qualify for innocent spouse relief if you

tax. See “Transfers of property to avoid tax” on

meet the other requirements. The understatement of tax

Page 4;

due to the $5,000 of gambling winnings will not qualify

4. You did not file your return with the intent to com-

for relief.

mit fraud;

Transfers of property to avoid tax. If your spouse trans-

5. You have filed all required personal income tax

fers property to you for the main purpose of avoiding tax

returns and do not have an outstanding personal

or payment of tax, the tax liability allocated to you will

income tax liability for a tax year or years other

than the year or years for which you are seeking

be increased by the value of the property transferred. A

relief;

transfer will be presumed to have as its main purpose

the avoidance of tax or payment of tax if the transfer is

6. You were not a member of the same household as

made during or after the 12-month period before the

the spouse with whom you filed the joint return at

any time during the 12-month period preceding the

mailing date of the Department’s first billing notice. This

date you filed the election packet; and

presumption will not apply if the transfer was made

under a divorce decree, separate maintenance agree-

7. You establish that taking into account all the facts

and circumstances, it would be unfair to hold you

ment, or a written instrument incident to such an agree-

liable for the understatement or underpayment of

ment. The presumption will also not apply if you estab-

tax. See Indications of unfairness for the granting

lish that the transfer did not have as its main purpose

of relief by income allocation (defined below).

the avoidance of tax or payment of tax.

Indications of unfairness for the granting of relief by

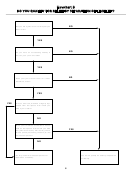

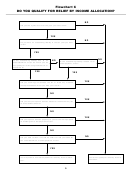

Relief by Income Allocation (See Flowchart C,

income allocation. The Department will consider all of

Page 9)

the facts and circumstances in order to determine

whether it is unfair to hold you responsible for the under-

You may qualify for relief by income allocation if you are

statement or underpayment of tax. The Department will

jointly liable for an underpayment of tax, and the under-

consider positive and negative factors and weigh them

paid tax is not attributable to income that would have

appropriately to determine whether to grant relief by

been on your separate return if you were to have filed a

income allocation.

separate return. In addition, you may qualify for relief

The following example shows a situation that may qual-

by income allocation if you failed to qualify for relief from

ify for relief by income allocation:

joint liability for an erroneous item through your election

for relief from an understatement of tax or your election

You and your spouse file a joint 2006 return. That return

for relief by separation of liability.

shows you owe $10,000. You have $5,000 of your own

money, and you take out a loan to pay the other $5,000.

Underpayment of tax. An underpayment of tax is the

You give two $5,000 checks to your spouse to pay the

amount of tax you reported or should have reported on

$10,000 liability. Without telling you, your spouse takes

your return, but you have not paid. For example, your

the $5,000 loan and spends it on himself. You and your

joint 2008 return shows that you and your spouse owe

spouse were divorced in 2007. In addition, you had no

$5,000. You pay $2,000 with the return. You have an

knowledge or reason to know at the time you signed the

underpayment of $3,000.

return that the tax would not be paid. Both of these

facts indicate to the Department that it may be unfair to

If you elect relief from an understatement of tax and/or

hold you liable for the $5,000 underpayment. The

relief by separation of liability and the Department deter-

Department will consider these facts, together with all of

mines that you do not qualify for either, the Taxpayers’

the other facts and circumstances, to determine whether

Rights Advocate will automatically consider whether

to grant you relief from joint liability through income

relief by income allocation is appropriate.

allocation for the $5,000 underpayment.

4

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11