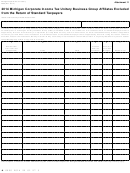

Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 10

ADVERTISEMENT

Line 1, Column C: Net total gains/losses reflected in federal

installment payments received during the current filing period

taxable income from all depreciable tangible assets that were

must be reported.

acquired in the same taxable year and disposed of during

Line 2, Column B: Total gross proceeds from all depreciable

the filing period. Report also in column C any gain reflected

mobile tangible assets that were acquired in the same taxable

in federal taxable income that is attributed to an installment

year and disposed of during the filing period. If a qualifying

payment received during the current CIT filing period, from

asset was sold on an installment sale in a prior filing period,

a prior installment sale of an asset that was of a type and

the entire sale price was reported for recapture purposes in

acquisition date covered in this table. For property placed

the year of sale. Therefore, if a payment was received on that

in service prior to January 1, 2008, gain reflected in federal

installment sale in the current filing period, do not report

taxable income is equal to the gain reported for federal

that amount as gross proceeds for this period. See column

purposes. Keep in your files a separate worksheet with the

C, however, with respect to the gain from that installment

appropriate information regarding each depreciable tangible

payment.

asset located in Michigan that was acquired or moved into

Line 2, Column C: Net total gains/losses reflected in federal

Michigan after acquisition in a tax year beginning after 1999

and prior to 2008, and was sold or otherwise disposed of during

taxable income from all depreciable mobile tangible assets

the tax year. Sum the total gross proceeds and gain or loss for

that were acquired in the same taxable year and disposed of

during the filing period. Report also in column C any gain

all disposed assets acquired in the same taxable year. Enter in

reflected in federal taxable income that is attributed to an

this form only the total sum of gross proceeds and gain/loss

installment payment received during the current CIT filing

grouped by taxable year the assets were acquired. Use one row

per group of disposed assets acquired in the same taxable year.

period, from a prior installment sale of an asset that was of a

Start from the earliest acquisition year.

type and acquisition date covered in this table. For property

placed in service prior to January 1, 2008, gain reflected in

Line 1, Column D: Enter the apportionment percentage from

federal taxable income is equal to the gain reported for federal

Form 4891, line 9g, or Form 4908, line 9c. If not apportioning,

purposes. Keep in your files a separate worksheet with the

enter 100 percent. Enter the same apportionment percentage for

appropriate information regarding each depreciable mobile

each row completed.

tangible asset acquired in a tax year beginning after 1999 and

Line 1, Column F: Subtract column E from column B for each

prior to 2008, and sold or otherwise disposed of during the

row. If column E is a loss, add its positive value to column B

tax year. Sum the total gross proceeds and gain or loss for all

for each appropriate row. A loss in column E will increase the

disposed assets acquired in the same taxable year. Enter in

recapture base.

this form only the total sum of gross proceeds and gain or loss

grouped by taxable year the assets were acquired. Use one row

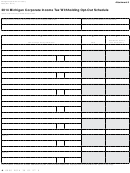

Worksheet 3b — Depreciable Mobile Tangible Assets

per group of disposed assets acquired in the same taxable year.

Mobile tangible assets are all of the following:

Line 2, Column D: Subtract figures in column C from figures

• Motor vehicles that have a gross vehicle weight rating of

in column B for each row. If column C is a loss, add its positive

10,000 pounds or more and are used to transport property or

value to column B for each appropriate row. A loss in column

persons for compensation;

C will increase the recapture.

• Rolling

stock

(railroad

freight

or

passenger

cars,

Line 2, Column E: Enter the apportionment percentage from

locomotives or other railcars), aircraft, and watercraft used by

Form 4891, line 9g, or Form 4908, line 9c. If not apportioning,

the owner to transport property or persons for compensation or

enter 100 percent. Enter the same apportionment percentage for

used by the owner to transport the owner’s property for sale,

each row completed

rental, or further processing;

Line 2, Column F: Multiply figures in column D by column E

• Equipment used directly in completion of, or in construction

for each row.

contracts

for,

the

construction,

alteration,

repair,

or

improvement of property.

Worksheet 3c — Assets Transferred Outside Michigan

For depreciable mobile tangible assets that were acquired in

For depreciable tangible assets other than mobile tangible

a tax year beginning after 1999 and prior to 2008, and were

assets acquired in tax years beginning after 1996 and prior to

sold or otherwise disposed of during the tax year, enter the

2008, that were eligible for the ITC in tax years beginning after

following:

1999 and prior to 2008, and were transferred outside Michigan

during the tax year, enter the following:

Line 2, Column A: Group the depreciable mobile tangible

assets that were disposed of during the filing period by the

Line 3, Column A: Group the depreciable tangible assets

tax year in which they were acquired. Use a separate row for

other than mobile tangible assets that were transferred out of

Michigan during the filing period by the tax year in which

each acquisition year. Enter the tax years of acquisition (end

dates only) in chronological order, starting with the first tax

they were acquired. Use a separate row for each acquisition

year beginning after 1999. An acquisition year for which there

year. Enter the tax years of acquisition (end dates only) in

chronological order, starting with the first tax year beginning

were no dispositions of depreciable mobile tangible assets

during the filing period may be omitted. However, do not omit

after 1999. An acquisition year for which there were no

the acquisition year of depreciable mobile tangible assets that

transfers of depreciable tangible assets out of Michigan during

the filing period may be omitted.

have been sold on an installment method if gains attributable to

82

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14