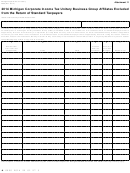

Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 5

ADVERTISEMENT

NOTE: A recapture is not required if the qualified taxpayer

Line 13: Enter the total amount of Anchor Company Taxable

Value Credits claimed on previously filed 4584 forms subject to

enters into a written agreement with SHPO that allows for the

transfer or sale of the historic resource.

recapture.

Start-Up Business Credits

Line 15: Enter the calculated recapture amount of all SBT

Historic Preservation Credit claimed on previously filed

A company that claimed the Start-Up Business Credit under

C-8000MC forms, or Form 4889, as applicable.

either MBT or SBT must pay back a portion of the credit if

they have no business activity in Michigan and have business

Line 16: Enter the calculated recapture amount of all MBT

activity outside of Michigan within three years after the last

Historic Preservation Credit claimed on previously filed 4584

tax year in which the credit was taken. The credit recapture

forms or 4889 forms, as applicable.

amounts are calculated as follows:

MEGA Battery Manufacturing Facility Credit

• 100 percent of the total of all credits claimed if the move is

The MEGA Battery Manufacturing Facility Credit is claimed

within the first tax year after the last tax year for which a

through an agreement with MEGA. A taxpayer that claimed a

credit is claimed;

credit that subsequently fails to meet the requirements of the

• 67 percent of the total of all credits claimed if the move is

agreement, as determined by MEGA, may have its credit reduced

within the second tax year after the last tax year for which a

or terminated or have a percentage of the credit previously

credit is claimed; and

claimed added back to the tax liability of the taxpayer in the tax

• 33 percent of the total of all credits claimed if the move is

year that the taxpayer fails to comply with the agreement.

within the third tax year after the last tax year for which a

Line 17: Enter the calculated recapture amount of all MEGA

credit is claimed.

Battery Manufacturing Facility Credits claimed on previously

Line 14: Enter the calculated recapture amount of the Start-Up

filed 4584 forms or 4889 forms, as applicable.

Business Credit claimed on previously 4573 forms, as applicable.

MEGA Large Scale Battery Credit

SBT and MBT historic Preservation Credits

The MEGA Large Scale Battery Credit is available to a

Both SBT and MBT Historic Preservation credits provide that

qualified taxpayer that enters into an agreement with MEGA

if a recapture event occurs, in the year of the event a percentage

to construct an eligible facility and create a minimum of 750

of the credit amount previously claimed must be added back

new jobs. A taxpayer that claimed a credit that subsequently

to the tax liability of the qualified taxpayer that received the

fails to meet the requirements of the agreement, as determined

certificate of completed rehabilitation or preapproved letter.

by MEGA, may have its credit reduced or terminated or have a

A recapture event occurs if, in less than five years after the

percentage of the credit previously claimed added back to the

tax liability of the taxpayer in the tax year that the taxpayer

historic resource is placed in service, either of the following

fails to comply with the agreement. In addition, if the taxpayer

happens:

fails to create 750 new jobs, the taxpayer shall have its credit

• A certificate of completed rehabilitation is revoked; or

reduced by $65,000 for each job less than 750 that was not

• A preapproval letter for an enhanced credit is revoked; or

created and, if the taxpayer fails to create at least 500 new jobs,

• A historic resource is sold or disposed.

additional recapture of any credit or benefit received pursuant

to the agreement may be recaptured.

The percentage of credit recapture that must be used varies

according to the number of years the recapture event occurs

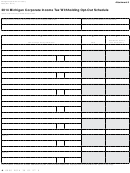

Line 18: Enter the calculated recapture amount of all MEGA

Large Scale Battery Credits claimed on previously filed 4584

after the credit was claimed, as follows:

forms, as applicable.

• 100 percent of the total of all credits claimed if the recapture

event occurs less than 1 year after the tax year for which a

MEGA Advanced Lithium Ion Battery Pack Credit

credit is claimed;

The MEGA Advanced Lithium Ion Battery Pack Credit is

• 80 percent of the total of all credits claimed if the recapture

claimed through an agreement with MEGA. If a taxpayer that

event occurs at least 1 year, but less than 2 years after the

claimed a credit relocates its advanced lithium ion battery

tax year for which a credit is claimed;

pack assembly facility that produces the battery pack units for

• 60 percent of the total of all credits claimed if the recapture

which the credit was claimed outside of Michigan during the

term of the agreement or subsequently fails to meet the capital

event occurs at least 2 year, but less than 3 years after the

investment or new jobs requirements of the agreement entered

tax year for which a credit is claimed;

• 40 percent of the total of all credits claimed if the recapture

with MEGA, the taxpayer shall have a percentage of the

amount previously claimed added back to the tax liability of the

event occurs at least 3 year, but less than 4 years after the

taxpayer in the tax year that the taxpayer fails to comply with

tax year for which a credit is claimed;

the agreement, and shall have its credit terminated or reduced

• 20 percent of the total of all credits claimed if the recapture

prospectively.

event occurs at least 4 year, but less than 5 years after the

Line 19: Enter the calculated recapture amount of all MEGA

tax year for which a credit is claimed.

Advanced Lithium Ion Battery Pack Credits claimed on

NOTE: If the credit has been assigned, the recapture is the

previously filed 4584 forms, as applicable.

responsibility of the qualified taxpayer that received the

Include completed Form 4902 as part of the tax return filing.

certificate of completed rehabilitation, not the assignee.

77

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14