Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 6

ADVERTISEMENT

Calculation of MBT ITC Credit Recapture Amount

the gain reflected in federal taxable income (as defined for MBT

Calculation of MBT ITC Credit Recapture Bases

purposes) is equal to the gain reported for federal purposes.

For each category of asset disposed (or moved out of

Michigan) that triggers an MBT ITC credit recapture, enter the

UBGs: The recapture of capital investments for UBGs is

information requested below.

calculated on combined assets of standard members of the

UBG. Assets transferred between members of the group are

In each category of disposed/moved asset, group assets by

not a capital investment in qualifying assets for purposes

taxable year in which they were acquired. All events that have

of calculating this credit or its recapture. Disposing of or

varying dates must be listed separately. Multiple dispositions

transferring an asset outside of the UBG triggers recapture.

(or transfers) may be combined as one entry, subject to the

Also, moving an asset outside of Michigan creates recapture,

following: all combined events must satisfy the terms of

even if the transfer is to a member of the UBG.

the table in which they are entered. “Taxable Year in which

disposed assets were acquired” must be the same for all events

Worksheet 1a — Depreciable Tangible Assets

combined on a single line.

Enter all dispositions of depreciable tangible assets located

in Michigan that were acquired or moved into Michigan after

UBGs: If capital asset subject to recapture is from a member

acquisition in a tax year beginning after 2007 and were sold

that was not part of the group in the tax year the asset was

or otherwise disposed of during the current filing period.

acquired, make a separate line entry for the tax year the

Give all information required for each disposition in columns

member filed outside of the group. Take care to report in this

A through F. In column A, enter the taxable year in which the

line information requested in each column only from the

disposed assets were acquired. Enter combined gross sales

member’s single filings, not the group’s.

price (net of costs of sale) in column B, and in column C, enter

NOTE: A sale of qualifying property reported on the

total gain or loss included in calculating federal taxable income

(as defined for MBT purposes).

installment method for federal income tax purposes causes

a recapture based upon the entire sale price in the year of the

NOTE: Sales price includes any benefit derived from the sale.

sale. The recapture is reduced by any gain reported in federal

taxable income (as defined for MBT purposes) in the year of the

Worksheet 1b — Depreciable Mobile Tangible Assets

sale. The gain attributable to the installment sale that is reported

Enter all dispositions of depreciable mobile tangible assets that

in subsequent years increases the credit base (or reduces other

were acquired after 2007 and were sold or otherwise disposed

of during the current filing period. Give all information required

sources of recapture) for those years, and must be reported on

column C of the appropriate Worksheet based on the type of

for each disposition in columns A through F. In column A, enter

asset. For property placed in service prior to January 1, 2008,

the taxable year in which the disposed assets were acquired.

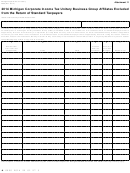

Worksheet 1a — Depreciable Tangible Assets

A

B

C

D

E

F

CIT Apportionment

Apportioned

MBT ITC Recapture

Taxable Year (End Date)

Combined Sales Price

Percentage from Form

Gain/Loss

(Base 1)

In Which Disposed

of Disposed Assets by

Net Gain/Loss From

4891, line 9g, or Form

Assets Were Acquired

Multiply Column C

Subtract Column E

Year of Acquisition

Sale of Assets

4908, line 9c

(MM-DD-YYYY)

by Column D

From Column B

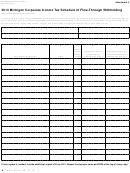

Worksheet 1b — Depreciable Mobile Tangible Assets

A

B

C

D

E

F

CIT Apportionment

MBT ITC Recapture

Taxable Year (End Date)

Combined Sales Price of

Percentage from Form

(Base 2)

Adjusted Proceeds

In Which Disposed

Disposed Assets by

Net Gain/Loss From

4891, line 9g, or Form

Multiply Column D

Assets Were Acquired

Subtract Column C

Year of Acquisition

Sale of Assets

by Column E

4908, line 9c

(MM-DD-YYYY)

From Column B

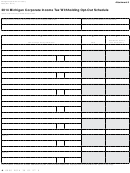

Worksheet 1c — Assets Transferred Outside Michigan

A

B

MBT ITC Recapture

Taxable Year (End Date)

Combined Adjusted Federal Basis of

In Which Disposed

Disposed Assets by Year of Acquisition

Assets Were Acquired

(Base 3)

(MM-DD-YYYY)

78

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14