Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 9

ADVERTISEMENT

Calculation of SBT ITC Credit Recapture Amount

Calculation of SBT ITC Recapture Bases

Worksheet 3a Depreciable Tangible Assets

For each category of asset disposed (or moved out of Michigan)

For depreciable tangible assets located in Michigan that were

acquired or moved into Michigan after acquisition in a tax

that triggers an SBT ITC recapture, enter the information

requested below.

year beginning after 1999 and prior to 2008, and were sold or

otherwise disposed of during the tax year, enter the following:

In each category of disposed/moved asset, group assets by

Line 1, Column A: Group the depreciable tangible assets that

taxable year in which they were acquired. All events that have

were disposed of during the current filing period by the tax

varying dates must be listed separately. Multiple dispositions

year in which they were acquired. Use a separate row for each

(or transfers) may be combined as one entry, subject to the

acquisition year. Enter the tax years of acquisition (end dates

following: all combined events must satisfy the terms of

only) in chronological order, starting with the first tax year

the table in which they are entered. “Taxable Year in which

disposed assets were acquired” must be the same for all events

beginning after 1999. An acquisition year for which there were

no dispositions of depreciable tangible assets during the filing

combined on a single line.

period may be omitted. However, do not omit the acquisition

NOTE: A sale of qualifying property reported on the

year of depreciable tangible assets that have been sold on an

installment method for federal income tax purposes causes a

installment method if gains attributable to installment payments

received during the current filing period must be reported.

recapture of the entire gross proceeds in the year of the sale.

The recapture is reduced by any gain reported in federal

Line 1, Column B: Total gross proceeds from all depreciable

taxable income in the year of the sale. The gain attributable

tangible assets that were acquired in the same taxable year and

to the installment sale that is reported in subsequent years

disposed of during the filing period. If a qualifying asset was

increases the credit base (or reduces other sources of recapture)

sold on an installment sale in a prior filing period, the entire

for those years, and must be reported on column C of the

sale price was reported for recapture purposes in the year of

appropriate Worksheet based on the type of asset.

sale. Therefore, if a payment was received on that installment

UBGs: Fill necessary Worksheets 3a, 3b, and 3c for each

sale in the current filing period, do not report that amount as

gross proceeds for this period. See instructions for column C,

member of the group who has disposed of assets that triggered

an SBT ITC recapture in the current filing period.

however, with respect to the gain from that installment payment.

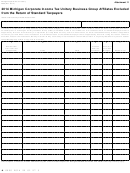

Worksheet 3a — Depreciable Tangible Assets

1.

A

B

C

D

E

F

Apportionment

Apportioned

SBT ITC Recapture

Taxable Year (End Date)

Combined Sales Price

Percentage from Form

Gain/Loss

(Base 1)

In Which Disposed

of Disposed Assets by

Net Gain/Loss From

4891, line 9g, or Form

Assets Were Acquired

Multiply Column C

Subtract Column E

Year of Acquisition

Sale of Assets

4908, line 9c

(MM-DD-YYYY)

by Column D

From Column B

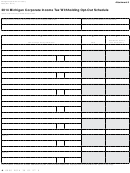

Worksheet 3b — Depreciable Mobile Tangible Assets

2.

A

B

C

D

E

F

Apportionment

SBT ITC Recapture

Taxable Year (End Date)

Combined Sales Price of

Percentage from Form

(Base 2)

Adjusted Proceeds

In Which Disposed

Disposed Assets by

Net Gain/Loss From

4891, line 9g, or Form

Multiply Column D

Assets Were Acquired

Subtract Column C

Year of Acquisition

Sale of Assets

4908, line 9c

by Column E

(MM-DD-YYYY)

From Column B

Worksheet 3c —Assets Transferred Outside Michigan

3.

A

B

SBT ITC Recapture

Taxable Year (End Date)

Combined Adjusted Federal Basis of

In Which Disposed

Disposed Assets by Year of Acquisition

Assets Were Acquired

(Base 3)

(MM-DD-YYYY)

81

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14