Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 4

ADVERTISEMENT

to 25 percent of the gross proceeds or benefit from the sale or

MEGA Photovoltaic Technology Credit

disposition, adjusted by the apportioned gain or loss.

The MEGA Photovoltaic Technology Credit is claimed

through an agreement with MEGA. If a taxpayer or assignee

Follow the worksheet below to calculate the Film Infrastructure

that claimed a credit and subsequently fails to meet the

Credit recapture amount.

requirements of the MBT Act or any other conditions

established by MEGA in the agreement may, as determined

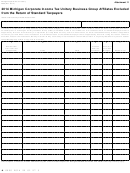

Recapture of Film Infrastructure Credit Worksheet

by MEGA, have its credit reduced or terminated or have a

The following calculation applies to all eligible depreciable tangible assets

percentage of the credit previously claimed added back to the

located in Michigan that were acquired in a tax year beginning after Dec. 31,

tax liability of the taxpayer in the tax year that the taxpayer or

2007, and were sold or otherwise disposed of during the tax year.

assignee fails to comply.

1. Total gross sales price for all

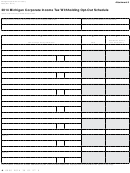

Line 7: Enter the calculated recapture amount of all MEGA

eligible depreciable tangible

Photovoltaic Technology Credits claimed on previously filed

assets ..........................................

00

4574 forms, as applicable.

2. Total gain/loss for all eligible

depreciable tangible assets .........

00

Biofuel Infrastructure Credit

3. Adjusted Proceeds. If line 2 is a

A taxpayer who received a Biofuel Infrastructure Credit and

gain, subtract line 2 from line 1.

stops using the new or converted fuel system within three

If line 2 is a loss, add line 1 and

line 2 ............................................

00

years of receiving an MBT credit may, as determined by the

Michigan Strategic Fund, have a percentage of a previously

If taxable in another state, complete line 4 and line 5; otherwise, skip to

line 6.

claimed credit added back to its tax liability in the year that the

taxpayer stops using the fuel delivery system.

4. Apportioned gains (losses).

Multiply line 2 by the percentage

Line 8: Enter the total amount of all Biofuel Infrastructure

Credits claimed on previously filed forms (Form 4573) subject

from Form 4891, line 9g ..............

00

to recapture.

5. Apportioned Adjusted Proceeds.

If line 4 is a gain, subtract line 4

SBT “New” Brownfield Credit and MBT Brownfield

from line 1. If line 4 is a loss, add

Redevelopment Credit

line 1 and line 4 ...........................

00

Both the SBT “New” Brownfield Credit and the MBT

6. Recapture of Film Infrastructure

Brownfield Redevelopment Credit provide that the disposal

Credit. Multiply line 3 or line 5

by 25% (0.25) ..............................

00

or transfer to another location of personal property used

to calculate each credit will result in an addition to the tax

liability of the qualified taxpayer that was originally awarded

NOTE on Installment Sales: A sale of qualifying property

the credit in the year in which the disposal or transfer occurs.

reported on the installment method for federal income tax

This is true even if the credit was assigned to someone else.

purposes causes recapture of the entire gross proceeds

This additional liability, or recapture amount, is calculated by

(including the amount of the note) in the year of sale, less any

multiplying the same percentage as was used to calculate the

gain reflected in federal taxable income (as defined for MBT

credit (e.g. 10 percent) times the federal basis of the property

purposes) in the year of the sale. In each subsequent year of the

used to calculate gain or loss (as calculated for federal

installment note, enter zero in a line on column E, and enter the

purposes) as of the date of the disposition or transfer.

gain reflected in federal taxable income (as defined for MBT

purposes) in the same line for column F. For property placed

Line 9: Enter the calculated recapture amount of all SBT

in service prior to January 1, 2008, gain reflected in federal

“New” Brownfield Credits claimed on previously filed forms

taxable income (as defined for MBT purposes) is equal to the

(C-8000MC), as applicable.

gain reported for federal purposes.

Line 10: Enter the calculated recapture amount of all MBT

Brownfield Redevelopment Credits claimed on previously

Line 11: Enter the calculated recapture amount of all Film

filed 4584 forms, or Request for Accelerated Payment for

Infrastructure Credits claimed on previously filed 4573 forms,

the Brownfield Redevelopment Credit and the Historic

as applicable.

Preservation Credit (Form 4889), as applicable.

Anchor Company Credits

The Anchor Company Payroll Credit and the Anchor Company

Film Infrastructure Credit

Taxable Value Credit are claimed through an agreement

The Film Infrastructure Credit is available through an agreement

with MEGA. If a taxpayer claimed one of these credits and

between the taxpayer and the Michigan Film Office, with the

subsequently failed to meet the requirements of the MBT Act

concurrence of the State Treasurer. The credit amount is equal

or conditions of the agreement, the taxpayer must recapture the

to 25 percent of the base investment expenditures in a qualified

entire amount of such credit previously claimed.

film and digital media infrastructure project. If the taxpayer sells

or otherwise disposes of a tangible asset that was paid for or

Line 12: Enter the total amount of all Anchor Company Payroll

Credits claimed on previously filed 4584 forms subject to

accrued after December 31, 2007, and whose cost was included

in the base investment, the taxpayer must report recapture equal

recapture.

76

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14