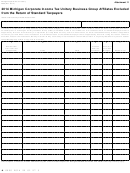

Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 14

ADVERTISEMENT

•

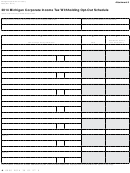

1) Taxpayer used the straight method to calculate the

Line 8, column M: For each taxable year on line

SBT liability for that taxable years: calculated the

8, column I, multiply line 6, column C by line 8,

column L. Enter results here. Match the taxable

credit rate on C-8000ITC, line 26 for that taxable

year, and enter the result here;

year on line 8, column I with the taxable year on

Worksheet 4a, line 4, column A, and carry amount

2) Taxpayer

used

the

excess

compensation

from line 8, column M to Worksheet 4a, line 4,

reduction method to calculate the SBT liability

column E for each appropriated tax year line.

for that taxable year: calculate the credit rate on

• Method C:

C-8000ITC, line 26, for that taxable year; subtract

the percentage found on C-8000S, line 6, from

○ Worksheet 4a, columns A through D: Fill column A,

100%, and multiply the result of that subtraction by

and leave all others blank.

the calculated credit rate on C-8000ITC, line 26.

○ Worksheet 4b, columns A and B: Leave lines blank.

Enter the result here.

○ Worksheet 4a, Column E: Enter results from the

•

Line 8, column J: Enter amount of ITC credit

taxpayer’s own software of choice (that is, a non-

used provided by the webtool that corresponds

Treasury Web tool) or the taxpayer’s own calculation

to each taxable year displayed on line 8, column

that reflects the MBT statute. Retain records to

I. Access the Michigan Department of Treasury

substantiate figures entered in the filed return.

(Treasury) Web tool by going to the Treasury site

( ), and enter the

necessary information as instructed.

Calculation of SBT ITC Credit Recapture Amounts

column A, enter the corresponding SBT ITC effective rate

from Worksheet 4a, column E. Match the acquisition year in

To complete Worksheet 5, follow the instructions below:

Worksheet 5, column A, with the corresponding acquisition

year in Worksheet 4a, column A.

Line 9, Column A: Enter in chronological order, beginning

with the earliest, the tax year end date of each acquisition

Line 9, Column D: Multiply column B by column C for each

year of disposed assets that triggered SBT ITC recapture from

Worksheets 3a through 3c.

acquisition year.

Add up figures in each row of Worksheet 5, column D, and

Line 9, Column B: Separately for each acquisition year

carry that amount to Form 4902, line 2.

listed in column A, combine the corresponding amounts

in Worksheet 3a, column F, Worksheet 3b, column F, and

UBGs: Add up figures in each row of Worksheet 5, line 9,

Worksheet 3c, column B for all disposed assets that triggered

column D from every group member that has disposed assets

SBT ITC recapture.

that triggered SBT ITC credit recapture. Carry the sum of all

years, for all group members, to form 4902, line 2.

Line 9, Column C: For each acquisition year listed in

Worksheet 5 — Calculation of SBT ITC Recapture Amounts

9.

A

B

C

D

Total SBT ITC Recapture Base

by Year of Acquisition

Taxable Year (End Date)

Year-Specified Recapture

Add amounts from Worksheet 3a, column F;

In Which Disposed

Worksheet 3b, column F; and Worksheet 3c,

Percentage Rate from

Recapture Amount

Assets Were Acquired

column B

Line 4, Column E

Multiply Column B by Column C

(MM-DD-YYYY)

%

%

%

00

10. TOTAL. Enter total of Line 1, column D. Carry total to Form 4902, line 2 ....................................................

86

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14