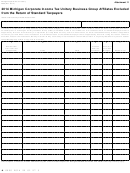

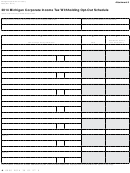

Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 3

ADVERTISEMENT

Instructions for Form 4902

Corporate Income Tax Schedule of Recapture

of Certain Business Tax Credits

Line 2: Enter calculated amount of total SBT ITC recapture

Purpose

from the “Calculation of SBT ITC Recapture Amount” section

Complete this form for any recapture in this tax year of

later in these instructions.

previously claimed Single Business Tax (SBT) or Michigan

Research and Development Tax Credit

Business Tax (MBT) credits listed on this schedule.

There were two Research and Development Credits in

Special Instructions for Unitary Business

MBT. The one previously reported on the MBT Credits for

Groups

Compensation, Investment and Research and Development

A Unitary Business Group (UBG) filling this form should

(Form 4570) does not require recapture. Report on this line

only recapture of the Research and Development Credit that

provide a table identifying each member whose credits are

is certified by the Michigan Economic Growth Authority

being recaptured. The table should contain the member’s FEIN

(MEGA) and claimed on the MBT Refundable Credits (Form

or TR number, name/type of each credit being recaptured by

4574).

the member, and the total recapture amount of each credit

by member. The UBG sums the total recapture amount for

The credit is earned under an agreement with MEGA. If

all members by credit type, and transfers the sum of total

MEGA determines that there has not been compliance with the

recapture amount to the appropriate credit recapture line on

terms of the agreement, the taxpayer must report recapture.

this form. Submit a completed Corporate Income Tax Schedule

of Recapture of Certain Business Tax Credits (Form 4902) and

Line 3: Enter recapture amount equal to 125 percent of the

total of all MEGA Research and Development Credits claimed

copy of the table identifying the members whose credits are

on previously filed MBT Refundable Credits forms (Form

being recaptured when filing the applicable CIT Annual return.

4574), as applicable.

Part 1: Line-by-Line Instructions

MEGA Employment Tax Credits

Lines not listed are explained on the form.

If a taxpayer receives an MBT MEGA Employment Tax Credit

Name and Account Number: Enter name and account number

for a previous tax period under an agreement with MEGA

as reported on page 1 of the applicable CIT Annual return: the

based on qualified new jobs and then removes 51 percent or

Corporate Income Tax Annual Return (Form 4891) for standard

more of those qualified new jobs from Michigan within three

taxpayers, the Corporate Income Tax Annual Return for

years after the first year in which the taxpayer claimed such a

Financial Institutions (Form 4908), or the Insurance Company

Annual Return for Corporate Income and Retaliatory Taxes

credit, the taxpayer must recapture an amount equal to the total

of all such credits claimed on prior returns.

(Form 4905).

Line 4: Enter the total amount of all MBT MEGA Employment

UBGs: A UBG reporting recapture should attach only one

Tax Credits claimed on previously filed forms (Form 4574)

copy of this form to its annual return, even if multiple members

subject to recapture.

are subject to recapture. Enter the Designated Member (DM)

name in the Taxpayer Name field and the DM account number

Entrepreneurial Credit

in the Federal Employer Identification Number (FEIN) field.

If the new jobs by which a taxpayer earned an Entrepreneurial

Investment Tax Credits

Credit are relocated outside of Michigan within five years after

Under both SBT and MBT, taxpayers were allowed to claim an

claiming the credit, or if a taxpayer reduces employment levels

Investment Tax Credit (ITC) for a percentage of the net costs

by more than 10 percent of the jobs by which the taxpayer

paid or accrued in the filing period for qualifying tangible asset

earned the credit, the taxpayer must recapture an amount equal

physically located in Michigan. The assets must have been of

to the total of all Entrepreneurial Credits received.

a type that were or would become eligible for depreciation,

Line 5: Enter the total amount of all Entrepreneurial Credits

amortization, or accelerated capital cost recovery for federal

claimed on previously filed MBT Miscellaneous Nonrefundable

income tax. Mobile tangible assets, wherever located, were

Credits forms (Form 4573) subject to recapture.

subject to apportionment in the same manner as the tax base.

Disposition of an asset, or moving an asset out of Michigan,

MEGA Federal Contract Credit

creates a recapture of the credit.

The MEGA Federal Contract Credit is claimed through an

For a guide on how to calculate the ITC recapture amount,

agreement with MEGA. If a taxpayer claimed this credit and

see the “Calculation of MBT ITC Recapture Amount” and

subsequently fails to meet requirements of the MBT Act or

“Calculation of SBT ITC Recapture Amount” sections later in

conditions of the agreement, the taxpayer must recapture the

these instructions.

entire amount of such credit previously claimed.

Line 1: Enter calculated amount of total MBT ITC recapture

Line 6: Enter the total amount of all MEGA Federal Contract

from the “Calculation of MBT ITC Recapture Amount” section

Credits claimed on previously filed MBT Election of Refund or

Carryforward of Credits (Form 4584) subject to recapture.

later in these instructions.

75

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14