Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 11

ADVERTISEMENT

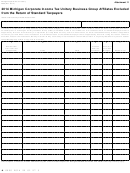

Line 3, Column B: Total sum of adjusted federal basis from

transferred outside Michigan during the tax year. Sum the total

all depreciable tangible assets acquired in the same taxable

adjusted federal basis for all such transferred assets acquired

year and transferred out of Michigan during the filing period.

in the same taxable year. Enter in this form only the total sum

Keep in your files a separate worksheet with the appropriate

of adjusted federal basis grouped by the taxable year the assets

information regarding each depreciable tangible asset other

were acquired. Use one row per group of such transferred

than mobile tangible assets acquired in tax years beginning

assets acquired in the same taxable year. Start from the earliest

after 1999 and prior to 2008, that were eligible for the ITC in

taxable year.

tax years beginning after 1999 and prior to 2008, and were

• Filers(**) who have filed an MBT Form 4583 for either 2008

Calculation of SBT ITC Recapture Rates

or 2009 tax year; or

Recapture rates can be calculated using any of 3 methods

• Filers(**) who have NOT filed 2008 or 2009 MBT return,

described in the “Method Summary Table” below. The Table

and have filed MBT return(s) for tax year(s) after 2009.

highlights the methods’ pros and cons. Choose your method,

and follow the appropriate instructions to calculate the rates on

(*) For UBGs, the condition applies only for groups where all

Worksheet 4a, line 4, column E.

members were included in every 2008 and 2009 MBT return

filed by the group.

NOTE: Whichever method used, the calculated effective

recapture rate of SBT ITC by year cannot be higher than the

(**) Filers refers to single filers (non-UBGs) or UBG members

figure calculated under Method A for any year.

in the current tax year who were not part of a group in 2008 or

2009 and were single-filers then. Not filing a Form 4567 does

NOTE ON USING SIMPLEST METHOD: When the

not allow a taxpayer to preserve SBT credit carryforward from

amount of SBT ITC used equals the amount of SBT ITC

one year to the next.

created, the three methods yield the same result. This occurs in

either of the following situations:

The simplest method that can be used is Method A. Taxpayers

Calendar year filer(*): 2009 MBT Form 4569, lines 2 and 3,

that meet either of the situations above should use Method A.

are equal for the latest 2009 tax year return filed;

It provides correct results using the least amount of data input

from the taxpayer.

Fiscal year filer(*): 2008 MBT Form 4569, line 4, equals zero

for the latest 2009 tax year return filed;

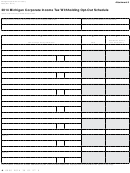

METhOD SUMMARY TABLE

TYPE OF METhOD

PROS

CONS

• Easy to calculate.

• Method does not take into account the extent to

Method A

• Works for all types of taxpayers, including any

which the ITC credit was used.

type of UBG groups.

• Taxpayer or UBG member disposing of ITC

asset only need to enter information on Worksheet

4a for years in which assets that trigger recapture

were acquired.

• Takes into account the extent to which the ITC

• Taxpayers must fill Worksheets 4a, 4b, and

Method B

was used.

4c and enter necessary information in Treasury

webtool.

• Information on Worksheet 4a must be entered

for all years in which assets were bought and ITC

was claimed, whether or not those assets were

disposed in the current tax year.

• Taxpayers fill only Worksheet 4a, line 4,

• Taxpayer need to develop own calculation

Method C

procedure that reflects the MBT statute. Retain

column E.

records to substantiate calculation.

83

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14