Form 4902 - Michigan Corporate Income Tax Schedule Of Recapture Of Certain Business Tax Credits - 2014 Page 7

ADVERTISEMENT

NOTE: Sales price includes any benefit derived from the sale.

Enter gross sales price (net of costs of sale) in column B, and in

column C, enter total gain or loss included in calculating federal

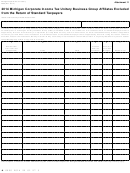

Worksheet 1c — Assets Transferred Outside Michigan

taxable income (as defined for MBT purposes).

Enter all depreciable tangible assets other than mobile tangible

For property placed in service prior to January 1, 2008, gain

assets acquired after 2007 that were eligible for ITC and were

reflected in federal taxable income (as defined for MBT

transferred outside Michigan during the filing period. Give

purposes) is equal to the gain reported for federal purposes.

all information required for each disposition in column A and

For property placed in service after December 31, 2007, gain

B. In column A, enter the taxable year in which the disposed

reflected in federal taxable income (as defined for MBT

assets were acquired, and in column B, enter adjusted basis as

purposes) is the gain reported federally except that it shall be

used for federal purposes. Do not use a recomputed MBT basis

calculated as if IRC § 168(k) were not in effect.

for this purpose.

• Column H: Calculate gross ITC credit amount: multiply

Calculation of MBT ITC Recapture Rates

and Amounts

column F by column G for each taxable year.

Complete Worksheet 2 (on the following page), entering each

• Column J: MBT recapture of capital investment. Enter total

taxable year (End Date) in which the disposed assets that

amount of recapture of capital investment reported on Form

triggered MBT ITC credit recapture were acquired.

4570, line 16, for each taxable year listed on column I.

NOTE: Lines references on columns below are based on

• Column L: Gross MBT ITC credit recapture amount.

2010 MBT Form 4570. Lines for 2008 MBT forms are

Multiply column J by column K. This represents the total

different, so if copying information from a 2008 MBT form,

amount of ITC credit recapture available to be reported in the

choose the appropriate lines.

tax year.

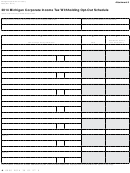

Worksheet 2

• Column M: MBT ITC credit recapture amount offset by

• Column A: Enter in chronological order, beginning with

credit. Enter the lesser of columns H and L. This is the amount

the earliest, the tax year end date of each acquisition year

of available ITC credit recapture that was offset by the total

of disposed assets that triggered MBT ITC recapture from

amount of available ITC credit in the year.

Worksheet 1a through 1c.

• Column O: SBT credit recapture amount. Enter total amount

UBGs: If capital asset subject to recapture is from a member

from Form 4570, line 19 for each taxable year listed on column

that was not part of the group in the tax year the asset was

N.

acquired, make a separate line entry for the tax year the

• Column P: SBT ITC credit recapture amount offset by credit.

member filed outside of the group. Take care to report in this

Enter lesser of the amount on column O, and the amount of

line information requested in each column only from the

column H minus column M. This is the amount of SBT ITC

member’s single filings, not the group’s.

credit recapture that was offset by the total amount of available

• Column B: Enter allowable MI compensation and ITC credits

ITC credit in the taxable year.

amount from Form 4570, line 26 with the corresponding

• Column Q: Total MBT ITC used. Add columns D, M, and

acquisition year in column A.

P. The total amount of MBT ITC used equals to the amount of

• Column C: Enter the MI compensation credit amount from

credit that offsets MBT ITC credit recapture, SBT ITC credit

Form 4570, line 3 with the corresponding acquisition year in

recapture, and the MBT liability.

column A.

• Column R: Extent used rate. Divide amounts on column Q

• Column D: Calculate net ITC credit amount: subtract column

by amounts on column H.

C from column B for each taxable year. If difference is less

• Column T: MBT recapture base. Enter total amount of

than zero (is negative), enter zero. This is the amount of ITC

recapture capital investment from Worksheet 1a, column F;

credit that offsets MBT liability.

Worksheet 1b, column F and Worksheet 1c, column B.

• Column F: MBT capital investment amount.

Enter total

• Column U: MBT recapture amount. Multiply amount in

amount of capital investment reported on Form 4570, line 8, for

each taxable year listed on column E.

column T by rates in column G, and in column R.

• Column G: ITC rate.

Enter 2.32% for taxable years on

Add up figures in each row of column U, and carry that amount

column E that end with 2008, otherwise enter 2.9%.

to Form 4902, line 1.

79

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14