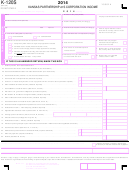

LINE INSTRUCTIONS FOR FORM K-120S, PAGE 1

Schedule K. For S corporations it is the total of amounts entered

TAXPAYER INFORMATION

on lines 2, 3c, 4, 5a, 6, 7, 8a, 9, and 10 of federal Schedule K.

Also include any gain from the sale of assets subject to section

Beginning and Ending Dates: Enter beginning and ending

179 that is not reported on Schedule K.

dates of the tax year, even if it is a calendar year.

Name and Address: PRINT or TYPE the name and address

LINE 2b—TOTAL DEDUCTIONS FROM SCHEDULE K: Enter

of the entity.

the allowable deductions listed on federal Schedule K. For

partnerships, this is the total of lines 12, 13b, 13c(2), and 13d of

EIN: Enter the federal Employer’s Identification Number.

federal Schedule K. For partners using Federal Form 1065-B,

Information for Items A through M: Complete all requested

the deductions are included in Line 2a above. For S corporations,

information.

this is the total of lines 11, 12b, 12c(2), and 12d of Schedule K.

•

A — Indicate whether the return is for a partnership or S

Contributions from Schedule K (Partnership, line 13a; or S

corporation. If federal form 1065 was filed, indicate a

Corporation, line 12a) may be deducted on line 2b unless the

partnership, if a federal form 1120S or other federal form

partner or shareholder is an individual. If the partner or

was filed, indicate an S corporation.

shareholder is an individual, and if they are itemizing deductions

•

B — Select a method to report income to Kansas. The

at the federal level, the contribution deductions should already

methods are described in the Definitions section on page 4.

be in their federal itemized deductions and no adjustment is

necessary on the Kansas individual return. If the partner or

•

C — Enter the NAICS code from Publication KS-1500,

shareholder is included in a composite return for Kansas

available from our web site:

(K-40C), they are required to use a standard deduction and not

•

D — Enter the date the business began in Kansas.

entitled to their share of the partnership or S corporation

•

E — Enter the date the business was discontinued in

contribution deduction or their credits.

Kansas, if applicable. If a final return is being filed due to

LINE 3—TOTAL: Add line 1 to line 2a and subtract line 2b.

liquidation, enter the date and also enclose a copy of the

Enter the result on line 3.

federal form that states the applicable federal code section.

•

F — Enter the two-letter abbreviation for the state of

LINE 4—TOTAL STATE AND MUNICIPAL INTEREST: Enter

incorporation and the date of that incorporation.

interest income received, credited, or earned by you during the

taxable year from any state or municipal obligations such as

•

G — Enter the two-letter abbreviation for the state of

bonds and mutual funds. Reduce the income amount by any

commercial domicile.

related expenses (such as management or trustee fees) directly

•

H — Enter the number of partners/shareholders that are

incurred in purchasing these state or political subdivision

listed on Part II.

obligations.

•

I — Mark this box if there are any tax credit schedules or

DO NOT include interest income on obligations of the state

supporting documentation enclosed with this return. If the

of Kansas or any Kansas political subdivision issued after

credit is initiated by this entity, enclose one credit schedule

December 31, 1987, or the following bonds exempted by Kansas

showing the total amount of credit claimed for all partners/

law: Board of Regents Bonds for Kansas Colleges and

shareholders. If the credit is passed to this entity from

Universities, Electrical Generation Revenue Bonds, Industrial

another entity, enclose one credit schedule showing the

Revenue Bonds, Kansas Highway Bonds, Kansas Turnpike

proportionate share of credit passed to this entity.

Authority Bonds and Urban Renewal Bonds.

•

J — Enter the original federal due date if other than the 15

th

If you are a partner or shareholder in a fund that invests in

rd

day of the 3

month after the end of the tax year.

both Kansas and other states’ bonds, only the Kansas bonds

•

K — Mark this box if any taxpayer information has changed

are exempt. Use the information provided by your fund

since the last return was filed in any boxes in this section

administrator to determine the amount of taxable (non-Kansas)

except for boxes H, I, L, or M.

bond interest to enter here.

•

L — Mark this box if a K-40C (composite schedule) is filed

LINE 5—TAXES ON OR MEASURED BY INCOME OR FEES OR

for this entity.

PAYMENTS IN LIEU OF INCOME TAXES: Enter the taxes on or

•

M — Mark this box if a K-120EL is filed.

measured by income or fees or payments in lieu of income

taxes which you deducted on your federal return in arriving at

INCOME

your federal ordinary income.

LINE 1—FEDERAL ORDINARY INCOME: Enter the federal

LINE 6—OTHER ADDITIONS TO FEDERAL INCOME: Enter on

ordinary income from federal Schedule K. A copy of certain pages

line 6 the following additions to your federal ordinary income:

of the federal return must be enclosed in all cases. See

•

Learning Quest 529 Education Savings Program. Enter the

instructions on page 3. For partners using federal Form 1065-B,

amount of any “nonqualified withdrawal” from the Learning

enter Line 1a from Form 1065-B, Schedule K.

Quest Savings Program.

LINE 2a—TOTAL OTHER INCOME FROM FEDERAL SCHEDULE

A tax credit for the additions below may be claimed on your

K: Enter the total of all other income listed on federal Schedule

tax return (schedule required):

K. For partners, this is the total of the amounts entered on lines

2, 3c, 4, 5, 6a, 7, 8, 9a, 10, and 11 of federal Schedule K. For

•

Community Service Contribution Credit. Enter the amount

partners using federal Form 1065-B, this is the total of the

of any charitable contribution claimed on your federal return

amounts entered on lines 1a, 2, 7 and 8 from Form 1065-B,

used to compute this credit on Schedule K-60.

Page 6

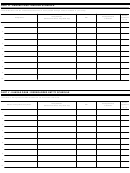

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16