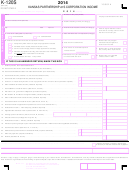

•

Disabled Access Credit. Enter the amount of any depreciation

•

Electrical Generation Revenue Bonds. Enter the gain from

deduction or business expense deduction claimed on your

the sale of Electrical Generation Revenue Bonds that was

federal return that was used to determine this credit on

included in your federal ordinary income.

Schedule K-37.

•

Learning Quest Education Savings Program. Enter the

•

Small Employer Healthcare Credit. Reduce the amount of

amount of contributions deposited in the Learning Quest

expense deduction that is included in federal ordinary income

Education Savings Program, or a qualified 529 tuition

by the dollar amount of the credit claimed on Schedule K-57.

program established by another state, up to a maximum of

$3,000 per student (beneficiary).

•

Swine Facility Improvement Credit. Enter the amount of any

costs claimed on your federal return and used as the basis

•

Sale of Kansas Turnpike Bonds. Enter the gain from the

for this credit on Schedule K-38.

sale of Kansas Turnpike Bonds that was included in your

federal ordinary income.

•

Expenditures— Energy Credits. Enter amount of any

expenditures claimed to the extent the same is claimed as

•

Amortization—Energy Credits. The carry forward amount of

the basis for any credit allowed on Schedule K-81 or carry

amortization deduction allowed relating to Schedule K-73,

forward amount on Schedule K-73, K-77, K-79, K-82, or K-83.

K-77, K-79, K-82 or K-83, and the amount of amortization

•

Amortization— Energy Credits. Enter the carry forward

deduction allowed for carbon dioxide capture, sequestration

amount of any amortization deduction—to the extent the

or utilization machinery and equipment, or waste heat

same is claimed on your federal return—with regard to

utilization system property.

Schedules K-73, K-77, K-79, K-82 or K-83 and any amount

LINE 11—TOTAL SUBTRACTIONS FROM FEDERAL INCOME:

claimed in determining federal adjusted gross income on

Add lines 8 through 10, and enter the result on line 11.

carbon dioxide recapture, sequestration or utilization

machinery and equipment, or waste heat utilization system

LINE 12— NET INCOME BEFORE APPORTIONMENT: Add lines

property.

3 and 7, then subtract line 11. Enter result on line 12.

LINE 7—TOTAL ADDITIONS TO FEDERAL INCOME: Add lines

APPORTIONMENT AND ALLOCATION

4 through 6 and enter the result on line 7.

LINE 13— NONBUSINESS INCOME - TOTAL COMPANY: Enter

LINE 8—INTEREST ON U.S. GOVERNMENT OBLIGATIONS:

on line 13 the total amount of nonbusiness net income

Enter any interest or dividend income received from obligations

everywhere that is to be directly allocated.

or securities of any authority, commission or instrumentality of

Any taxpayer that claims nonbusiness income on the Kansas

the United States and/or its possessions that was included in

return is required to clearly demonstrate that the transaction or

your federal ordinary income. This includes U.S. Savings Bonds,

activity which gave rise to the income was unusual in nature and

U.S. Treasury Bills, and the Federal Land Bank. You must reduce

infrequent in occurrence or that the income was earned in the

the interest amount by any related expenses (such as

course of activities unrelated to the taxpayer’s regular business

management or trustee fees) directly incurred in the purchase

operations; or that the income did not arise from transactions

of these securities.

and activities involving tangible and intangible property or assets

If you are a shareholder in a mutual fund that invests in both

used in the operation of the taxpayer’s trade or business.

exempt and taxable federal obligations, only that portion of the

The taxpayer must also submit a schedule as required below.

distribution attributable to the exempt federal obligations may

If the taxpayer does not demonstrate that the income is

be subtracted here. Enclose a schedule showing the name of

nonbusiness and does not submit the required schedule(s),

each U.S. Government obligation interest deduction claimed.

the income will be considered business income and KDOR will

Interest from the following are taxable to Kansas and may

apportion it accordingly.

NOT be entered on this line:

From the items of income directly allocated, there shall be

„

Federal National Mortgage Association (FNMA)

deducted the expenses related thereto. As used in this

„

Government National Mortgage Association (GNMA)

paragraph, expenses related thereto means any allowable

„

Federal Home Loan Mortgage Corporation (FHLMC)

deduction or portion thereof attributable to such income and a

LINE 9—IRC SECTION 78 AND 80% OF FOREIGN DIVIDENDS:

ratable part of any other allowable deductions which cannot

Enter the amount included in federal ordinary income pursuant

definitely be allocated to some item or class of income.

to the provisions of Section 78 of the Internal Revenue Code

A schedule must accompany the return showing: 1) the gross

and 80% of dividends from corporations incorporated outside

income from each class of income being specifically allocated,

of the United States or the District of Columbia which are included

2) the amount of each class of related expenses together with

in federal ordinary income.

an explanation or computations showing how amounts were

arrived at, 3) the total amount of the related expense for each

LINE 10—OTHER SUBTRACTIONS FROM FEDERAL INCOME:

income class, and 4) the net income for each income class.

Enter a total of the following subtractions from your federal

The schedules should provide appropriate columns as set forth

ordinary income (schedule required).

above for items specifically assigned to Kansas and for

•

Refunds or Credits. Any refund or credit for overpayment of

nonbusiness items specifically assigned outside Kansas. An

taxes on or measured by income or fees or payments in lieu

explanation must also be enclosed to explain specifically why

of income taxes imposed by this state, or any taxing

the income should be classified as nonbusiness income.

jurisdiction, to the extent included in federal ordinary income.

LINE 14—APPORTIONABLE BUSINESS INCOME: Subtract line

•

Jobs and WIN Tax Credit. The amount of federal targeted

13 from line 12 and enter the result on line 14.

jobs and WIN credit.

•

Kansas Venture Capital, Inc. Dividends. Dividend income

LINE 15—AVERAGE PERCENT TO KANSAS: Enter the

received as a result of investing in stock issued by Kansas

applicable percentages in spaces A, B, and C of line 15. If you

Venture Capital, Inc.

are qualified and utilizing the elective two-factor formula, do not

Page 7

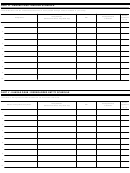

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16