Activity Wholly Within Kansas. If a particular trade or business is carried on exclusively within Kansas or if

Definitions

the activities outside of Kansas are such that federal Public Law 86-272 prohibits another state from imposing

(continued)

a tax, then the entire net income is subject to the Kansas Income Tax. If two or more corporations file federal

income tax returns on a consolidated basis, and if each of such corporations derive all of their income and

expenses from sources within Kansas, they must file a consolidated return for Kansas income tax purposes.

Single Entity Apportionment Method. Any taxpayer having income from business activity which is taxable

both within and without this state, other than activity as a financial organization or the rendering of purely

personal services by an individual, shall allocate and apportion net income as provided in the Uniform

Division of Income for Tax Purposes Act.

Combined Income Method—Single Corporate Filing. When a group of corporations conduct a unitary

business both within and outside of Kansas, the source of income shall be determined by the “combined

income approach.” This approach is the computation by formula apportionment of the business income of a

unitary trade or business properly reportable to Kansas by members of a unitary group. The property, payroll,

or sales factor for each member of a unitary business shall be determined by dividing the property, payroll, or

sales figure for Kansas by the total property, payroll, or sales figure of the entire group. The average is multiplied

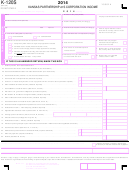

All small business

by the income of the unitary group to determine the income of the company derived from sources in Kansas.

corporations filing

The Kansas S Corporation return filed on the combined income approach must include Schedule K-121S,

a combined return

which can be found in this booklet.

(single or multiple)

must complete lines

Any small business corporation which files a consolidated return for federal purposes and a combined

1 through 20 of Form

report for Kansas purposes must submit a copy of the consolidated federal Form 1120S and all other schedules

K-120S using the

and statements necessary to support the federal ordinary income reported on the Kansas return. Schedule

total combined

K-121S must be used to determine income of the small business corporation. Schedule K-121S single entity

income column from

Kansas income is then shown on line 20, Form K-120S.

Schedule K-121S.

Combined Income Method—Multiple Corporation Filing. This method is the same as “Combined Income

Method—Single Corporation Filing” except that any corporation filing using the combined income method with

more than one entity doing business in Kansas may file the Kansas return reporting the total combined income

on that return. Schedule K-121S must be used to determine the Kansas taxable income of each separate

corporation. Schedule K-121S combined Kansas income is then entered on line 20 of Form K-120S.

Qualified Elective Two-Factor Method. This method may be used by any taxpayer who qualifies and elects

to utilize the two-factor formula of property and sales. A qualified taxpayer is any taxpayer whose payroll factor

for a taxable year exceeds 200% of the average of the property factor and the sales factor. An election must be

made by including a statement with the original tax return indicating the taxpayer elects to utilize this

apportionment method. It will be effective and irrevocable for the taxable year of the election and the following

nine taxable years.

Common Carrier Method. All business income of railroads and interstate motor carriers of persons or

property for-hire shall be apportioned to this state on the basis of mileage. For railroads, multiply the business

income by a fraction, the numerator of which is the freight car miles in this state and the denominator of which

is the freight car miles everywhere. For interstate motor carriers, multiply the business income by a fraction,

the numerator of which is the total number of miles operated in this state and the denominator of which is the

total number of miles operated everywhere.

Alternative Accounting Method. If the uniform allocation and apportionment provisions do not represent

fairly the extent of the taxpayer’s business activity in this state, the taxpayer may petition for, or the Secretary of

Revenue may require, in respect to all or any part of the taxpayer’s business activity, if reasonable: (a) Separate

accounting; (b) the exclusion of one or more of the factors; (c) the inclusion of one or more additional factors;

or (d) the employment of any other method to effect an equitable allocation and apportionment of the taxpayer’s

income. A copy of the letter from KDOR granting the use of an alternative method must be enclosed with the

return when filed. Enter the amount determined on your separate schedule on line 20, Form K-120S.

Separate Accounting Method. The separate accounting method of reporting income to Kansas is allowable

only in unusual circumstances and with the permission of KDOR where the use of the three-factor formula

does not fairly represent the taxpayer’s business activity. Before a taxpayer engaged in a multistate business

may use the separate accounting method, the following requirements shall be satisfied:

„

The books and records are kept by recognized accounting standards to reflect accurately the amount

of income of the multistate business which was realized in Kansas during the taxable period;

„

The management functions of the business operations within Kansas are separate and distinct so

that in conducting the Kansas business operations the management within Kansas did not utilize or

incur centralized management services consisting of operational supervision, advertising, accounting,

insurance, financing, personnel, physical facilities, technical and research, sales and servicing or

purchasing during the taxable period;

„

The business operations within Kansas are separate and distinct and do not contribute to or depend

upon the overall operations of the company, and there are no interstate, intercompany, or interdivisional

purchases, sales or transfers during the taxable period.

If all three requirements are not satisfied, the taxpayer shall determine Kansas taxable income by use of the

apportionment formula. Enter the amount determined on your separate schedule on line 20, Form K-120S.

Page 5

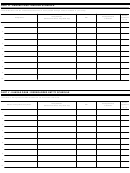

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16