Amended

adjusted or disallowed, you must provide the department with a copy of the adjustment or denial letter.

If you did not file a Kansas return when you filed your original federal return, and the federal return has since

Returns

been amended or adjusted, use the information on the amended or adjusted federal return to complete your

(continued)

original Kansas return. A copy of both the original and amended federal returns should be enclosed with the

Kansas return along with an explanation of the changes.

Federal Audit. Any taxpayer whose income has been adjusted by the Internal Revenue Service must file an

amended return with Kansas and include a copy of the Revenue Agent’s Report or adjustment letter showing

and explaining the adjustments. These adjustments must be submitted within 180 days of the date the

federal adjustments are paid, agreed to, or become final, whichever is earlier. Failure by the taxpayer to notify

KDOR within the 180 day period shall not bar KDOR from assessing additional taxes or proceeding in court

to collect such taxes. Failure by the taxpayer to comply with the requirements for filing returns shall toll the

periods of limitation for KDOR to assess or collect taxes.

Capital

Any adjustment, provided by Kansas law, which applies to a capital gain received by the partnership or

corporation and reported by the individual partners or shareholders on their individual federal income tax

Gains

return, is to be made by each partner or shareholder on his Kansas individual income tax return.

If, during the taxable year, the partnership or corporation received a gain from the sale of property or other

capital assets for which the tax basis for Kansas is higher than the tax basis for federal, each partner or

shareholder must be notified of his share of the difference in basis and whether the gain qualified as a long

or short term capital gain.

Any partnership or corporation which has a partner or shareholder who is a nonresident of Kansas must

advise such partner of those capital gains and losses incurred from assets located in Kansas because the

nonresident partner or shareholder is subject to tax on gains realized from the sale or exchange of property

located in Kansas.

If such computations result in a net capital loss to Kansas, the loss is limited to $3,000 ($1,500 for married

individuals filing separate returns) on the partner’s or shareholder’s Kansas individual income tax return.

Capital transactions from Kansas sources to which the above instructions apply include: a) Capital gains

or losses derived from real or personal property having an actual situs within Kansas whether or not connected

with the trade or business; b) capital gains or losses from stocks, bonds and other intangible property used

in or connected with a business, trade or occupation that is carried on within Kansas; and, c) respective

portion of the partnership or corporate capital gain or loss from a partnership or corporation of which the

partnership or shareholder is a member, partner or shareholder, or an estate or trust of which the partnership

or corporation is a beneficiary. See instructions for Part III - Apportionment Formula .

Partnerships, S corporations and limited liability companies with nonresident owners are required

Nonresident

to withhold Kansas income tax at the rate of 4.8% on the Kansas taxable income (whether distributed

Owner

or undistributed) of their nonresident partners, members or shareholders. Pass-through entities with

Withholding

nonresident owners must complete Form KW-7/KW-7S and pay the withheld funds on or before the due date

of the income tax return for the pass-through entity, including extensions. These forms and additional

information about this requirement are available from our web site at .

Definitions

Business Income. For tax years commencing after December 31, 2007, “business income” means: 1)

Income arising from transactions and activity in the regular course of the taxpayer’s trade or business; 2)

income arising from transactions and activity involving tangible and intangible property or assets used in the

operation of the taxpayer’s trade or business; or 3) income of the taxpayer that may be apportioned to this state

under the provisions of the Constitution of the United States and laws thereof, except that a taxpayer may elect

that all income constitutes business income. Business income is apportioned to Kansas generally using the

average of the three factors of property, payroll, and sales. For instance, business income received from

another partnership is included in your apportionable income and your share of that partnership is multiplied

times the property, payroll and sales both in Kansas and everywhere of that partnership to add to your entity’s

property, payroll and sales both in Kansas and everywhere. The apportionable income is then multiplied by

the resulting factor. Any deviation from using the three factor method requires alternative qualifications. All the

apportionment methods are listed in this section.

K.S.A. 79-3279 provides that the use of the three-factor method formula of property, payroll, and sales be

used to apportion income to Kansas. Direct or segregated accounting methods will not be allowed unless the

taxpayer has petitioned the Secretary of Revenue for use of direct or segregated accounting, and the petition

is approved. Direct or segregated accounting will not be allowed only because that is the method used in

another state or because partnership income is received from other entity.

Unitary Business. A multistate business is unitary when the operations conducted in one state benefit or are

benefited by the operations conducted in another state or states. The essential test to be applied is whether or not

the operation of the portion of the business within the state is dependent upon or contributory to the operation of

the business outside the state. If there is such a relationship, the business is unitary. Stated another way, the test

is whether various parts of a business are interdependent and of mutual benefit so as to form one business rather

than several business entities and not whether the operating experience of the parts are the same at all places.

Page 4

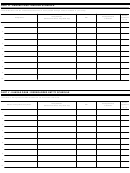

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16