Gross receipts are attributed to Kansas if, with respect to a

nonbusiness income, in valuing property or of excluding or

single item of income, the income-producing activity is performed

including property in the property factor, in the treatment of

within and without Kansas but the greater proportion of the

compensation paid in the payroll factor, or in excluding or

income-producing activity is performed in Kansas, based on

including gross receipts in the sales factor, the taxpayer shall

costs of performance. In cases where services are performed

disclose by separate enclosed schedule the nature and extent

partly within and partly without Kansas, the services performed

of the variance or modification. Only inconsistencies in the

in each state will usually constitute a separate income-producing

denominators of the property, payroll, and sales factors which

activity; in such case, the gross receipts for the performance of

materially affect the amount of business income apportioned

services attributable to Kansas shall be measured by the ratio

to Kansas need to be disclosed. Inconsistencies in the

which the time spent in performing such services in this state

determination of nonbusiness income and in the denominators

bears to the total time spent in performing such services

of the factors due to a difference in state laws or regulations

everywhere. Time spent in performing services includes the

must be identified by that state’s statute or regulation section

amount of time expended in the performance of a contract or

number and shown on the separate schedule. The amount of

other obligation which gives rise to such gross receipts.

each inconsistency by state is to be shown.

Personal service not directly connected with the performance of

When a taxpayer makes sales of tangible personal property

the contract or other obligation, such as time expended in

which are shipped from Kansas and assigned to a state in

negotiating the contract, is excluded from the computation.

which the taxpayer does not file a return or report, the taxpayer

LINE D(1)—TOTAL PERCENT. If you are utilizing the three-

shall identify the state to which the property is shipped, report

factor formula to apportion income to Kansas, add lines A, B

the total amount of sales assigned to such state, and furnish

and C.

the facts upon which the taxpayer relies as establishing

jurisdiction to tax by such state.

LINE D(2)—TOTAL PERCENT. If you are qualified and are

utilizing the elective two-factor formula to apportion income to

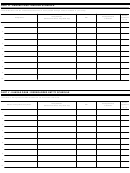

PART IV—KANSAS PASS-THROUGH SCHEDULE

Kansas, add lines A and C.

Complete this schedule if this entity receives passed through

LINE E—AVERAGE PERCENT. Divide line D(1) or D(2),

distributions from another entity. For instance, if you own a 50%

whichever is applicable, by the number of factors used in the

interest in Partnership A and are required to report income and/

formula. For instance, if you are using the three-factor formula

or expenses on your tax return, disclose the name, address,

and the corporation does not have payroll anywhere, divide by 2.

EIN, principal product or service and whether or not Partnership

Consistency in Reporting

A has Kansas activity.

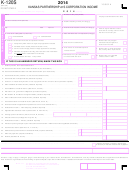

In completing Form K-120S, K-120S AS and K-121S, if, with

PART V—KANSAS QSUB/DISREGARDED ENTITY SCHEDULE

respect to prior tax years and to filing other states’ tax returns,

Complete this schedule if Qsub or disregarded entities are

the taxpayer departs from or modifies the manner in which

income has been classified as business income from

included in this return

.

Page 11

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16