Compensation is paid in Kansas if any one of the following

The numerator of the sales factor shall include gross receipts

tests, applied consecutively, are met: (a) The employee’s service

attributable to Kansas and derived by the taxpayer from

is performed entirely within Kansas; (b) The employee’s service

transactions and activity in the regular course of its trade or

is performed both inside and outside of Kansas, but the service

business. All interest income, service charges, carrying charges,

performed without this State is “incidental” to the employee’s

or time-priced differential charges incidental to such gross

service in Kansas (the word “incidental” means any service which

receipts shall be included regardless of the place where the

is temporary or transitory in nature, or which is rendered in

accounting records are maintained or the location of the contract

connection with an isolated transaction); (c) If the employee’s

or other evidence of indebtedness.

services are performed both inside and outside of Kansas, the

employee’s compensation will be attributed to Kansas if: (1) the

Sale of Tangible Personal Property in this State

employee’s base of operations is in Kansas; or (2) there is no

•

Gross receipts from sales of tangible personal property

base of operations in any state in which some part of the service

(except sales to the United States Government) are in this

is performed, but the place from which the service is directed or

state if:

controlled is in Kansas; or (3) the base of operations or the place

–

the property is delivered or shipped to a purchaser within

from which the service is directed or controlled is not in any state

this state regardless of the f.o.b. point or other conditions

in which some part of the service is performed, but the employee’s

of sale;

residence is in Kansas. The term “base of operation” is the place

from where employees begin work and to which they customarily

–

the property is shipped from an office, store, warehouse,

factory, or other place of storage in this state and the

return in order to receive instructions from the taxpayer or

communications from his customers or other persons, or to

taxpayer is not taxable in the state of the purchaser.

replenish stock or other materials, repair equipment, or perform

•

Property shall be deemed to be delivered or shipped to a

any other functions necessary to the exercise of their trade or

purchaser within this state if the recipient is located in this

profession at some other point or points.

state, even though the property is ordered from outside this

LINE C—Sales Factor. For purposes of the sales factor of the

state.

apportionment formula, the term “sales” means all gross

•

Property is delivered or shipped to a purchaser within this

receipts derived by the taxpayer from transactions and activity in

state if the shipment terminates in this state, even though

the regular course of such trade or business. The following are

the property is subsequently transferred by the purchaser to

rules for determining “sales” in various situations:

another state.

•

In the case of a taxpayer engaged in manufacturing and

•

The term “purchaser within this state” shall include the

selling or purchasing and reselling goods or products, “sales”

ultimate recipient of the property if the taxpayer in this state,

includes all gross receipts from the sales of such goods or

at the designation of the purchaser, delivers to or has the

products (or other property of a kind which would properly be

property shipped to the ultimate recipient within this state.

included in the inventory of the taxpayer if on hand at the

•

When property being shipped by a seller from the state of

close of the income year) held by the taxpayer primarily for

origin to a consignee in another state is diverted while enroute

sale to customers in the ordinary course of its trade or

to a purchaser in this state, the sales are in this state.

business. “Gross receipts” for this purpose means gross

•

If a taxpayer whose salesman operates from an office located

sales, less returns and allowances, and includes all interest

in this state makes a sale to a purchaser in another state in

income, service charges, carrying charges, or time-price

which the taxpayer is not taxable and the property is shipped

differential charges incidental to such sales. Federal and

directly by a third party to the purchaser, the following rules

state excise taxes (including sales taxes) shall be included

apply:

as part of such receipts if such taxes are passed on to the

buyer or included as part of the selling price of the product.

1) if the taxpayer is taxable in the state from which the third

party ships the property, then the sale is in such state;

•

In the case of cost plus fixed fee contracts, such as the

operation of a government-owned plant for a fee, “sale”

2) if the taxpayer is not taxable in the state from which the

includes the entire reimbursed cost, plus the fee.

property is shipped, then the sale is in this state.

•

In the case of a taxpayer engaged in providing services,

Sales to the United States Government: Gross receipts from

such as the operation of an advertising agency, or the

the sales of tangible personal property to the United States

performance of equipment service contracts, or research

Government are to be included in Kansas if the property is shipped

and development contracts, “sales” includes the gross

from an office, store, warehouse, factory, or other place of storage

receipts from the performance of such services, including

in this state. Only sales for which the United States Government

fees, commissions, and similar items.

makes direct payment to the seller pursuant to the terms of its

•

In the case of a taxpayer engaged in renting real or tangible

contract constitute sales to the United States Government. Thus,

property, “sales” includes the gross receipts from the rental,

as a general rule, sales by a subcontractor to the prime contractor,

lease, or licensing the use of the property.

the party to the contract with the United States Government, does

not constitute sales to the United States Government.

•

In the case of a taxpayer engaged in the disposition of non-

inventory assets and property used or purchased in the

Sales Other Than Sales of Tangible Personal Property: K.S.A.

regular course of business, “sales” includes the capital

79-3287 provides for the inclusion in the numerator of the sales

gain or ordinary gain realized from such disposition. The

factor of gross receipts from transactions other than sales of

term “sales” does not include the return of capital or recovery

tangible personal property (including transactions with the United

of basis with respect to non-inventory capital assets.

States Government). Under this section gross receipts are

•

For all taxable years beginning after December 31, 2007, in

attributed to Kansas if the income-producing activity which gave

the case of sales of intangible business assets, only the

rise to the receipts is performed within Kansas or if property

net gains from the sale shall be included in the sales factor.

producing the receipts is located within Kansas.

Page 10

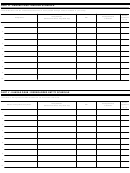

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16