IN THIS BOOKLET

WHAT’S NEW

General Information .......................................

2

EXEMPT INCOME. During the 2012 Legislative

Line Instructions (K-120S) .............................

6

Session House Bill 2117 was passed and signed into law.

Line Instructions (K-120S AS) .......................

9

Provisions of the bill added new subtraction modifications

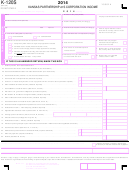

Form K-120S ................................................. 12

to K.S.A. 79-32,117. The overall effect of these new

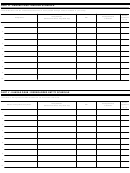

Form K-120S AS ........................................... 14

provisions is to exempt certain categories of income from

Form K-121S ................................................. 16

Kansas income tax. Although the net result for many

Taxpayer Assistance .......................... Back Cover

taxpayers is a zero tax liability, filing a tax return is still

Electronic Filing .............................. Back Cover

required in order utilize the subtraction modifications.

GENERAL INFORMATION

If any due date falls on a Saturday, Sunday, or legal holiday, substitute the next regular workday.

Who Must

A Kansas corporate return must be filed by all corporations doing business within or deriving income from

sources within Kansas who are required to file a federal income tax return, whether or not a tax is due.

File a

Corporations which elect under subchapter S of the Internal Revenue Code not to be taxed as a corporation

Return

must file a Kansas Partnership or S Corporation Return, Form K-120S. All other corporations file Form K-120.

Banks and savings and loan associations allowed to file as small business corporations at the federal

level are not allowed to file as small business corporations at the Kansas level. Those entities are required to

file a Privilege Tax return (K-130) to report any income or loss. The federal level shareholders income or loss

which is included in their individual federal income tax return is to be subtracted from federal adjusted gross

income so as to not allow that income.

A partnership return (Form K-120S) must be completed by any business partnership, syndicate, pool, joint

venture or other such joint enterprise to report income from operations. The Kansas partnership return must be

completed by every enterprise that has income or loss derived from Kansas sources regardless of the amount

of income or loss. Income or loss derived from Kansas sources includes income or loss attributed to:

„ any ownership interest in real property or tangible personal property located in Kansas and intangible

property to the extent it is used in a trade, business, profession or occupation carried on in Kansas; and,

„ a trade, business, profession or occupation carried on in Kansas.

Any partnership, joint venture, syndicate, etc., required to file a partnership return for federal purposes is

required to file a Kansas partnership return if such enterprise receives income or loss from Kansas sources.

When and

Calendar Year: If your return is based on a calendar year, it must be filed no later than April 15, 2014.

Fiscal Year: If your return is based on a tax year other than a calendar year, it must be filed no later than the

Where to

15th day of the fourth month following the end of your tax year.

File

Conformity to Federal Due Dates: Kansas small business returns are due on or before the 15th day of the

fourth month following the close of the taxable year. The close of the taxable year is the same as the close of the

taxable year for federal income tax purposes. If the federal original due date is not the 15th day of the third month

after the close of a taxable year for corporations or the 15th day of the fourth month after the close of a taxable year

for partnerships, complete item “J” on the front of Form K-120S, and enclose a letter indicating the authorizing

federal statute. Do not enter your extended due date.

Amended Returns: If the amended return will result in a refund, then it must be filed within three (3) years

from the date the original return was due including any extension allowed pursuant to law; or two (2) years

from the date the tax claimed to be refunded or against which the credit claimed was paid, whichever of such

periods expires later.

Mail your return to: KANSAS S CORPORATION TAX, KANSAS DEPARTMENT OF REVENUE, 915 SW HARRISON

STREET, TOPEKA, KS 66612-1588.

Confidential

Income tax information disclosed to KDOR, either on returns or through department investigation, is held in

strict confidence by law. KDOR, the Internal Revenue Service, the Multi-state Tax Commission, and several other

Information

states have an agreement under which some tax information is exchanged. This is to verify accuracy and

consistency of information reported on federal and Kansas tax returns.

Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16