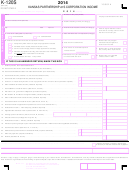

enter a percentage in space B. Enter on line 15 the average

using the alternative or separate accounting method, enter on

line 20 the: 1) Kansas income from line 20 of Schedule

percent from Form K-120S AS, Part III, line E. Important––Round

K-121S; or, 2) Kansas income from a separate schedule

the percent to the fourth decimal point. If your business is wholly

prepared by you (Separate/Alternative Method of Reporting).

within Kansas enter 100.0000.

LINE 16—AMOUNT TO KANSAS: Multiply line 14 by line 15

LINE 21—ESTIMATED TAX PAID AND AMOUNT CREDITED

and enter the result on line 16.

FORWARD: If you filed a Form K-120 last year, enter the total of

your 2013 estimated tax payments plus any 2012 overpayment

LINE 17—NONBUSINESS INCOME-KANSAS: Enter the total

you had credited forward to 2013.

amount of nonbusiness net income directly allocated to Kansas.

Submit a schedule to support the amount shown.

LINE 22—OTHER TAX PAYMENTS: Enter on line 22 any amount

of prepaid tax not entered above. Do NOT enter KW-7 or KW-7S

LINE 18—KANSAS EXPENSING RECAPTURE (K-120EX). If you

withholding on this line.

have a Kansas expensing recapture amount from Schedule

K-120EX, enter the amount on line 18 and enclose a copy of

LINE 23—REFUND: Add lines 21 and 22 and enter the result.

your completed K-120EX and federal Form 4562.

Amounts less than $5.00 will not be refunded.

LINE 19—KANSAS EXPENSING DEDUCTION: Enter the amount

SIGNATURE AND VERIFICATION: The return must be signed

of your Kansas expensing deduction from Schedule

and sworn to by a member, partner, president, vice-president, or

K-120EX and enclose a copy of your completed K-120EX and

other principal officer. If the return is prepared by a firm or

federal Form(s) 4562. Also enclose any schedule necessary to

corporation, the return should be signed in the name of the firm

enable KDOR to reconcile the federal Form 4562 amounts to

or corporation. Any person or persons who prepare the return

the expensing claimed on the K-120EX.

for compensation must also sign the return and provide their

EIN (Employer Identification Number) or SSN (Social Security

LINE 20—TOTAL KANSAS INCOME: If you are filing a

Number).

combined report (Schedule K-121S) or you are authorized to file

LINE INSTRUCTIONS FOR FORM K-120S, PAGE 2

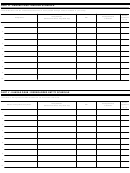

COLUMN 7—Partner’s or Shareholder’s portion of total

PART I—ADDITIONAL INFORMATION

Kansas income. Multiply the partner’s or shareholder’s

All entities must answer all questions in Part I.

percentage in column 4 by line 12, page 1.

PART II—PARTNER’S OR SHAREHOLDER’S

COLUMN 8—Partner’s or Shareholder’s modification.

DISTRIBUTION OF INCOME

Subtract column 7 from column 6 and enter result in column 8.

This is the Kansas adjustment to be entered on Schedule S

Part II must be completed for all partners or shareholders.

(supplemental schedule for Form K-40), as a partnership or S

corporation adjustment. If the amount in column 7 is greater

COLUMN 1—Name and address of partner or shareholder.

than column 6, the amount in column 8 should be shown as an

List the name and permanent address of each person who was

addition modification and entered on line A12 of Schedule S. If

a partner of the partnership or shareholder of the corporation

the amount in column 7 is less than column 6, the amount in

during the taxable year. Check the box on the right side of column

column 8 should be shown as a subtraction modification and

1 if the respective partner or shareholder was a nonresident of

entered on line A26 of Schedule S.

Kansas during the year.

COLUMN 2—Social Security Number (SSN) or Employer

Nonresident Partner’s or Shareholders’ Computation

Identification Number (EIN). Enter in column 2 the SSN or EIN

Nonresident partners or shareholders must use the following

of each partner or shareholder listed.

method to determine the amounts that will be entered in Part B

COLUMN 3—Partner’s or Shareholder’s Percent of

of Schedule S.

Ownership. Enter in column 3 the partner’s or shareholder’s

The taxpayer’s share of income to be entered on line B10

percent of ownership in the partnership or corporation.

(Amount from Kansas Sources) is determined by multiplying

COLUMN 4—Partner’s Profit Percent or Shareholder’s

column 4, Part II, page 2, Form K-120S by line 12, page 1, Form

Applicable Percentage. Enter in column 4 the partner’s profit

K-120S, if income is derived totally within Kansas; or line 20, if

percentage or shareholder’s applicable percentage.

income is derived within and outside of Kansas.

COLUMN 5—Income from Kansas sources. Kansas

Since modifications for nonresident income are included in

Resident Individuals: Multiply column 4 by line 12, page 1.

line 20, Form K-120S, a modification relative to the S corporation

Nonresident Individuals: If income is earned only from Kansas

or partnership income is not to be entered on line B20 of

sources multiply column 4 by line 12. If earned from inside and

Schedule S.

outside of Kansas, multiply column 4 by the sum of lines 16 and

NOTE: Any difference in the basis of property sold which has

17, page 1. All Other Partners or Shareholders: Multiply column

a higher basis for Kansas income tax purposes than for federal

4 by the sum of lines 16 and 17, page 1.

income tax purposes and which is reported as a long-term

Enclose a schedule showing adjustments due to any

capital gain for Kansas purposes, should be computed and

guaranteed payments.

reported to the respective shareholder or partner for adjustment

COLUMN 6—Partner’s or Shareholder’s portion of federal

of this item on the individual income tax return. If the basis of

ordinary and other income (losses) and deductions. Multiply

property sold has a lower basis for Kansas income tax purposes

the partner’s profit percent or applicable shareholder’s

than for federal income tax purposes, no adjustment is

percentage in column 4 by line 3, page 1.

necessary.

Page 8

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16