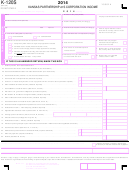

INSTRUCTIONS FOR FORM K-120S AS

You must complete and enclose Part III, of Form 120S AS

LINE A—Property Factor. The property factor shall include all

with your Kansas return if the taxpayer is doing business within

real and tangible personal property owned or rented and used

and outside of Kansas and utilizing the apportionment formula

during the income year to produce business income. Property

to determine Kansas income.

used in connection with the production of nonbusiness income

shall be excluded from the factor. Property shall be included in

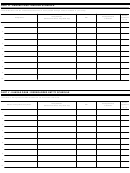

PART III—APPORTIONMENT FORMULA

the property factor if it is actually used or is available for or capable

of being used during the income year for the production of

Part III is to be used by corporations which derive income

business income. Property used in the production of business

from sources both within and without Kansas for the purpose of

income shall remain in the property factor until its permanent

allocating and apportioning income. All business income is

apportionable to Kansas by one of the following methods:

withdrawal is established by an identifiable event such as its

sale or conversion to the production of nonbusiness income.

•

The majority of taxpayers will multiply business income by a

The numerator of the property factor shall include the average

fraction, the numerator of which is the property factor plus

value of the taxpayer’s real and tangible personal property owned

the payroll factor plus the sales factor, and the denominator

and used in Kansas during the income year for the production of

of which is three.

income, plus the value of rented real and tangible personal

•

Railroads will multiply business income by a fraction, the

property so used. Property owned by the taxpayer in transit between

numerator of which is the freight car miles in this state and

locations of the taxpayer shall be considered to be at the

the denominator of which is the freight car miles everywhere.

destination for purposes of the property factor. Property in transit

•

Interstate motor carriers will multiply business income by a

between a buyer and seller which is included by a taxpayer in the

fraction, the numerator of which is the total number of miles

denominator of its property factor in accordance with its regular

operated in this state and the denominator of which is the

accounting practices shall be included in the numerator according

total number of miles operated everywhere.

to the state of destination. The value of mobile or movable property,

•

A qualifying taxpayer may elect to multiply business income

such as construction equipment, trucks and/or leased electronic

by a fraction, the numerator of which is the property factor

equipment which are located within and without Kansas during

plus the sales factor, and the denominator of which is two. A

the income year, shall be determined for purposes of the

qualifying taxpayer is any taxpayer whose payroll factor for a

numerator of the factor on the basis of total time within Kansas

taxable year exceeds 200% of the average of the property

during the income year. Property owned by the taxpayer shall be

factor and the sales factor. For additional information relating

valued at its original cost. As a general rule, “original cost” is

to this method and to determine if you are qualified, you may

deemed to be the basis of the property for federal income tax

review K.S.A. 79-3279. If you qualify to use this method you

purposes at the time of acquisition by the taxpayer and adjusted

are required to complete, for the first year, the payroll

by subsequent capital additions or improvements thereto and

information on Form 120S AS, Part III, line B or Form K-121S,

partial disposition thereof, by reason of sale, exchange,

Part II, Section 2.

abandonment, etc. Property rented by the taxpayer is valued at

eight times the net annual rental rate. As a general rule, the

•

Single Factor Apportionment – all years beginning after

average value of property owned by the taxpayer shall be

12/31/01, and at the election of the taxpayer made at the

determined by averaging the values at the beginning and ending

time of filing of the original return, the qualifying business

of the income year. However, the Director of Taxation may require

income of any investment funds service corporation

or allow averaging by monthly values if such method of averaging

organized as a corporation or S corporation which maintains

is required to properly reflect the average value of the taxpayer’s

its primary headquarters and operations or is a branch facility

that employs at least 100 individuals on a full-time equivalent

property for the income year.

basis in this state and has any investment company fund

LINE B—Payroll Factor. The payroll factor shall include the

shareholders residenced in this state shall be apportioned

total amount paid by the taxpayer for compensation during the tax

to this state as provided in this subsection, as follows:

period. The total amount “paid” to the employees is determined

upon the basis of the taxpayer’s accounting method. If the

By multiplying the investment funds service corporation’s

taxpayer has adopted the accrual method of accounting, all

qualifying business income from administration, distribution

compensation properly accrued shall be deemed to have been

and management services provided to each investment

company by a fraction, the numerator of which shall be the

paid. Notwithstanding the taxpayer’s method of accounting, at

average of the number of shares owned by the investment

the election of the taxpayer, compensation paid to employees

company’s fund shareholders residenced in this state at

may be included in the payroll factor by use of the cash method if

the beginning of and at the end of the investment company’s

the taxpayer is required to report such compensation under such

taxable year that ends with or within the investment funds

method for unemployment compensation purposes. The term

service corporation’s taxable year, and the denominator of

“compensation” means wages, salaries, commissions and any

which shall be the average of the number of shares owned

other form of remuneration paid to employees for personal

by the investment company’s fund shareholders everywhere

services. Payments made to an independent contractor or any

at the beginning of and at the end of the investment

other person not properly classifiable as an employee are

company’s taxable year that ends with or within the

excluded. Only amounts paid directly to employees are included

investment funds service corporation’s taxable year.

in the payroll factor. The compensation of any employee on account

of activities which are connected with the production of

Descriptions of each of the factors in the three-factor formula

nonbusiness income shall be excluded from the factor. The

follow. The laws applicable to these factors are contained in K.S.A.

denominator of the payroll factor is the total compensation paid

79-3280 through K.S.A. 79-3287. The applicable regulations are

everywhere during the income year.

contained in K.A.R. 92-12-84 through K.A.R. 92-12-103. These

laws and regulations are in the Policy Information Library at:

The numerator of the payroll factor is the total amount paid in

Kansas during the income year by the taxpayer for compensation.

Page 9

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16