Accounting

A taxpayer’s taxable year is the same as the taxable year for federal tax purposes. If a taxpayer’s taxable

year is changed, or the method of accounting is changed for federal tax purposes, then the taxable year

Period

and method of accounting shall be similarly changed for Kansas tax purposes.

Federal Return

Enclose with Form K-120S:

„ „ „ „ „

Pages 1 through 4 of the Federal Form 1120S or pages 1 through 5 of the Federal Form 1065, as

and Other

filed with the Internal Revenue Service.

Enclosures

„ „ „ „ „

Federal schedules to support any Kansas modifications claimed on page 1.

„ „ „ „ „

Credit schedules and the required attachments to support pass-through activities.

„ „ „ „ „

An organizational chart showing all partnerships/S Corps and taxable entities that have income

that flows into this entity or flows from this entity.

Be sure to keep copies of all tax documents associated with your return as KDOR reserves the right to

request additional information as necessary.

Extension of

If you are unable to complete your return by the filing deadline, you may request an extension of time to

file. If you filed federal form 7004 with the Internal Revenue Service for an extension of time, enclose a copy

Time to File

of that form with your completed K-120S to automatically receive a five-month extension (for Partnerships)

or a six-month extension (for S-Corporations) to file your Kansas return. Kansas does not have a separate

extension request form. If you are entitled to a refund, an extension is not required in order to file the return

after the original due date.

Important—An extension of time to file Form K-120S does not extend the time for filing a partner’s or

shareholder’s Kansas Individual Income Tax return (Form K-40).

Business

Taxpayers may elect to have all income derived from the acquisition, management, use, or disposition

of tangible and intangible property treated as business income. The election is effective and irrevocable

Income

for the taxable year of the election and the following nine taxable years. The election is binding on all

Election

members of a unitary group of corporations. To make this election, an entity must file Form K-120EL with

KDOR within the time limits established by law for its filing situation.

„ „ „ „ „

An entity not previously doing business in Kansas that intends to make this election for its initial

year of business must file Form K-120EL within 60 days after filing the articles of incorporation or

application for authority to engage in business with the Kansas Secretary of State.

„ „ „ „ „

For an entity currently doing business in Kansas, the election must be filed on or before the last

day of the tax year immediately preceding the tax year for which the election is made.

Form K-120EL must be sent separately from the K-120S return.

Adjustments

Kansas income tax law provides that partners receiving income from a partnership or corporation may

be required to make certain adjustments to their share of the entity’s income included in their individual

and Other

federal income tax return in order to properly determine their individual Kansas adjusted gross income.

Information

This modification can only be made from information available to the partnership, thus it is necessary that

each partnership notify each partner of his share of the adjustments. In addition to the adjustments,

to Partners

information regarding income not included in ordinary partnership income must be given to each partner.

NOTE: Each partner or shareholder should be notified of the gross of such income received by the

partnership or corporation, each partner’s or shareholder’s share of such income, the total adjustments

applicable and each partner’s or shareholder’s share of such adjustment.

Information given to the partners receiving income should also include the partner’s share of the

Kansas and everywhere property, payroll and sales factors of the partnership making the distribution. This

information is necessary so the partner receiving the distribution can include those factors with their

Kansas and everywhere property, payroll and sales factors in order to properly apportion income to Kansas

in their returns when filed.

Amended

You must file an amended Kansas return when an error was made on your Kansas return or there is a

change (error or adjustment) on another state’s return or on your federal return.

Returns

To amend your Kansas Partnership or S Corporation return, mark the “Amended Return” checkbox on the

front of the K-120S and insert the changes on the return. Include a copy of the other state’s amended return or

a copy of the IRS amended return or Revenue Agent’s Report or adjustment letter showing the adjustments.

AMENDED FEDERAL RETURN: If you are filing an amended federal income tax return for the same taxable

year as your Kansas amended return, enclose a complete copy of the amended federal return and full

explanations of all changes made on your amended Kansas return. If your amended federal return is

Page 3

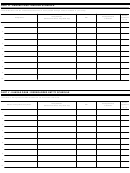

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16