Form Wv/bcs-1 - Business Investment And Jobs Expansion Credit And Corporate Headquarters Relocation Credit (Super Credits) - Page 12

ADVERTISEMENT

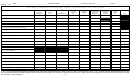

Column 13. Enter the sum of the entries in Column 10 and Column 12 for each of the listed taxes in the amount to

be claimed as credit on the appropriate annual returns filed.

PART IV - B - TAX CREDIT COMPUTATION SCHEDULE FOR 11TH THROUGH 13TH TAX YEARS

The credit may be applied to the taxes as listed and must be applied in the order shown.

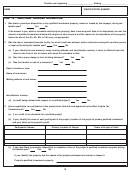

Line 1.

Enter your tax liability, if any, for each of the taxes listed, determined before application of any other

allowable credits or exemptions. In the case of Business Franchise Tax, the tax liability is the amount

remaining after deductions for any Subsidiary Credit, Business and Occupation Tax Credit and Bank

Shares Tax Credit available to the taxpayer.

If you are claiming the Corporate Headquarters Relocation Credit, the Corporation Net Income Tax

liability must be determined separately on allocated income and apportioned income. This is required

even if the corporation is taxable only in West Virginia. Apportioned income is income arising from

transactions and activity in the regular course of trade or business activity and includes all income unless

the income is clearly classifiable as nonbusiness income. Allocated income is nonbusiness income and

may include interest and dividend income, certain capital gains income, rents and royalty income, but

only to the extent that such income is not earned from business activity.

If your computation of qualified investment does not include property or expenses for the relocation of

corporate headquarters, enter your total Corporation Net Income Tax liability in Column (e) 1, Line 1,

and make no entries in Columns (e) 2 and 3.

If your computation of qualified investment includes property and expenses for relocating corporate

headquarters within West Virginia, enter your Corporation Net Income Tax on apportioned income in

Column (e) 2, Line 1 and the tax on allocated income in Column (e) 3, Line 1. Make no entry in Column

(e) 1. The total of the separate tax computations should equal the Corporation Net Income Tax liability

shown on your annual tax return.

Line 3.

The payroll factor does not apply to the Corporation Net Income Tax on allocated income. If you have

an entry in Column (e) 3, Line 1 enter that amount also in Column (e) 3, Line 3.

Multiply the tax liability on Line 1, for each of the taxes by the payroll factor on Line 2 (where applicable),

and enter the result on Line 3. This is the amount of tax liability attributable to the qualified investment.

The credits may be used to offset eighty percent (80%) of the tax attributable to the qualified investment

of the taxes listed. If you have Corporate Headquarters Relocation Credit, then you may offset 100%

of tax on allocated income tax in addition to 80% of the other taxes.

The credits must be claimed against the taxes in the order shown.

Legislation enacted in early 1990 eliminated the application of the Business Investment and Jobs

Expansion Credit against the West Virginia Severance Tax. As a result, Column (b) (Severance Tax)

should be skipped unless the qualified investment was placed into service or use prior to January 1,

1990 or the taxpayer qualified under one of the transition rules of W. Va. Code § 11-13C-14 and filed

Form WV BCS-SEV (Notice of Intent to Claim Credit Against Severance Tax) with the Department on

or before July 2, 1990.

Line 4.

Multiply the amounts on Line 3 by the percentages shown on the Offset Factor line and enter the result

on Line 4.

Line 5.

Enter the amount of your annual credit allowance that you are applying to each of the taxes listed. The

annual credit allowance is applied to the first of the listed taxes to which you are subject. If the annual

credit allowance is used up, you may then use any rebate credit carried forward from prior years against

tax subject to credit. If there is annual credit allowance or rebate credit carried forward from prior years

remaining after that application, it is next applied to the second of the listed taxes. Follow this procedure

for each of the taxes to which you are subject, carefully monitoring the application to see that the amount

of the annual credit allowance used does not exceed the annual credit allowance available and/or

rebate credit carried forward from prior years. Add the amounts on Line 5 and enter the result in Column

g, Line 5.

12

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30